Key points

- AMD shines amid the AI revolution, with recent volume and price increases highlighting its resilience and potential.

- Despite recent headwinds, the stock has shown relative strength, suggesting the potential for higher highs.

- Analysts maintained bullish ratings on AMD despite the consensus price target calling for a downside, reflecting confidence in the company’s long-term growth prospects despite short-term market fluctuations.

- 5 stocks we like best from Advanced Micro Devices

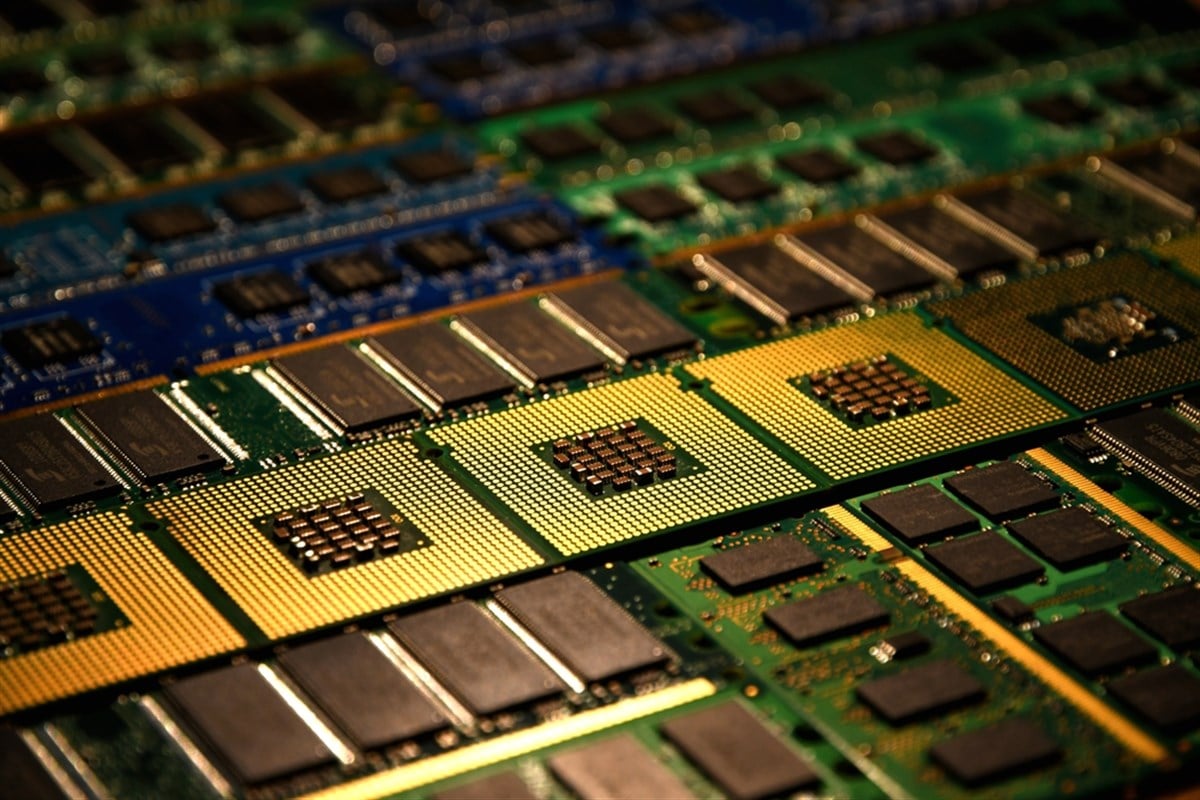

While Advanced Micro Devices NASDAQ:AMD it may not always steal the spotlight like its competitor Nvidia NASDAQ:NVDA, investors in this global semiconductor powerhouse have much to cheer about. The company continues to impress, particularly in the wake of the AI revolution, with rising demand driving impressive gains, seen especially with the recent increase in both volume and price.

Despite recent challenges and a negative catalyst, shares of Advanced Micro Devices have remained resilient, reflecting the broader strength of the semiconductor sector.

With the recent explosive breakout and, even more recently, a negative headline, AMD stock continues to outperform the overall market and shows impressive relative strength and resilience. So it’s definitely worth taking a closer look at AMD to see whether or not higher highs might be on the horizon.

A snapshot of AMD and recent developments

Advanced Micro Devices is an established semiconductor company based in Santa Clara, California, founded in 1969. It plays a crucial role in various sectors of the global economy.

The company operates in two segments: computing and graphics and enterprise, embedded and semi-custom. Its product portfolio includes microprocessors, chipsets, GPUs, data center solutions and game console technology, making it one of the most versatile semiconductor companies on the market today.

Despite regulatory hurdles, the company remains on a notable growth trajectory. The company’s shares have risen 39% year-to-date and more than 150% over the past year, reflecting investor confidence in its ability to meet challenges and take advantage of emerging opportunities, particularly those presented by growing demand due to ‘artificial intelligence.

Recent negative news regarding AMD’s tailor-made AI chip for the Chinese market highlights the complexities of operating in a dynamic global environment, while also showing the resilience of the company and its stocks to shake off such news and continue its trajectory ascending.

AMD’s recent earnings and analyst ratings

In its latest earnings report on January 30, 2024, AMD showed resilience, slightly beating analysts’ expectations with an EPS of $0.77. Quarterly revenue came in at $6.17 billion, marking an increase of 10.2% from a year earlier. With a P/E ratio of 392.2 and a P/E of 37.17, while AMD demonstrates strong financial fundamentals, it is definitely not a value play but rather an aggressive growth name. Forecasts point to a promising 58.05% growth in earnings next year, reflecting the company’s continued momentum.

AMD maintains a Moderate Buy rating based on 27 analyst ratings, supported by bullish sentiment despite a nuanced outlook. While the consensus price target calls for a potential downside of nearly 11%, recent analyst actions suggest a more optimistic view. Barclays, for example, raised its target from $200 to $235, signaling confidence in AMD’s long-term prospects. Likewise, Cantor Fitzgerald reiterated its Overweight rating, reaffirming the positive sentiment surrounding the stock.

Higher and higher highs are approaching for AMD

The stock recently emerged from a longer period of consolidation, signaling the potential for further upside. Despite market fluctuations and Tuesday’s sharp sell-off, AMD remained above $200, maintaining its post-breakout gains and demonstrating its resilience. Crucially, maintaining levels above previous resistance points, such as $185, underlines AMD’s strength. Monitoring broader industry trends will be essential to assess AMD’s relative performance amid market volatility.

Despite regulatory challenges and market uncertainties, AMD endures, driven by the unstoppable momentum of the artificial intelligence revolution. Investors can take comfort in the company’s strong financial performance, supported by bullish analyst sentiment and promising growth prospects. As AMD continues to ride the wave of artificial intelligence, meeting challenges with resilience, it remains poised for further success in the rapidly evolving semiconductor landscape.

Before you consider Advanced Micro Devices, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Advanced Micro Devices wasn’t on the list.

While Advanced Micro Devices currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

With average gains of 150% since the start of 2023, now is the time to take a look at these stocks and boost your 2024 portfolio.

Get this free report