Key points

- Samsara has demonstrated an impressive 80% increase over the past year, outpacing the broader tech sector.

- Samsara provides Industrial Internet of Things (IoT) solutions, focusing on fleet management, safety and compliance, with offerings such as GPS tracking and video telematics.

- The stock’s recent consolidation within a tight range suggests a potential bullish breakout, particularly as earnings approach.

- 5 titles we prefer to Samsara

Samsara Actions NYSE: IOT have demonstrated remarkable resilience over the past year, showing an impressive 80% increase, outpacing the broader tech sector. While year-to-date performance shows a modest 5% increase, the stock’s recent consolidation within a tight range sets the stage for a potentially bullish breakout, especially as earnings loom.

So, with an interesting setup looming over a stock with a near-term catalyst, let’s take a dive into Samsara.

What is Samsara?

Samsara is renowned for providing Industrial Internet of Things (IoT) solutions, specializing in fleet management, security and compliance. The company’s core mission is to optimize operational efficiency and ensure customer safety by implementing cutting-edge IoT technology. Its offerings include GPS tracking, ELD compliance, video telematics and environmental monitoring services.

In December 2021, Samsara debuted on the NYSE under the ticker IOT, offering 35 million shares at $23 each, resulting in a total capital raise of $805 million. Following the initial listing, the stock exhibited significant volatility, rising to $31.41 in late December 2021, before embarking on a prolonged downtrend, reaching new lows near $9 in November 2022. However, this downward trajectory does not was indefinite, as the stock recorded an impressive rebound. , achieving growth of nearly 80% over the past year while maintaining a steady upward trend.

The technical setup in the IOT

Since December last year, Samsara shares have consolidated within a tight range, with $32 as a robust support level and $36 as a significant resistance barrier. This consolidation pattern, coupled with the stock’s position above key rising simple moving averages (SMAs), primarily the 50-day SMA aligning with support, indicates a bullish formation.

If Samsara can break above the $36 resistance level before or after earnings and manages to support this move convincingly, it could trigger a substantial upward trajectory. This scenario is supported by the current technical structure of the stock, which suggests a favorable risk-return profile for investors.

Samsara has a short-term catalyst

Samsara last reported its quarterly earnings on November 30, 2023, beating analysts’ expectations with earnings per share ($0.08), beating estimates of $0.02. The company posted revenue of $237.53 million, beating analysts’ forecasts of $225.36 million. Over the last year, Samsara had diluted earnings per share of ($0.42).

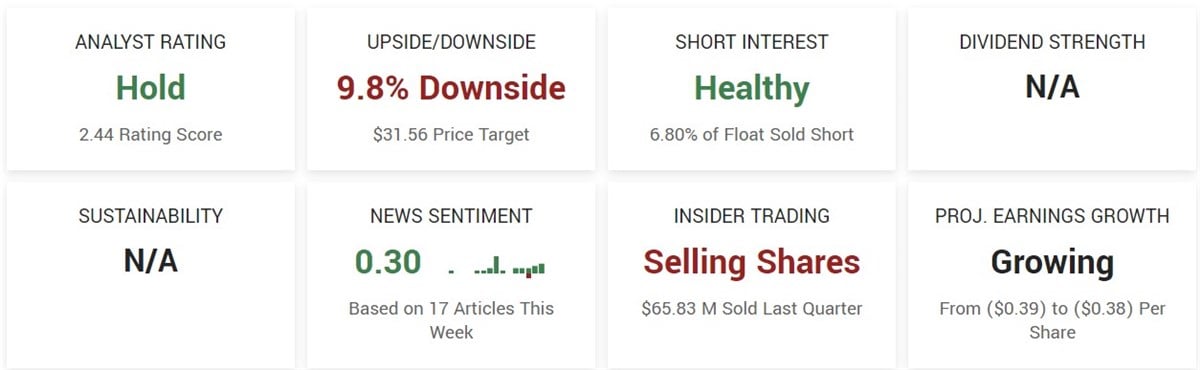

Looking ahead, Samsara’s earnings are expected to improve over the next year, with growth expectations of ($0.39) to ($0.38) per share. The company will release its next quarterly earnings report on Thursday, March 7, after the market closes.

Analyst ratings, short-term interests and insider selling

Samsara holds a Hold rating based on nine analyst ratings, with a consensus price target suggesting a potential downside of nearly 9%. Despite this, the stock remains attractively positioned for potential upside, particularly given its technical strength and upcoming earnings catalyst.

As earnings approach, the stock also commands a short interest of 6.8%, which could serve as a significant driver of volatility in the near term. If Samsara were to deliver robust earnings results and offer upbeat guidance during its next earnings call, it could potentially trigger a short squeeze scenario, further amplifying the upside momentum.

Continued domestic selling and lack of purchases over the past twelve months could be perceived as a negative for shareholders. Ten insiders have sold shares in the last twelve months, with no insider purchases. In total, insiders sold nearly $300 million worth of Samsara shares during this period. Most recently, on February 27, Samsara’s CEO sold 80,342 shares.

Is Samsara a buy?

Samsara offers an attractive outlook for investors and momentum traders, particularly given its recent consolidation that signals a potential bullish breakout, especially as it approaches its upcoming earnings release. However, it is critical to recognize the recent insider selling and short-term market underperformance. Despite the cautious sentiment among analysts, the stock’s strong technicals and improved earnings outlook provide compelling reasons for close monitoring during earnings season. However, investors should proceed with caution, waiting for confirmation of a breakout before making significant commitments.

Before you consider Samsara, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Samsara wasn’t on the list.

While Samsara currently has a “Hold” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

As the AI market heats up, investors who have a vision for AI have the potential to see real returns. Learn more about the industry as a whole and the seven companies that are working with the power of AI.

Get this free report