juststock/iStock via Getty Images

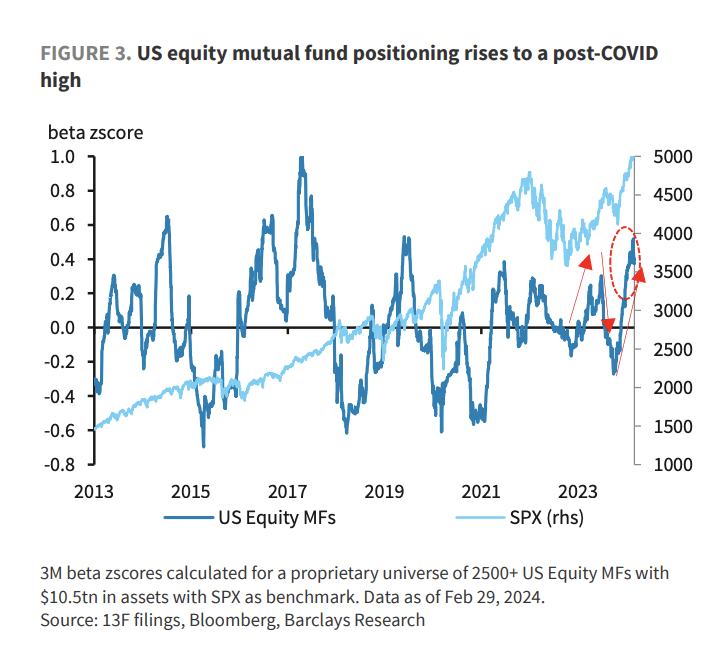

According to Barclays, mutual funds piled into stocks in the fourth quarter in a catch-up move.

“US equity mutual funds rushed to extend US equity exposure in December after being caught light in the year-end rally, after substantially reducing risk in 3Q23,” strategist Venu Krishna wrote in a note. “These real money investors continue to rapidly add to their positions, pushing long-only institutional equity exposure to a post-COVID record.”

“Long positions in stock futures are hovering near 3-year highs,” Krishna added.

“Q4’23 saw strong technical bidding for equities which forced both systematic and discretionary investors to liquidate short/underweight equity positions,” he said. “The catalyst was, of course, the Fed; while higher rates for a longer period were the predominant narrative at the start of 2023, the dovish surprise at the FOMC in November (combined with a good deal of supply relief from the Treasury and steady progress on disinflation) triggered broad risk appetite to close the year.”

“Much of the momentum behind this rotation has carried over into 2024, and while the outlook for short-term rates has once again become less rosy in recent weeks (after inflation jumped in January, pushing our own request for the Fed’s first cut in June), it appears the stock train has already left the station,” Krishna added. “Fundamental macroeconomic data is holding up, US consumption remains strong, and earnings exceptionalism within US tech mega-caps has raised the floor for the S&P 500 Index (NYSEARCA:SPY) (IVV) (VOO) in 2024, bringing the world to the table for US stocks.”

Among the largest equity mutual funds are: Vanguard Total Stock Market Index Fund Inst (VSMPX), Fidelity 500 Index Fund (FXAIX), Vanguard 500 Index Fund Inst (VFIAX), Vanguard Total Stock Market Index Fund Admiral (VTSAX), Vanguard Total International Stock Index Fund (VGTSX), Vanguard Institutional Index Fund (VIIIX) and Vanguard 500 Index Fund Inst (VFFSX).