When hedge fund billionaire Ken Griffin said at an industry conference this week that the U.S. bond market would need some discipline, he was voicing many investors’ concerns about the impact of huge spending and bond-issuing plans. government debt.

American government spending “is out of control,” he told the Futures Industry Association conference in Florida. “And unfortunately, when the sovereign market starts to bring down its hammer in terms of discipline, that can be quite brutal.”

But while there may be good reasons for so-called bond vigilantes – hedge funds and other traders who punish spendthrift nations by betting against their debt or simply refusing to buy it – to turn their attention to the Treasury market, analysts say they have so far not has materialized.

After a brief burst of vigilantism in the fall of last year, bond investors have doubled their attention on the main driver of fixed income markets: the path of interest rates. While the supply of new Treasury securities has been high, so has demand, as investors in the United States and elsewhere seek to secure relatively high yields ahead of an expected round of interest rate cuts.

“All the fear around supply and bond vigilantes is a load of rubbish,” said Bob Michele, chief investment officer and head of the global fixed income, currency and commodities group at JPMorgan Asset Management. “I don’t see any evidence of that.”

“For at least the last six months, clients have been coming to us asking, ‘Where can I get into the bond market? When will I enter the bond market?’ Everyone has money to invest in bonds,” Michele added.

The yield on 10-year Treasuries fell from a peak of 5% in October to 4.3%, reflecting rising bond prices. Inflows into U.S. bond funds in the first week of March reached their highest level since 2021, according to EPFR data.

The heyday of shadowy market vigilantes fighting to contain government deficits was in the 1990s, during Bill Clinton’s presidency, when concerns about the federal budget deficit drove the 10-year yield from 5.2 % in October 1993 to 8.1% in November 1994. the government responded with efforts to reduce the deficit.

But betting against bond markets has become an increasingly dangerous game in the wake of the 2008 global financial crisis, when central banks, including the Federal Reserve, purchased large amounts of their own government debt in an attempt to reduce borrowing costs and stimulate their economies.

In the wake of the coronavirus pandemic, the Fed’s big purchases have stymied vigilantes, despite record US borrowing needs.

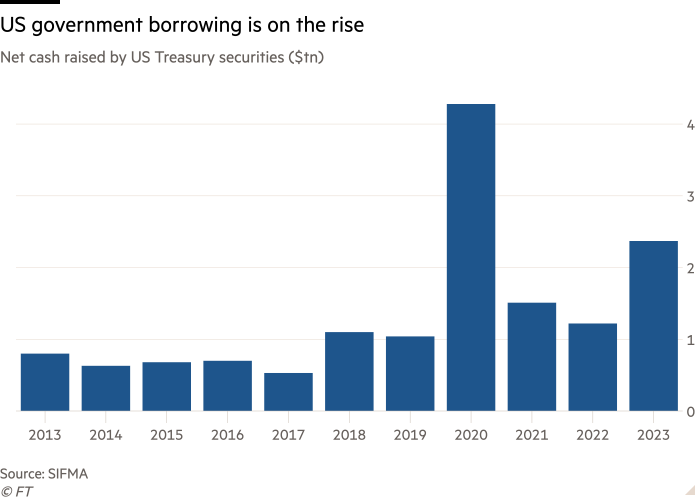

But as the Fed turned from buyer to seller, the amount of selling of US Treasuries remained high, suggesting that conditions may finally be turning in the vigilantes’ favor. According to Goldman Sachs, the amount of Treasury securities in circulation will increase by $1.7 trillion this year. While this is lower than last year’s increase, it will be weighted more to longer-dated bonds, which are riskier for investors and harder for markets to digest.

Last fall, Treasury bond yields hit a 16-year high. While this was driven by the Fed’s message of “higher for longer” rates, some investors said it was exacerbated by the sheer weight of issuance, after the U.S. Treasury said in August it would increase the size of its auctions of debt.

The episode had echoes of the bond market revolt in the UK a year earlier, when investors objected to then Prime Minister Liz Truss’s unfunded tax cuts, sending gilts into free fall.

Bond vigilantes are back, said Edward Yardeni, the researcher who coined the phrase in 1983. Kevin Zhao, head of global sovereign and currency at UBS Asset Management, said similarly in an October interview with CNBC that markets are acting to curb runaway lending. .

But yields then fell sharply as markets went from fears of a prolonged period of high borrowing costs to frenzied speculation about when and how quickly the Fed will cut them, reaffirming the primacy of monetary policy as the driver of market action. bond.

“There was a short-lived protest by bond vigilantes,” Yardeni said in an interview this week. “But they are back in siesta mode. Siesta doesn’t mean they’re gone forever. The supply issue is still open, but the bond market doesn’t seem to care much about it.”

Some analysts say the abundance of liquidity parked in money market funds, which invest in very short-term government debt, serves as a potential source of continued demand for Treasury securities. According to ICI data, money market assets in the United States reached a record high of $6.1 trillion this week. Some of that “dry powder” is likely to end up in longer-dated debt once investors become sufficiently convinced that the Fed was destined to lower rates, Michele said.

But for some investors the threat of vigilantism remains. Vincent Mortier, investment director at Europe’s largest fund manager, Amundi, said Treasuries are at risk of a severe sell-off if Donald Trump’s victory in November’s US presidential election is accompanied by concerns about the level of government spending similar to that which triggered the 2022 gilt crisis.

Furthermore, if stubbornly high inflation means the Fed is unable to lower rates as quickly as the market expected, investors may once again turn their attention to the huge wave of Treasury supply coming soon, according to Torsten Sløk, chief economist at Apollo Global Management. .

The Treasury Department held record-sized auctions this month for two- and five-year bonds, which will rise again in April and May. Would-be bond vigilantes “are still napping,” Sløk said. “But a really weak auction could wake up [them] on.”

Additional reporting by Jennifer Hughes in Boca Raton, Florida