hirun/iStock via Getty Images

Real estate stocks fell this week as economic data dashed rate cut hopes among stock traders and a lack of positive news gave way to mild pessimism.

The S&P 500 index fell 0.13% this week, recording its second consecutive week loss, like the markets he reacted inflation and sales data, reducing interest rate cut expectations. The Federal Reserve is expected to keep rates stable when it makes its second monetary policy decision of the year next Wednesday.

“Mortgage rates began rising again in February – a disappointing development for prospective homebuyers, who only a few months ago had a glimmer of hope when rates finally started to fall,” said Daryl Fairweather, the Mortgage’s chief economist. online real estate brokerage Redfin.

“With rates still high, many are choosing to continue renting, which is supporting rental demand and, in turn, rental prices,” Fairweather added.

U.S. asking rents posted their biggest annual increase in more than a year in February, Redfin ( RDFN ) said in a report.

Real estate agencies/platforms tumbled on Friday particularly following news of the National Association of Realtors settlements. NAR has agreed to pay $418 million to resolve a series of real estate collusion allegations aimed at keeping agent commissions artificially high. Additionally, the association is poised to review multiple regulations in a move that is expected to result in a substantial drop in the cost of selling a home.

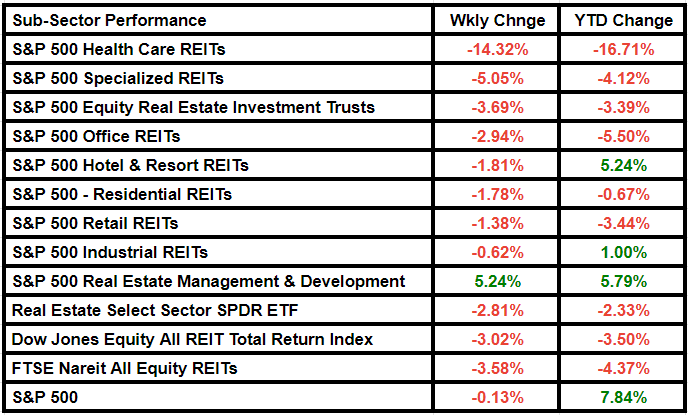

The SPDR Fund Real Estate Select Sector ETF (NYSEARCA:XLRE), which tracks real estate stocks in the S&P 500 index, fell 2.81% during the week to close at $39.04. The FTSE Nareit All Equity REITs index fell 3.58%while the Dow Jones Equity All REIT Total Return Index fell 3.02%.

Extra Space Storage (EXR), Equinix (EQIX), and Crown Castle (CCI) were the biggest losers among S&P 500 real estate stocks. CoStar Group (CSGP) was an outlier, being the week’s only gainer . Trinity Place Holdings (TPHS), Lead Real Estate (LRE) and Safe and Green Development (SGD) were the other notable losers in the real estate sector.

Seeking Alpha’s Quant Rating system maintained a Hold rating on XLRE, but lowered its momentum recommendation. SA analysts also rate the stock as Hold.

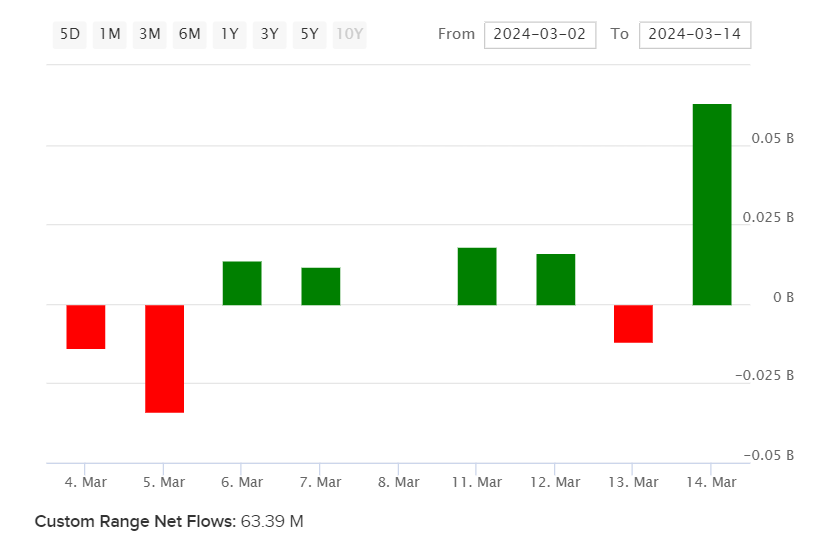

The ETF saw it net inflows by $85.48 million this week, compared to outflows by $22.9 million last week. Inflows gained pace especially after real estate stocks tumbled on news of the NRA settlement. Here’s a look at the movement of fund flows in and out of XLRE over the last 2 weeks, according to data solutions provider VettaFi.

Earnings season for the industry ended this week. Of the 88 equity REITs providing full-year FFO guidance, 59 REITs (67%) beat the midpoint of their forecasts. Single-family residential, data center, retail, hotel REITs were among the best-performing real estate sectors this quarter, SA contributor Hoya Capital said in a recent report.

Relative weakness was seen in interest rate-sensitive real estate sectors – net leasing and office – along with asset-oriented sectors. According to Hoya Capital, rising interest spending is the culprit, not real estate fundamentals.

During the week, healthcare REITs were the biggest losers, while specialty REITs trailed behind them. Here’s a look at the performance of the subsectors: