Unlock the Publisher’s Digest for free

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

The Bank of England is set to keep interest rates unchanged this week, looking for clearer signs that wage growth and services inflation are cooling enough to allow a cut in the cost of borrowing.

Financial markets are overwhelmingly betting that the BoE’s key rate will be kept at 5.25% when the Monetary Policy Committee announces its latest decision on Thursday. It would be the fifth consecutive meeting in which the rate is kept unchanged, after 14 consecutive increases.

Prices in the swaps market – which reflect the BoE’s forecast of the future level of interest rates – suggest that the first move lower will only come by August, with one or two further cuts by the end of the year.

Stable monetary policy in the UK this week would be in line with the approach of major central banks, including the Federal Reserve and the European Central Bank, which are making clear that they will only start cutting rates when they have sufficient evidence that inflation is heading permanently downward.

The ECB has kept rates unchanged this month, while the Fed is expected to do the same on Wednesday.

“’Not yet’ is the key phrase currently uniting the message from the Bank of England, the Federal Reserve and the ECB,” said Sandra Horsfield, an economist at Investec.

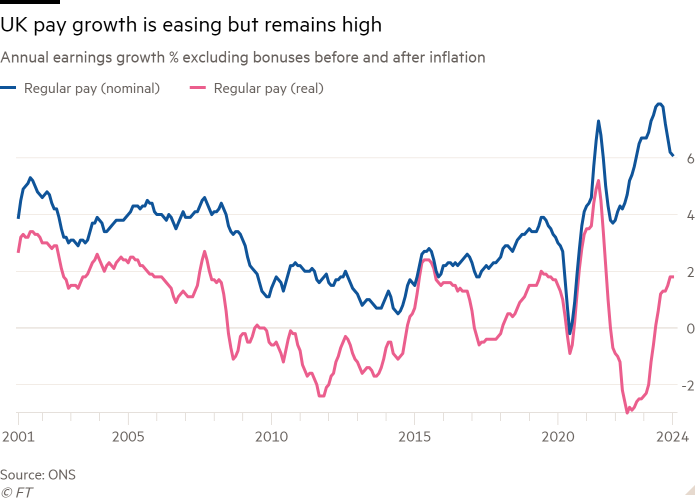

Official data this month highlighted weaker conditions in the UK labor market, with slightly slower wage growth combined with a decline in job vacancies, a stall in growth in the number of paid employees and a rise in the number of unemployment benefit claimants.

Excluding bonuses, annual wage growth slowed to 6.1% in the three months to January, from 6.2% previously.

But the BoE is wary of giving too much weight to single labor market data, given ongoing quality problems with Office for National Statistics surveys. In any case, according to analysts, the pace of wage growth remained well above levels consistent with the central bank’s 2% inflation target.

A crucial issue for the OAG will be the form of the wage agreements entered into by employers in March and April. Average wage growth across the economy remained stable at 5% in the three months to January, according to analysis of wage premiums by Incomes Data Research.

However, a quarter of the 63 deals examined were worth at least 6%. A key factor in April is the impending 9.8% increase in the national minimum wage, a push which will also have knock-on effects on the pay of some employees who earn a little more than the legal minimum.

Andrew Goodwin, an economist at consultancy Oxford Economics, said recent data did not suggest wages would fall short of the BoE’s forecast of 5.7% for the first quarter. “We believe most in the MPC will be keen to see more data on pay deals in the new year before committing to rate cuts,” he added.

Waiting has another advantage: it gives the BoE time to draw up a full set of economic forecasts, scheduled for its May meeting.

Central bank officials have also been closely watching growth in service prices, which rose 6.5% in January from a year earlier. They view the prices charged by the UK’s massive services sector as a key indicator of underlying price pressures in the economy.

While the MPC largely supported rate hikes between November 2021 and last summer in a bid to tame inflation, the committee was divided into three parts when its nine members last met in February.

While two politicians, Catherine Mann and Jonathan Haskel, opted for a rate increase to 5.5%, fellow external member Swati Dhingra called for an immediate cut. The majority voted for no change.

BoE Governor Andrew Bailey said after the meeting that the central bank had received “good news on inflation in recent months.” But he warned: “We need to see more evidence that inflation is set to fall to the 2% target, and stay there, before we can lower interest rates.”

Pressure for rate cuts is likely to increase in the coming months as headline inflation falls rapidly to the 2% target, thanks to lower energy prices. Consumer price inflation is now at 4%, compared to a 2022 peak of more than 11%.

Official inflation data for February will be released on Wednesday, with the headline CPI inflation rate expected to fall further to 3.6%, according to a Reuters poll of analysts.

The BoE predicted in February that, after bottoming in the second quarter, price growth was likely to start picking up towards the end of 2024, strengthening the case for the central bank to maintain restrictive policy.

Other forecasters, including the Office for Budget Responsibility, the fiscal watchdog, cast doubt on the idea that CPI inflation will recover quickly.

Markets see both the Fed and the ECB announcing rate cuts this summer. BoE officials have been coy about the likely timing of their first reduction, with chief economist Huw Pill recently insisting that he thought the timing of the first move was “a bit far away”.

“The BoE will probably need more convincing to actually start the movement” on rate cuts, said Allan Monks, a British economist at investment bank JPMorgan. “The goal is to avoid having to backtrack after easing begins, and it may be difficult to contain expectations once it begins.”