Buying a home is a lot more complicated than exchanging cash for a set of keys: In addition to home inspection fees and an initial deposit, there’s a long list of costs home buyers must pay before moving in.

Among the largest? The deposit.

In general, the more you can pay up front, the lower your monthly mortgage bill will be. Most home loans require a minimum down payment of 3% of the sales price, but 20% is traditionally considered ideal by mortgage lenders.

Nowadays, that might be easier said than done. U.S. home prices soared to new heights following the pandemic-induced homebuying frenzy in 2020. According to a report from real estate data provider ATTOM, the average down payment in the second quarter of 2023 was $31,500, up by approximately 19% compared to the previous quarter. Data from the Federal Reserve Bank of St. Louis puts the average home sales price for the same quarter at $418,500.

In a September housing affordability analysis, ATTOM noted that increases in home prices and mortgage rates have continued to push spending beyond what many Americans earn, sidelining potential homebuyers nationwide . In more than half of the local housing markets analyzed, homebuyers needed annual salaries above $75,000 to afford the increased costs associated with an average home.

“The dynamics influencing the U.S. housing market seem to continually work against everyday Americans,” ATTOM CEO Rob Barber said in a press release.

Fortunately, there is no shortage of programs that can help cover down payments.

What is Down Payment Assistance or DPA?

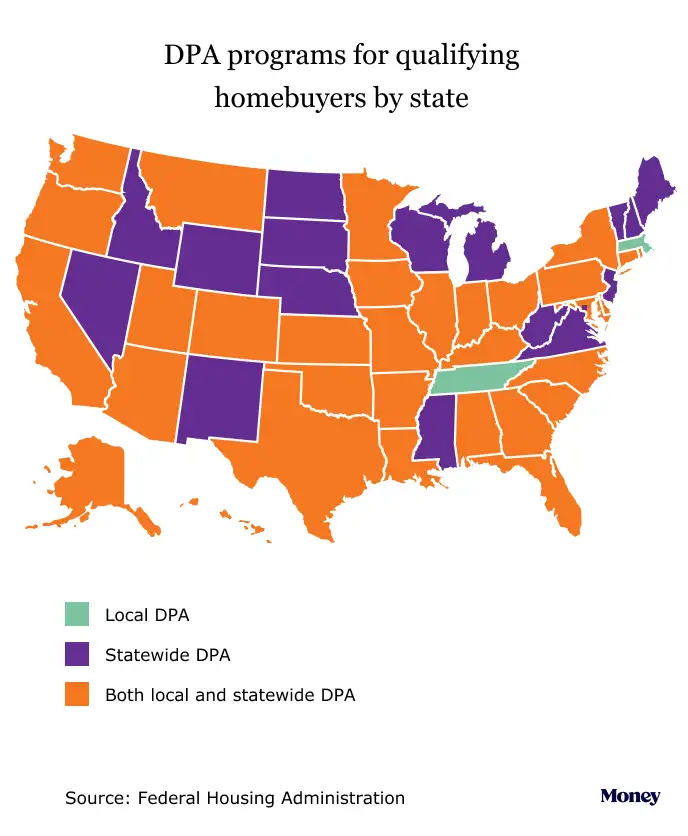

The data in the map below is current as of October 10, 2023.

In the United States, there are more than 2,000 programs that provide down payment assistance — DPA for short — at the state, regional and local levels, according to David Berenbaum, deputy assistant secretary for housing counseling at the Department of Housing and Urban Development .

Many of these programs are offered through entities such as HUD, state housing finance authorities, and municipalities, but there are also some led by private lenders and community organizations. State and municipal governments often partner with local lenders. Programs are typically customized to meet the specific needs of homebuyers in each individual market.

“DPA programs play a critical role in helping consumers overcome some of the biggest challenges in the market right now: one is affordability and the high cost of housing, and the other is interest rates,” he says Berenbaum at Money.

Most DPA programs are exclusively for first-time homebuyers, according to Berenbaum, while about 40% are aimed at other groups, such as veterans.

How does down payment assistance work?

“Support” is, of course, a broad term. Berenbaum says about 75% of DPA programs offer a cash grant for purchasing a home that can be used for down payments and closing costs. DPA can also come in the form of low- or zero-interest loans, tax credits, or cash-back loans.

Loans are made as second mortgages and are usually large enough to cover the entire down payment. If you receive the DPA as a zero-interest loan with 0% interest, you don’t have to pay it back as long as you live in the home for a certain period of time. With a zero-interest deferred payment loan, you typically can’t get forgiveness, but you don’t have to repay these loans unless you move, sell your home, refinance your first mortgage, or pay it off.

Berenbaum says the amount of DPA financing a person can get depends on the cost of the housing they are looking to make a purchase on. Some programs and lenders require no down payment for qualified homebuyers, while others will offer a percentage based on the home’s sales price or provide grants up to a certain dollar amount, usually around $10,000, according to the company Homebuyer.com mortgages.

According to Berenbaum, there aren’t many downsides to using DPA programs, although applying could slow down the home-buying process by a few weeks. Because many programs have residency requirements, they may not be ideal for those who plan to move again within a few years of purchasing. Additionally, you usually need to finance with approved lenders or products such as a Federal Housing Authority mortgage, which is a government-backed loan with relaxed financial requirements.

How to Qualify for Down Payment Assistance

While these programs are mostly only available to first-time homebuyers, they generally define a first-time buyer as anyone who has not owned a home in the past three years. (For the most part, you can’t qualify if you own rental or investment properties.)

The programs often have strict income limits that vary based on location and cost of living for a particular market, according to Berenbaum, and are usually reserved for low- or moderate-income buyers.

“The parameters for a loan in New York state will be very different than those in Colorado or Arizona because New York is one of the most expensive real estate markets in the nation,” he says.

Some programs, such as the Texas State Affordable Housing Corporation’s Homes for Texas Heroes initiative, offer DPAs for people in certain professions, usually teachers, nurses and first responders. Others aim to expand homeownership for specific demographic groups, such as Black or Latino homebuyers.

Eileen Tu, vice president of product development for Rocket Mortgage, tells Money that programs usually require a credit score of at least 620 and a positive credit history. Many also require homebuyers to attend education seminars or complete homebuyer training courses to learn about the mortgage process and how to maintain their personal finances after making a purchase.

How to find a DPA program

Despite the surge in home prices in recent years, Berenbaum says, homeownership is still the most affordable option for low- and middle-income Americans due to the high cost of rental housing across the country. He advises home buyers to shop wisely and keep an open mind.

Each program is different, so it’s best to start by researching the DPA in your state, county and city and contacting providers with any questions. HUD and the Federal Housing Administration, an agency within HUD, have online resources and directories to help you search for programs by location. The Down Payment Resource company also has a database of homebuyer programs and tools to help you determine your eligibility.

Given the number of homebuyer programs and their specific requirements, Berenbaum recommends homebuyers connect with a real estate advisor to understand which programs they may qualify for in their region. Every lender has real estate counselors available, he adds, and you can find counseling through HUD.

“We often go into a real estate transaction with a lot of preconceptions: ‘Where do I want to live? What can I afford? What will my tax benefit be if I buy a house?’” she says. “These are all factors that a HUD-approved counselor will help with by developing a budget and establishing an affordability range.”

Counseling can also assist with buyers’ post-purchase finances. Berenbaum emphasizes the importance of sustaining a home and building adequate resources to maintain homeownership.

The bottom line, he says, is that most homebuyers will benefit from DPA programs, as long as they understand the expectations of the origination and settlement process of any loans, as well as the terms of those loans and their down payment.

More from Money:

How to save for a down payment

The massive settlement of a real estate lawsuit will change the way homes are bought and sold

The 8 Best Mortgage Lenders of 2024