Scams

Personal loan scams exploit your financial vulnerability and may even trap you in a vicious cycle of debt. Here’s how to avoid being scammed when considering a loan.

March 26, 2024

•

,

6 minutes Read

Times have been tough financially for many of us since the pandemic. Climate shocks, rising food and energy prices and persistent inflation elsewhere have compressed household spending and put enormous pressure on working families, with interest rates high across much of the Western world which only made things worse. As usual, cyber criminals are waiting in the wings to see how to exploit the misfortune of others. In some cases, they do this through loan fraud.

Understanding loan fraud

Loan fraud can take many forms. But it essentially uses the lure of no-strings-attached loans to lure vulnerable Internet users. It can be especially common at certain times of the year. The UK’s financial regulator, the Financial Conduct Authority (FCA), warned last December of an increase in loan fee fraud after saying that more than a quarter (29%) of British parents had taken borrow money, or intend to, in the run-up to Christmas.

In the UK, losses from loan fee fraud average £255 ($323) per victim. This is a potentially significant sum for someone already struggling to pay their bills. Those particularly at risk are the young, the elderly, low-income families and individuals with low credit scores. Scammers know that these groups are among the hardest hit by the current cost of living crisis. And they have developed various strategies to trick users into handing over their money.

Take a closer look at the following schemes to stay safer online.

Top Loan Fraud Threats

There are several loan scams, each using slightly different tactics.

1. Loan fee fraud (upfront fee).

Probably the most common type of loan fraud, usually involving a scammer posing as a legitimate lender. They will claim to offer a no-strings-attached loan, but will ask you to pay a small fee upfront to access the money. The scammers will then disappear with your money.

They might say the fee is for “insurance”, an “administration fee” or even a “deposit”. They might even say it’s because you have a bad credit rating. Usually, the scammer will claim that it is refundable. However, they often require it to be paid in cryptocurrency, via a money transfer service, or even as a gift card. This will make it virtually impossible to recover lost funds.

2. Student loan fraud

A particular variety of loan fraud targets people eager to obtain financing for their education and recent graduates burdened with college tuition and other educational expenses. These schemes also involve attractive loan terms or even debt forgiveness, phony loan repayment assistance, fraudulent promises to cut monthly payments, consolidate multiple student loans into a more manageable “bundle,” or negotiate with lenders on behalf of borrowers – in exchange for advance tariffs for these “services”. Unsuspecting people are often deceived give away your personal and financial informationwhich scammers then use for identity theft or fraudulent purposes.

3. Loan “phishing” fraud

Some scams may involve the scammer asking you to fill out an online form before the loan can be “processed.” However, by doing so, your personal and financial data will be handed over directly to bad actors for use in more serious identity fraud. This could be run in tandem with an advance payment scam, resulting in the loss of both money and sensitive personal and bank account information.

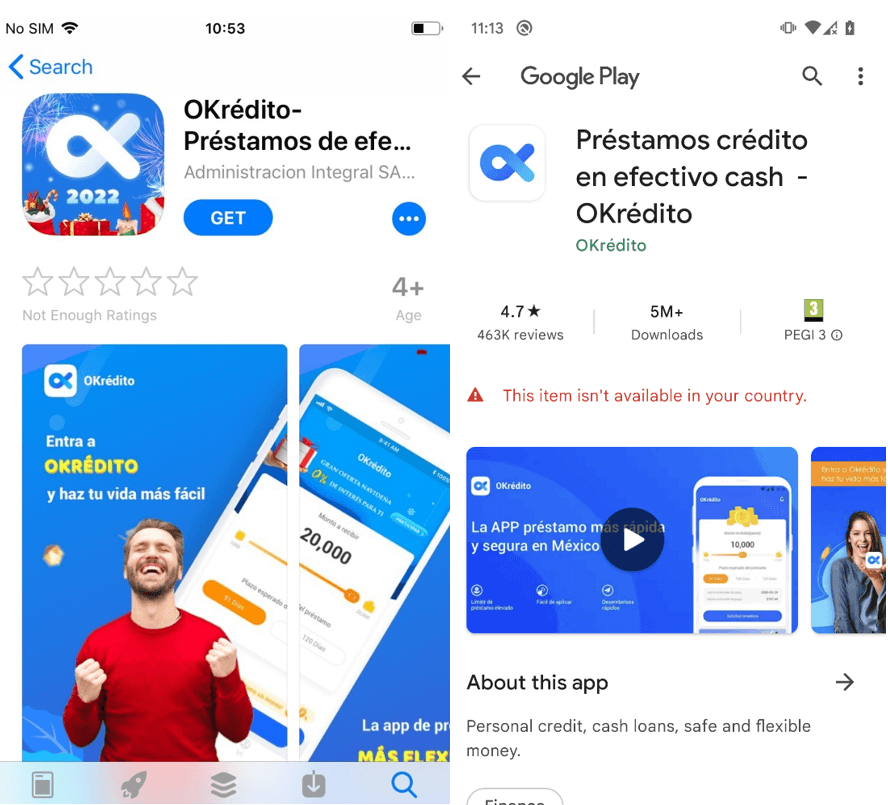

4. Harmful lending apps

Over the past few years, ESET has observed a worrying increase in malicious Android apps masquerading as legitimate lending apps. In early 2022, it notified Google about 20 such scam apps that had over nine million collective downloads on the official Play Store. “SpyLoan” app detections increased by 90% between the second half of 2022 and the first half of 2023. And in 2023, ESET detected another 18 malicious apps with 12 million downloads.

SpyLoan apps lure victims with the promise of easy loans via SMS messages and on social media sites such as X (formerly Twitter), Facebook and YouTube. They often spoof the branding of legitimate lending and financial services companies in an attempt to add legitimacy to the scam. If you download one of these apps you will be asked to confirm your phone number and then provide extensive personal information. This could include your address, bank account information, and photo ID cards, as well as a selfie, which can be used for identity fraud.

Even if you don’t apply for a loan (which will be rejected anyway) the app developers may start harassing and blackmailing you into handing over money, potentially even threatening physical harm.

5. Payday loan scams

These scammers target people in need of cash, often people with poor credit or financial difficulties. Just as with the other varieties, they promise quick and easy loan approval with minimal documentation and no credit checks, taking advantage of the urgency of the borrower’s financial situation. To apply for the loan, the scammer often asks the borrower to provide sensitive personal and financial information, such as Social Security number, bank account details and passwords, using them for identity theft and financial fraud.

RELATED READING: 8 common work-from-home scams to avoid

6. Loan repayment fraud

Some scams require more upfront reconnaissance work by criminals. In this version, victims who have already taken out loans will be targeted. By spoofing that loan company, they will send you a letter or email stating that you missed a repayment deadline and demanding payment plus a penalty.

7. Identity fraud

A slightly different approach is to steal your personal and financial data, perhaps via a phishing attack. And then use them to take out a loan in your name with a third-party provider. The scammer will max out the loan and then disappear, leaving you to pick up the pieces.

How to protect yourself from loan fraud

Watch out for the following warning signs to stay safe:

- Guaranteed approval of a loan

- Request for advance payment of a fee

- Unsolicited contact from the lending company

- Pressure tactics and a sense of urgency, which are an extremely popular ploy among scammers of various kinds

- A sender email address or website domain that doesn’t match your company name

- No fine print to check the loan itself

Also consider the following precautionary measures:

- Research the company that intends to offer the loan

- Never pay an upfront fee unless the company sends you an official notice setting out the terms of the loan and the reasons for the additional fee (which you must agree to in writing)

- Always use anti-malware on your computer and multi-factor authentication (MFA) to reduce the chances of data theft

- Do not respond directly to unsolicited emails

- Don’t overshare online: Scammers may scan social media for opportunities to exploit your financial situation

- Only download apps from official Google/Apple app stores

- Make sure your mobile device is protected with security software from a reputable vendor

- Don’t download apps that require excessive permissions

- Read user reviews before downloading any app

- Report suspected scams to the appropriate authorities, such as the Federal Trade Commission (FTC) or the Consumer Financial Protection Bureau (CFPB)

As long as there are people in need of financing, loan fraud will be a threat. But by remaining skeptical online and understanding scammers’ tactics, you can stay out of their clutches.