By Howard Schneider and Ann Saphir

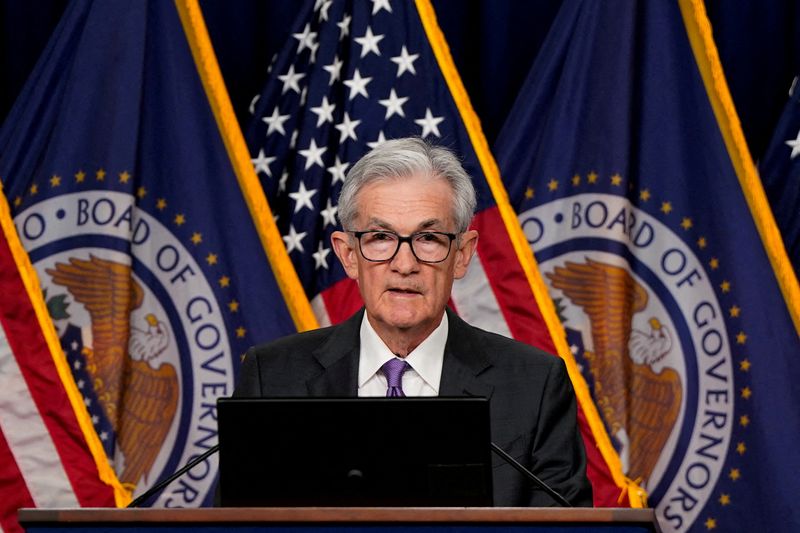

WASHINGTON (Reuters) – The latest U.S. inflation data is “in line with what we would like to see,” Federal Reserve Chair Jerome Powell said on Friday in comments that appeared to keep the central bank’s baseline for rate cuts intact. interest rates this year.

The personal consumption expenditure (PCE) price index data for February, released on Friday, “is what we expected,” Powell said, and while the numbers showed less of a slowdown from last year, “they don’t you’ll see we overreact.”

Last month’s data was “not as low as most of the good readings we got in the second half of last year, but they are certainly more in line with what we want to see,” Powell said during an appearance at the Fed San Francisco. where he was interviewed by Kai Ryssdal of public radio’s “Marketplace” program.

Powell’s comments were in line with his remarks after last week’s Fed policy meeting, in which he said higher-than-expected inflation in January and February had not changed the sense that price increases would continue. fall to the central bank’s 2% target this year. .

Data from the U.S. Commerce Department on Friday showed the PCE price index rose at an annual rate of 2.5% in February, up from 2.4% the previous month. The number, excluding food and energy price volatility, rose 0.3% month over month, slightly faster than Powell had forecast when he said last week that core inflation would be “well below” by 0.3% in February.

Lou Crandall, chief economist at Wrightson ICAP (LON:), said the unrounded core PCE value sits just below that figure, at 0.26%. “This is still above their annualized target of 2%, but it’s not a terrible number,” he said.

Indeed, Powell indicated that the latest PCE report did not undermine the central bank’s underlying outlook, but said that with the economy on “strong” footing, “that means we shouldn’t be in a hurry to cut.” .

The Fed chief will have another opportunity next week to sharpen his message on the outlook for monetary policy, with a second public appearance Wednesday in the San Francisco Bay Area at Stanford University, where he delivered prepared remarks.

“While we expect a message that is more carefully worded than the short-term outlook,” Deutsche Bank economists wrote about the upcoming event, “we do not expect a material deviation from the message from the FOMC on March 20 (Federal Open Market Committee), meaning the Fed is data dependent and needs further evidence that inflation is on track to 2%.

“WE WILL BE CAREFUL”

Some details of the February PCE data, economists noted, showed improvement in aspects of inflation that the Fed considers important, even as the headline numbers showed little progress in the first two months of the year.

The central bank last week kept its benchmark overnight interest rate stable in the 5.25%-5.50% range and also reaffirmed – narrowly – a baseline projection that the rate will fall by three-quarters of percentage point by the end of 2024.

The Fed is expected to keep rates stable, as it has done since July last year, at its April 30-May 1 policy meeting.

By then policymakers will have received the inflation and employment reports for March, as well as the initial estimate of gross domestic product growth for the first three months of the year.

While Fed officials have been careful to say they don’t put much weight on any single month’s data, March’s data could have a huge impact on their policy discussion if it confirms — or perhaps even more so if it contradicts — a jobs and a expected salary. slowdown in growth and cooling of real estate inflation.

Economists polled by Reuters expect the March jobs report, to be released next Friday, to show continued strong wage growth, with 200,000 jobs added, but with annual wage growth at 4.1% , hitting its slowest pace since June 2021.

Powell in recent weeks has had to reconcile expectations that rate cuts will begin this year with data showing an improvement in inflation numbers that had slowed earlier in the year.

“We need to see more” progress on inflation before cutting rates, he said Friday. “The decision to start reducing rates is very, very important… The economy is strong right now, and the job market is strong right now. And inflation is falling. We can be careful and we will be be careful with this decision because we can be.”