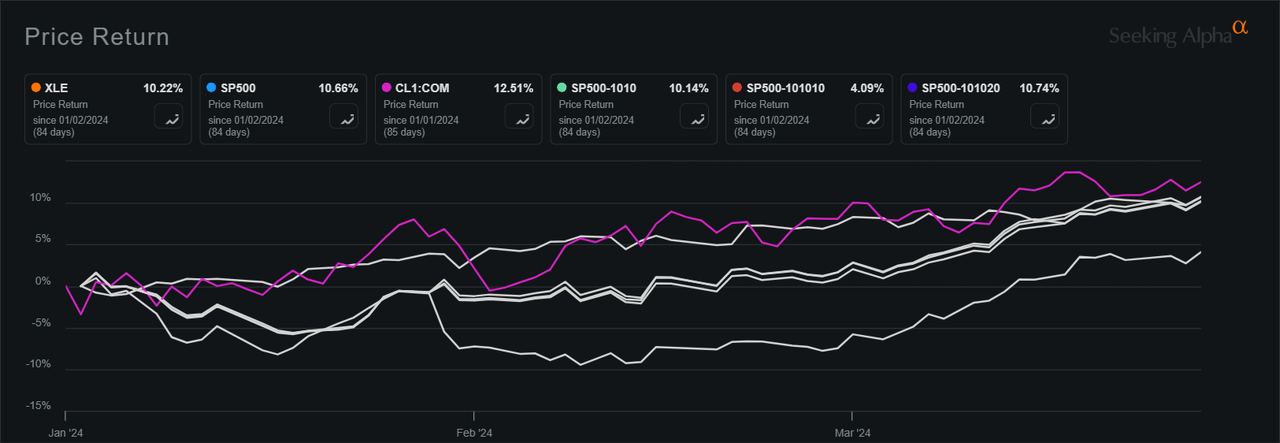

The SPDR Energy Select Sector Fund ETF (NYSEARCA:XLE), which tracks the energy sector of the S&P 500 index, increased by approximately 10.2% in the first quarter of 2024, almost similar to the performance of the broader S&P 500 index, which increased by 10.7% during the same period.

THE The ETF had fell 0.7% in 2023, while the benchmark index grew by 24.7% over the same period.

Crude oil futures are up 12.5% while the energy index is up 10.1% so far today.

The index, made up of companies involved in oil production, drilling, refining and transportation, is the best-performing sector among the S&P 500 sectors over the past month and ranks third year to date.

Within energy, energy equipment and services are up 4.1%, while oil, gas and consumable fuels are up 10.7% to date.

XLE has $39.44 billion in assets under management as of March 28, 2024, and its largest constituents include ExxonMobil (XOM), Chevron (CVX), ConocoPhillips (COP), SLB (SLB), and EOG Resources (EOG).

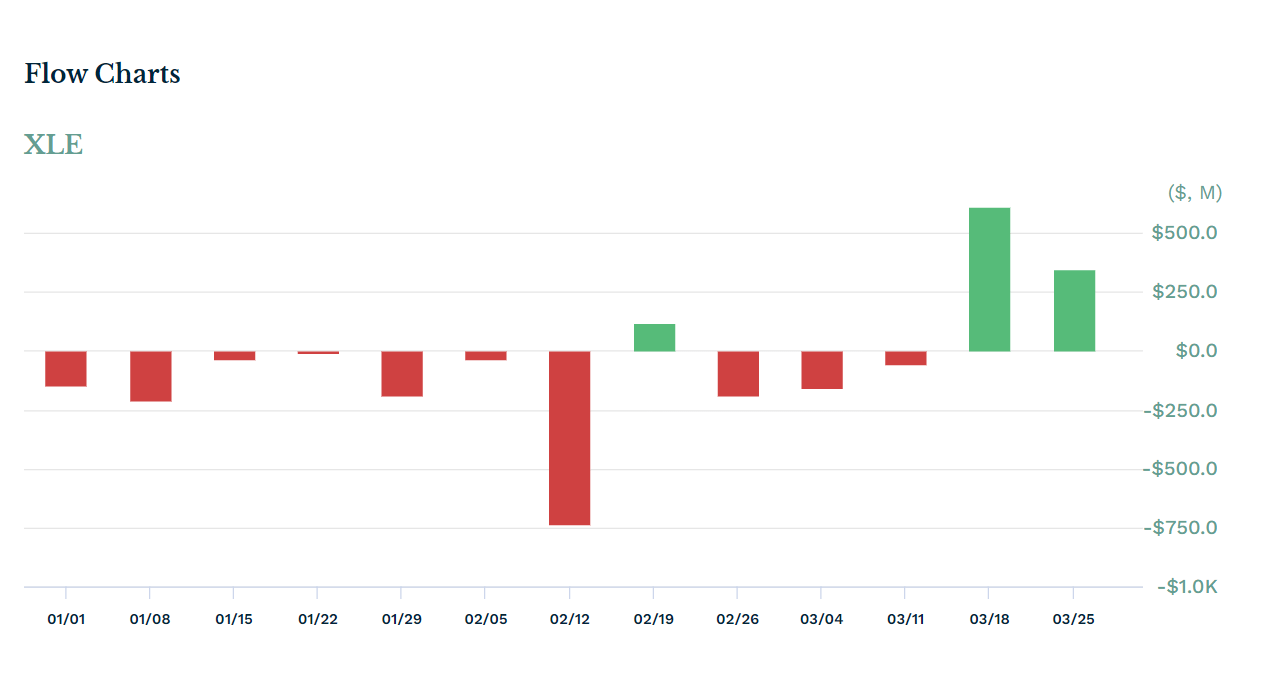

US equity fund flows in and out of the energy sector have been in the red in the first 7 weeks of 2023. The energy-focused ETF has seen a net outflow of $676.52 million to date.

Top mover since the beginning of the year

- Winners: Oil marathon (MPC) +35.82%

- Valero Energia (VLO) +31.30%

- Diamondback Energy (FANG) +29.31%

- License Plate Resources (TRGP) +28.92%

- Phillips 66 (PSX) +22.68%

- Losers: APA Corp. (APA) -4.18%

- EQT Corp (EQT) -4.11%

- Baker Hughes (BKR) -1.99%

What the quantitative measures say

XLE received a Buy rating from Seeking Alpha’s Quant Rating system with a score of 4.38 out of 5, supported by A+ in liquidity and A in expense category. The ETF earned an A+ for momentum. However, it got a B+ for dividends and a D- for risks.

What analysts expect

Seeking Alpha contributor Mott Capital Management said in its March 25 report that the ETF is testing its all-time high, suggesting a potential breakout and significant rally if oil and gasoline prices rise.

“Technically and fundamentally, it would make sense for the XLE to break out and push higher, mostly depending on where oil and gasoline prices go. For the XLE, it is now the fifth time it has encountered resistance around $93.20, and a breakout move to that level would be enough to see the ETF rise significantly. If this fifth breakout attempt is successful, then it looks like we could see the XLE rally significantly, perhaps to $120, gauging the distance between the resistance and the uptrend lower,” they said.