sand sun

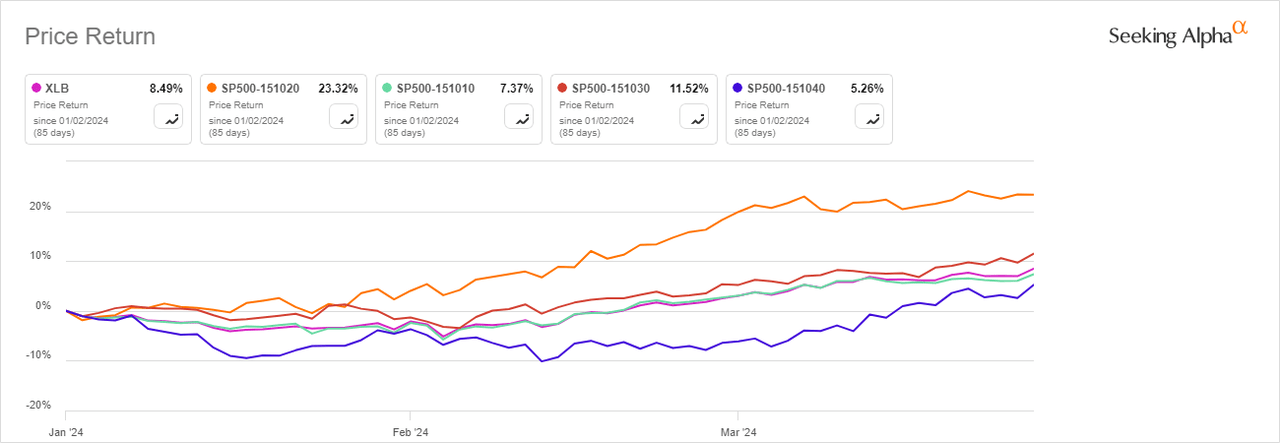

The Materials Select Sector SPDR Fund ETF (NYSEARCA: XLB), which tracks the materials sector of the S&P 500 (SP500-15), increased by approximately 8.78% in the first quarter of 2024, marginally underperforming the broader S&P 500 index, which rose 10.79% during the same period. The ETF had made gains 10.2% in 2023.

The index has entered the top-performing S&P 500 sectors over the past month, driven by strong economic growth and a weakening U.S. dollar index, as well as sector rotation toward resource-based companies.

Among industrial sectors, construction materials gained the most in the first quarter, recording an increase 23.56%containers and packaging have grown 11.57%while chemicals increased 7.41%while metals and mining occupy the last place, increasing 6.65%.

XLB has more than $5 billion in assets under management as of March 28, 2024, and its largest constituents include Linde (LIN), Sherwin Williams (SHW), Freeport-McMoRan (FCX), Ecolab (ECL), and Air Products (APD ) ). The materials-focused ETF saw net inflows of $18.19 million in the first quarter.

Top 5 S&P500 Materials Players in Q1:

- Materials by Martin Marietta (MLM) +25.03%

- Steel Dynamics (STLD) +24.66%

- Vulcan Materials (VMC) +22.06%

- Corteva (CTVA) +18.76%

- Ecolab (ECL) +16.50%

The Bottom 5 S&P500 Materials Performance Stocks in Q1:

- Newmont (NO) -12.39%

- Air Products and Chemicals (APD) -11.41%

- Mosaic (MOS) -11.02%

- Albemarle (ALB) -10.31%

- PPG Industries (PPG) -1.62%

What the quantitative measures say

XLB received a Buy rating from Seeking Alpha’s Quant Rating system with a score of 4.09 out of 5, supported by A+ in liquidity and A in expense category. The ETF got an A- for momentum. However, it got a B for dividends and a D for risks.

What analysts expect

Seeking Alpha contributor Mike Zaccardi upgraded the ETF from Hold to Buy.

“Fears of higher interest rates for a longer period do not appear to have the same bearish impact that they have had at times in 2023, Zaccardi said, arguing that, for XLB and the materials sector, the new period of momentum is favorable for the month to come.”

Seasonally, XLB tends to see flat returns in March, but April is among the strongest months of the year, according to Seeking Alpha’s Seasonality tool.