Stay informed with free updates

Just sign up to Global inflation myFT Digest: delivered straight to your inbox.

Inflation is falling faster than expected in Europe, while exceeding expectations in the United States, prompting investors to predict that the European Central Bank could cut interest rates before the Federal Reserve.

Eurozone inflation fell to 2.4% in the year to March, the fourth consecutive monthly decline and the latest evidence that prices are enticingly close to the ECB’s 2% target.

By contrast, U.S. inflation has exceeded forecasts since the start of this year, with the personal consumption spending measure the Fed uses for its target rising from 2.4% in the year to January to 2. 5% in February.

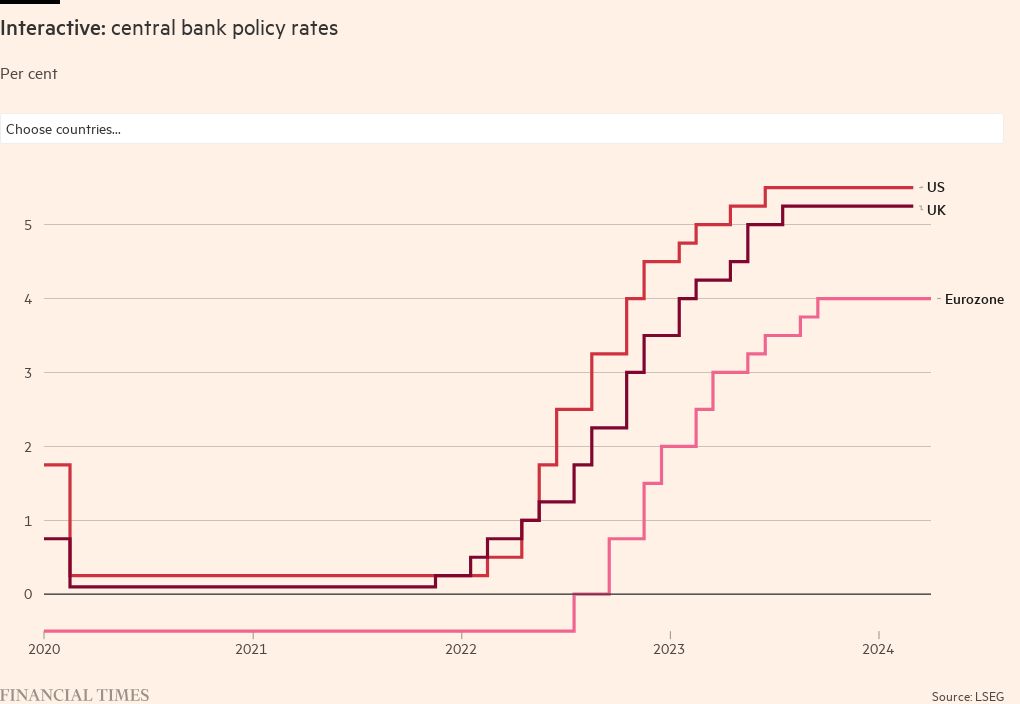

After the biggest rise in the cost of living in a generation, diverging inflation paths in the Eurozone and the United States have prompted investors to scale back the full interest rate cuts they expect from the Fed this year, forecasting at most at the same time that the ECB will loosen monetary policy anyway. more aggressively.

“In the first three months of the year there is now ample evidence that the disinflationary dynamic remains stronger in Europe than in the United States,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management.

Fed Chair Jay Powell signaled in a speech on Wednesday that persistently high inflation in the United States may prevent the central bank from cutting rates as quickly as previously thought.

“We do not expect it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably towards 2%,” Powell said. “Given the strength of the economy and the progress made so far on inflation, we have time to let incoming data guide our policy decisions.”

Interest rate swap markets on Wednesday were pricing in nearly 70 basis points of rate cuts by the Fed and the Bank of England this year, equivalent to cuts of two to three quarter points. As for the ECB, they discounted almost 90 basis points of cuts, which is almost a quarter of a point more.

Last year the Fed raised its key rate to the highest in 23 years, from 5.25% to 5.5%, while the ECB raised the deposit rate to a record high of 4%.

UK inflation fell to 3.4% in February. The BoE expects consumer price growth to fall below its 2% target in the second quarter but is closely monitoring services inflation which remained worryingly high at 6.1% in February, driven by rapid growth in wages.

Katharine Neiss, chief European economist at PGIM Fixed Income, said the “encouraging” eurozone inflation data meant the level was “pretty high” for the ECB to delay rate cuts beyond June, unlike the Fed .

“The increased belief about the likelihood and timing of rate cuts by the ECB is somewhat at odds with what we are seeing in the US.”

Price pressures in the United States are kept elevated by strong growth in the world’s largest economy, which increased gross domestic product by 2.5% last year. The Eurozone, by contrast, remained stagnant after its GDP grew just 0.5% last year, fueling calls to revive economic activity with looser monetary policy.

“With Eurozone growth certainly more timid, we believe this will allow the ECB, as indicated, to cut rates in June while we could see the Fed cut be pushed back to July,” said Kaspar Hense, senior portfolio manager at RBC Bluebay. Resource management.

Pablo Hernández de Cos, governor of Spain’s central bank and ECB board member, responded to the latest drop in eurozone inflation by saying that “the central scenario is that June could be the first interest rate cut.”

The ECB is expected to signal it is moving closer to cutting rates when its governing council meets in Frankfurt next week.

However, there are reasons why the ECB should remain cautious and wait until June before cutting rates for the first time since 2019.

The main one is rapid growth in services prices, which make up 45% of the basket used to calculate Eurozone inflation and rose at an uncomfortably high annual pace of 4% for the fifth consecutive month in March.

“Hawks will indicate that services inflation, still sticky, points to continued risk to underlying domestic inflation,” said Krishna Guha, vice president of equities at investment bank Evercore-ISI. “A significant drop in services inflation – signaling marked weakness in domestically generated inflation – would have been necessary to put an April cut back on the table.”

Another reason why the ECB needs to be patient – despite calls from some board members, such as Piero Cipollone, to start cutting rates “rapidly” – is the desire to avoid a divergence with the Fed, which could cause movements in the currency and bond markets which risk a resurgence of inflationary pressures.

“I don’t think the ECB would dare to cut if the Fed changed communications before the summer,” said Ludovic Subran, chief economist at insurance company Allianz, although he predicts that a weakening of the U.S. labor market could also allow both the Fed and to the ECB to cut rates by July.