Key points

- Stocks spend most of their time in a trading range or consolidation, which can be frustrating for traders as breakout and breakdown attempts cause feints and swings.

- A long-term butterfly spread strategy allows options traders to profit during periods of consolidation.

- A butterfly call spread includes selling 2 middle strike calls (bodies) and buying 1 lower strike call and 1 higher strike call (wings). They are a combination of a bearish credit spread and a bullish debit spread.

- 5 stocks we prefer to Intel’s

Stocks can be very interesting when they trigger breakouts and breakdowns, forming strong price trends. However, the reality is that stocks usually tend to be edged out in a consolidation. Whether small or large, stock prices tend to fluctuate within a range much more often than their trend.

If we assume that stocks only trend about 30% of the time, the remaining 70% of the time can be considered a consolidation. This applies to all stocks in any stock sector. While consolidations are not bad, they give the stock time to rest before another trend move emerges; they can be choppy and frustrating for stock and options traders due to head feints and wobbles.

Using options to profit during stock consolidations

With stock options, you can capitalize on rangebound stocks during consolidations using a call butterfly strategy. This is also called a long call butterfly spread, call butterfly or butterfly spread. It is a market-neutral multi-range strategy with a defined maximum loss risk and a limited maximum profit reward. Look to profit from low volatility and theta (time decay) erosion as the underlying stock moves within a consolidation range. It is also a strategy that can earn profits many times greater than the risk.

The mechanics of a calling butterfly

This multi-leg strategy uses four call options with three different strike prices for the same stock and the same expiration. We will first want to identify a strike price that indicates the stock is consolidating near or at-the-money (ATM). While it doesn’t have to be an ATM, the maximum profit increases the closer it gets. Secondly, we want to evaluate strike prices at equal distances above and below the average strike price.

For example, if the average strike of XYZ is $55, the upper and lower strike prices would be $60 and $50, or $57.50 and $52.50. We would sell 2 call options at the average strike price to receive credit. So we buy 1 call option 1 at the higher strike price and buy 1 call option 1 at the lower strike price.

Butterfly for Long Calls = Debit Spread for Up Calls + Credit Spread for Down Calls

A butterfly call spread is a combination of a bull call debit spread and a bear call credit spread.

The bull call debit spread is the part where we buy the low strike call and sell the medium strike call. The bear call credit spread is where we sell the mid-call strike and buy the high strike.

The strategy is called butterfly because the 2 mid-stroke decoys make the body, and the 1 lower stroke decoy and 1 upper stroke decoy are the wings.

Put on the market

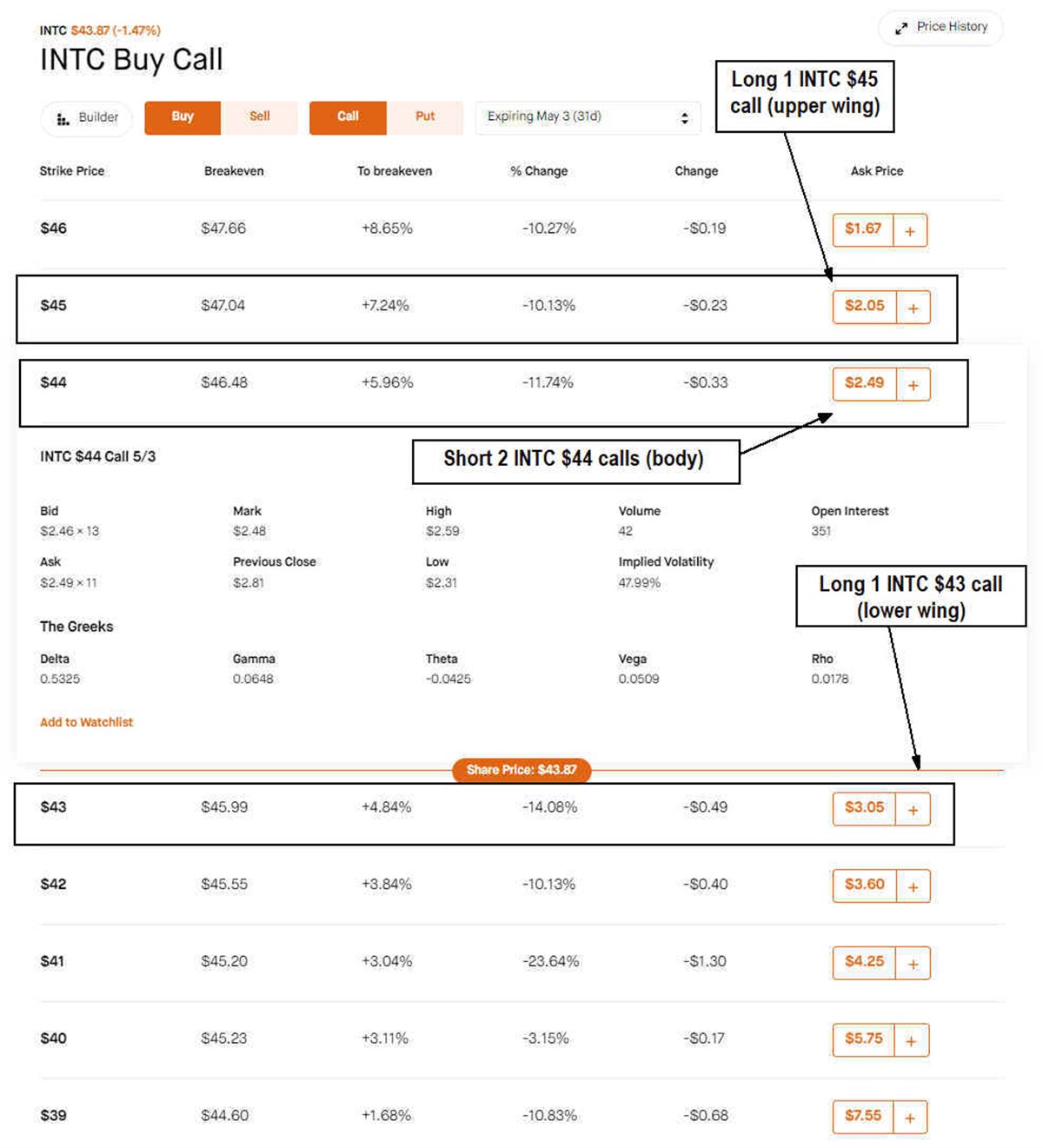

We use Intel Co. NASDAQ: INTC as an example.

The daily candlestick chart illustrates the rangebound action since it turned lower on the earnings misses. The shares fluctuate between $46 and $42, hovering around $44. The daily relative strength index (RSI) is also flat around the 52 band. If we consider $44 for the body, then we can use $45 and $43 as the wings of a call butterfly.

Start the operation with INTC

There are three directions to pull options. The first two involve adjusting strike prices and the last involves extending the expiration date.

Here are the four professions.

Buy 1 in-the-money (ITM) call at $43.00 for ($3.05) ß Ala

Sell 2 at-the-money (ATM) calls at $44.00 for $2.46 for $4.98 credit § Body

Buy 1 out of the money (OTM) call at $45.00 for ($2.05) ß Ala

The net cost can be calculated as credit of $4.92 less debit of $5.10 per a net cost of 11 cents for the sale.

Potential results

The butterfly has 3 definite outcomes and everything in between. We will look at the break-even, maximum profit and maximum loss levels of the underlying stock at the close of expiry.

The breakeven level has 2 price points including the lower strike price of $43.00 plus the trade cost at 12 cents for $43.12 and the upper strike price of $45.00 less the cost of 12 cents of the transaction or $44.88.

The maximum profit is $1.00 minus the trade cost of 12 cents for 88 cents if INTC closes at $44.00 at expiration for a gain of 733%.

The maximum loss is the cost of the trade or 12 cents. Each contract represents 100 shares for 12 cents, which equates to $12 per contract.

When to use Call Butterfly spreads

The call butterfly strategy seems complicated at first, but the key is to imagine a butterfly. When you visualize a butterfly made up of a body (2 middle stroke short calls) and the wins (1 top stroke long call and 1 bottom stroke long call), it’s actually quite simple. They can be used for securities that are in consolidation ranges.

Make sure there are no events scheduled before the deadline, such as an earnings report. Low volatility is your friend. You can also take your chips off the table and cash them in before expiration at any time. Waiting until expiration allows you to capture more of the time decay.

Before considering Intel, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Intel wasn’t on the list.

While Intel currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

Click the link below and we’ll send you MarketBeat’s list of the seven best retirement stocks and why they should be in your portfolio.

Get this free report