Bet_Noire

Stocks have recovered from recent lows as investors await favorable regulatory changes in the United States, while others have raised concerns of a sharp turnaround if the next catalysts fail to materialize.

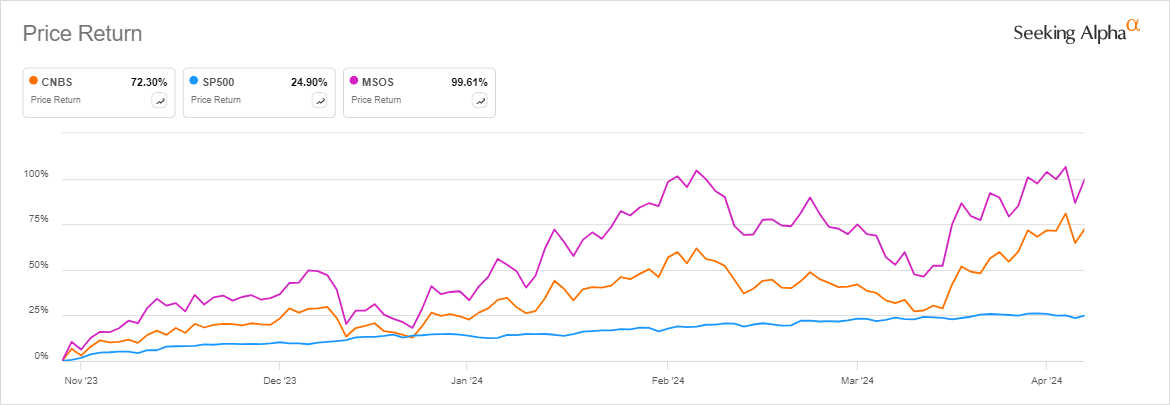

Amplify the Seymour Cannabis ETF (NYSEARCA:CNBS), which represents the The global cannabis industry, including Canadian licensed producers, has returned more than 72% since its October low, eclipsing a roughly 25% gain in the S&P 500 (SP500).

Cannabis ETF AdvisorUS Pure Cannabis Stocks (NYSEARCA:MSOS), a benchmark for U.S. multistate traders, outperformed further, nearly doubling from a multi-year low in August, just before the sector saw its first major stock move event.

In late August, a letter from the US Department of Health and Human Services (HHS) recommending that cannabis be classified as a low-risk substance raised hopes of a rapidly changing regulatory landscape ahead of the upcoming presidential election.

A potential rescheduling decision by the Drug Enforcement Administration (DEA) could be “imminent,” Seeking Alpha analyst Julian Lin wrote, highlighting the tax benefits cannabis operators could reap if marijuana is moved from Schedule I to Table III.

“Rescheduling cannabis into Schedule III, while falling short of decriminalization, could lead to a sudden increase in cash flows and decreased capital costs for these operators,” Lin wrote, reaffirming his bullish view on MSOS .

However, according to SA analyst Alan Brochstein, the “bigger risk” is that a potential rescheduling event reclassifying cannabis alongside medicines such as Tylenol will never materialize and that fiscal problems will persist.

“Although I believe they could strengthen further if 280E were swept away, they would otherwise have a lot of disadvantages,” the analyst warned, referring to a tax code related to high-risk substances under the Controlled Substances Act (CSA).

Emphasizing that there is no timeline for the DEA’s decision, Brochstein argued that the pot industry is troubled by financial problems. “The sector is now in poor financial condition, with some companies’ balance sheets under pressure,” Brochstein wrote with a sell rating on MSOS.

However, former Cantor Fitzgerald analyst Pablo Zuanic disagrees. “If you have a long-term view and have quality names, you can rest assured that there are many more benefits,” said Zuanic, a managing partner at cannabis consultancy Zuanic & Associates.

“This is a very difficult sector to trade in the short term,” he noted in a comment to Barron’s.

This week, the cannabis industry saw another major catalyst when the Florida Supreme Court ruled in favor of a campaign to legalize recreational marijuana in the state, paving the way for a referendum on the November ballot.

The Smart & Safe Florida-sponsored initiative is funded by Florida-based Trulieve (OTCQX:TCNNF) along with several other MSOs, including Cresco Labs (OTCQX:CRLBF), Ayr Wellness (OTCQX:AYRWF), Curaleaf (OTCPK: CURLF), Pollice Verde (OTCQX:GTBIF) and Verano (OTCQX:VRNOF).

Meanwhile, global developments have further increased investor interest. Germany legalized cannabis this week despite several restrictions, making it the third European country, after Malta and Luxembourg, to legalize the drug for recreational use.

The event prompted US MSO Curaleaf (OTCPK:CURLF), which operates in Europe, to consider a secondary listing in the region.

However, Curaleaf (OTCPK:CURLF), a favorite on Wall Street, is a strong sell in terms of valuation, according to Brochstein. “The company has a lot of debt and will likely sell shares during a rally. If 280E doesn’t disappear, the stock will face substantial downside,” he concluded last month.