Brett_Hondow/iStock via Getty Images

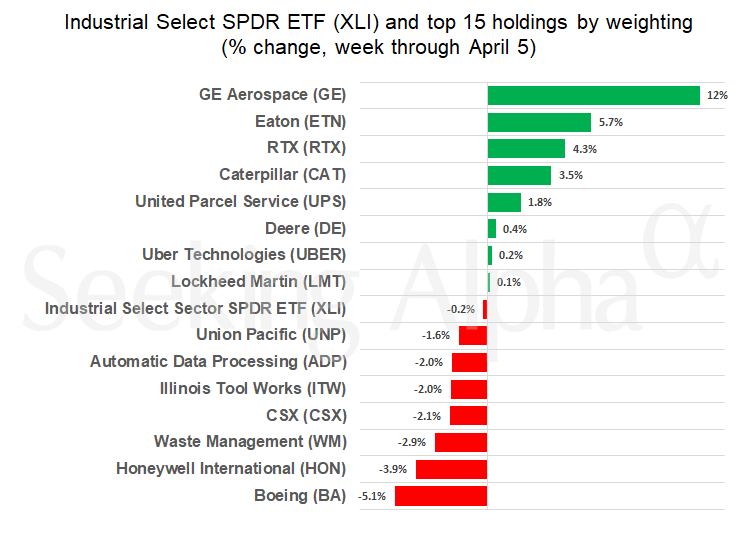

Boeing (NYSE: BA) and Honeywell International (NASDAQ: ON) fell the most among major US industrial companies in a turbulent week for US stocks.

The SPDR Industrial Select Sector ETF (NYSEARCA:XLI), whose holdings include some of the largest US companies in the sector, slipped 0.2% on the week.

The performance mirrored that of other benchmarks, with the Standard & Poor’s 500 stock index (SP500) losing 1%, the Dow Industrials Average (DJI) down 2.3% and the Nasdaq Composite (COMP:IND) down 0.8%.

The yield on the 10-year Treasury note rose to 4.377% on Friday, the highest since November. Monthly gold futures rose the most since October, ending the week at a record high.

U.S. stocks have languished for much of the week, and on Thursday the S&P 500 Index (SP500) posted its worst daily loss since February. Friday’s strong jobs report helped offset some of the weekly decline as rising job market growth is a sign that the U.S. economy is avoiding a recession. Investors are looking for indicators that the Federal Reserve will cut interest rates in June.

Boeing prolongs decline

Boeing (BA) fell 5.1% on the week to extend its year-to-date loss to 30%. The plane maker is likely to report deliveries and orders data for March on Tuesday. Analysts at financial services firm Baird said channel checks indicate Boeing (BA) likely delivered 32 planes in March, including 25 of its best-selling 737 Max model.

In the wake of the near-catastrophe on a 737 Max in January, the US Federal Aviation Administration has barred Boeing (BA) from increasing production of the plane to more than 38 planes per month until it resolves safety concerns . Boeing’s (BA) production is said to have slowed as it avoids so-called traveled work, or assembling planes out of sequence to speed up production.

The company’s search for a new CEO and efforts to resolve manufacturing issues have led some sell-side analysts to predict the company will stage a strong comeback amid growing demand for new planes. Boeing (BA) will report first-quarter earnings on April 24.

GE Aerospace establishes itself as a pure aviation play

General Electric completed its breakup this week with the split of its aerospace and energy units. GE Aerospace (NYSE:GE), which makes jet engines, grew 12% as a purely aerospace and defense company. The aviation sector has benefited from a strong recovery in travel demand as airlines order hundreds of new planes to keep up with growing passenger volumes. They also try to reduce fuel expenses by replacing older planes.

Eaton grows with updates

Eaton (NYSE:ETN), maker of energy management tools, gained 5% to extend its year-to-date gain to 37%, as investors continued to pile into stocks poised to benefit from the rise of artificial intelligence. The technology requires enormous computing power, helping to drive demand for electrical equipment. Financial analysts at RBC Capital Markets and Barclays both upgraded Eaton (ETN) last week based on its strong backlog.