apomares/E+ via Getty Images

Short bets against materials stocks increased in March compared to the end of February, with lithium producer Albemarle (ALB) being the most shorted stock in the sector and Ecolab (ECL) the least short of the group.

Average short-term interest among the S&P500 materials stocks, the share fluctuation at the end of March was 2.01%, up from 1.78% at the end of February.

The S&P 500 Materials Sector ETF (NYSEARCA: XLB), which has a weight of about 2.4% on the S&P 500, gained about 8.8% in the January-March period, underperforming the market’s overall 10.8% growth.

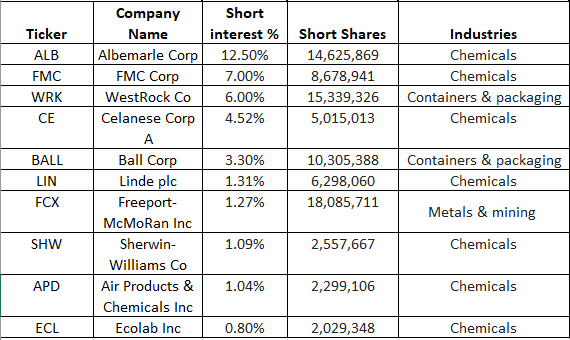

Stocks with the largest and least short positions:

Ranked by short interest as a percentage of the stock’s float

Linde (LIN), Sherwin-Williams (SHW), and Freeport-McMoRan (FCX), the three largest contributors to the index, saw short interest of 1.31%, 1.09%, and 1.27%, respectively.

Albemarle (ALB) had 14.6 million shares sold short as of Mar 28, or 12.50% of the stock’s float. The stock has a Sell rating by Seeking Alpha’s Quant, earning a D in the rating.

FMC (FMC) was the second most shorted stock with 7% of the float, followed by WestRock (WRK) and Celanese (CE), with short interest of 6% and 4.52%, respectively.

Ecolab (ECL) was preceded by Air Products & Chemicals (APD) with a short share of 1.04% and Sherwin-Williams Co (SHW) with a short share of 1.09%.

Industry Analysis:

Containers and Packaging remains the most shorted sector within the sector, with short interest of 2.40% at the end of March, up from 2.21% at the end of February.

Chemical stocks took second place with short interest of 2.15% as of March 28, compared to 1.77% a month ago.