How to use the POWR options approach by combining fundamental, technical and implied volatility analysis with a recent RIO trade as an example.

One of the screens we use in the POWR options trade selection process involves comparing recent performance to help identify relative underperformance of Strong Buy (A – Rated) stocks.

The expectation is that this relative underperformance will be short-lived and that these A-rated stocks will outperform relatively in the coming weeks. Bullish calls are purchased on these temporarily discounted Strong Buy stocks to profit from expected outperformance.

Technical and implied volatility analysis is also used in the decision-making process.

A quick overview of a recent operation at Rio Tinto (RIO) launched on April 1 can help shed some light on the process.

Rio Tinto was a Strong Buy rated stock in the POWR Ratings. Ranked #1 out of 33 in the Industrial Metals industry. As it comes.

Yet RIO, one of the world’s leading steel producers, has significantly underperformed the steel index in recent months.

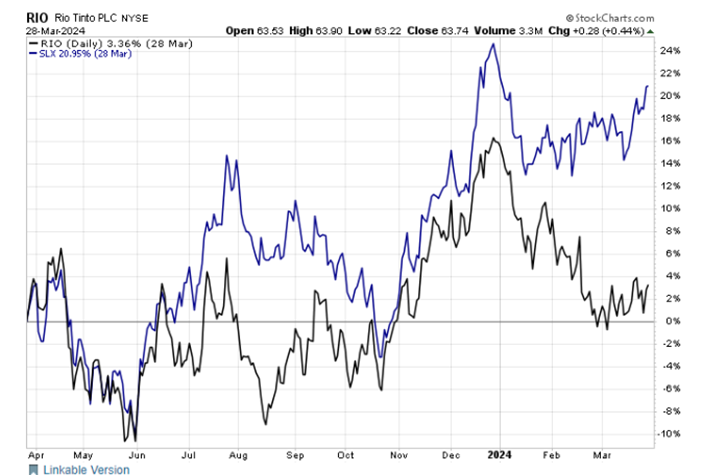

In fact, this underperformance had reached an extreme level, as seen in the semi-annual chart below. Rio Tinto grew just over 3% compared to the previous six months, while SLX had gained almost 21% in the same period. The performance difference was now at 17.59%. This is despite the fact that RIO is the largest component with just over 10% in the steel index.

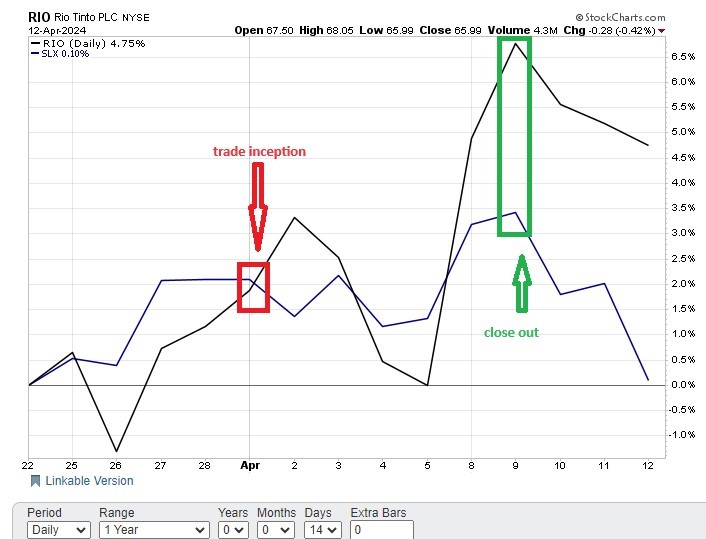

On April 1, RIO stock finally showed some improvement in price action on a technical basis. Shares had moved back above the 20-day moving average after reaching oversold readings.

Implied volatility (IV) was also very reasonable at just 13%. This means that options prices have been cheaper just 13% of the time over the past year.

POWR Options issued a trade recommendation on April 1 to position itself for a pop at Rio Tinto. The actual trade was to purchase the 07/19/2024 RIO calls from $62.50 to $5.00.

Fast forward to April 9th and RIO’s expected outperformance over SLX had begun to shine through. Rio Tinto shares were up about 3 points (5%). RIO stock also closed the performance gap versus SLX from 17.59% to 12.20%.

POWR Options closed on April 9 to sell Rio calls at $6.70. The performance spread had converged and RIO shares had become overbought and were facing general resistance on a technical basis.

The 9-day RSI has approached the 70 level. The Bollinger Percent B has crossed 100. The MACD has recently touched an extreme. Shares were trading at a large premium to the 20-day moving average. RIO stock had difficulty clearing major resistance at $67, as we noted in the closing email.

POWR Options purchased RIO calls on April 1 for $5.00. These calls closed on April 9 at $6.70 for a gain of 34%. The detention period was 9 days. Not bad for a few weeks’ work.

RIO shares went from $64 to $67 in the same 9-day period. A very respectable gain, just under 5%.

So while the stock is up just under 5%, the calls are up almost 35%, or 7 times the amount of the stock. It highlights the powerful leverage that options can provide.

Not all operations work so well or so quickly. After all, trading is about probability and not certainty.

Those looking to increase their odds of success may want to take a closer look at POWR options.

POWR Options

What to do next?

If you are looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with POWR Ratings. Here we show you how to consistently find the best options trades while minimizing your risk.

If this interests you and you would like to learn more about this powerful new options strategy, click below for instant access to this timely investing presentation:

How to Trade Options with POWR Ratings

I wish you the best!

Tim Biggam

Editor, POWR Options Newsletter

RIO shares closed at $65.99 on Friday, down -$0.28 (-0.42%). Year to date, RIO has fallen -7.71%, compared to a 7.81% rise in the benchmark S&P 500 index over the same period.

About the author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim, and 3 years as Market Maker for First Options in Chicago. He appears regularly on Bloomberg TV and is a weekly contributor to TD Ameritrade Network’s “Morning Trade Live.” His main passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

Moreover…

The mail How to buy the best stocks at the best time appeared first StockNews.com