Stay informed with free updates

Just sign up to Global economy myFT Digest: delivered straight to your inbox.

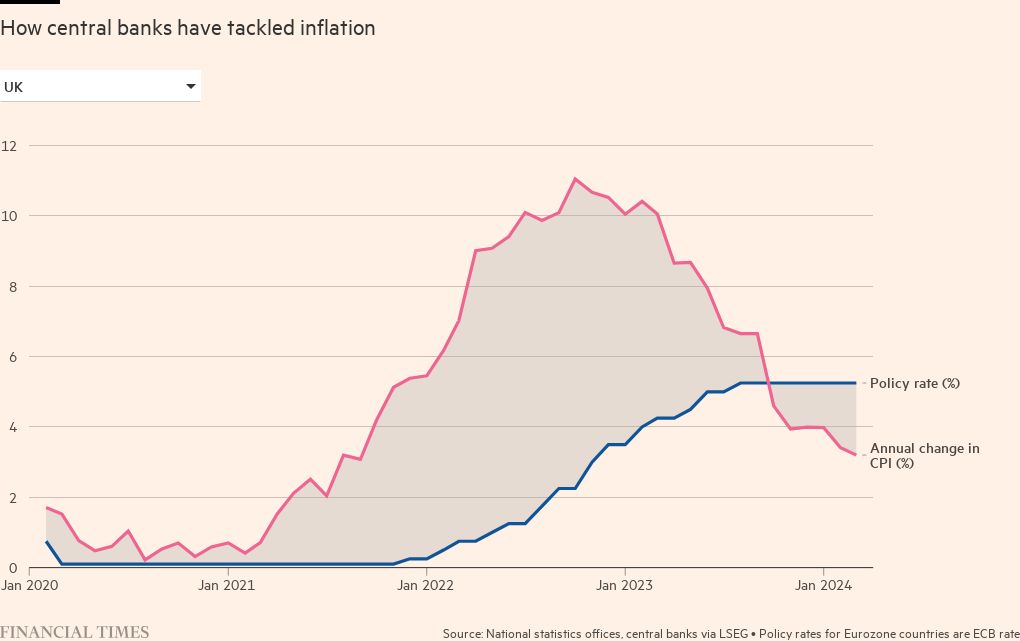

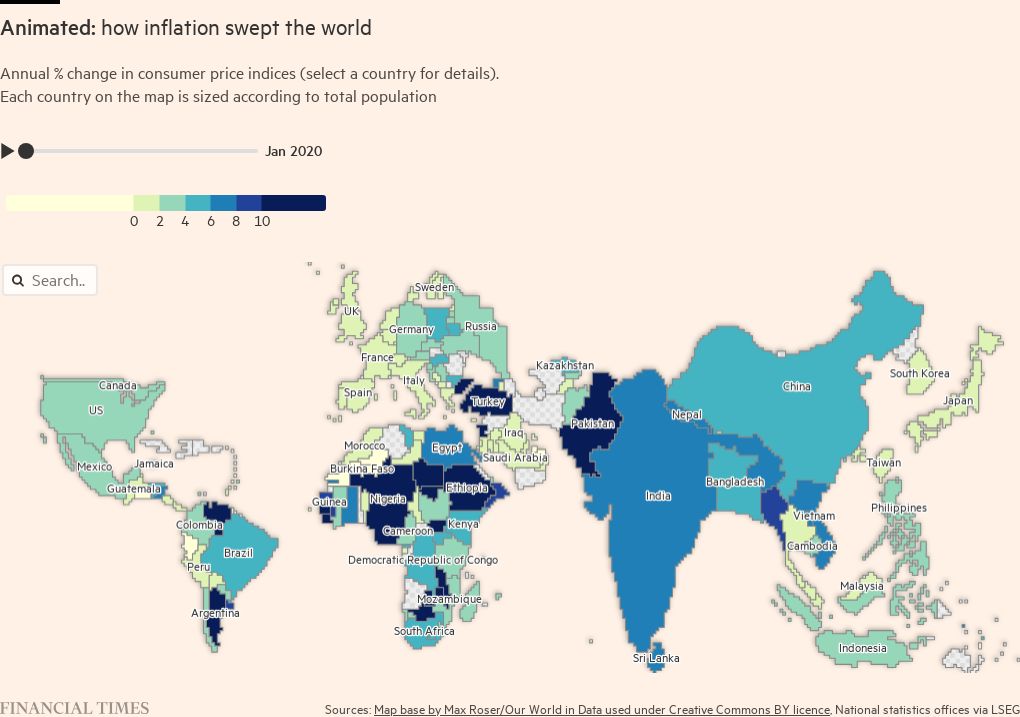

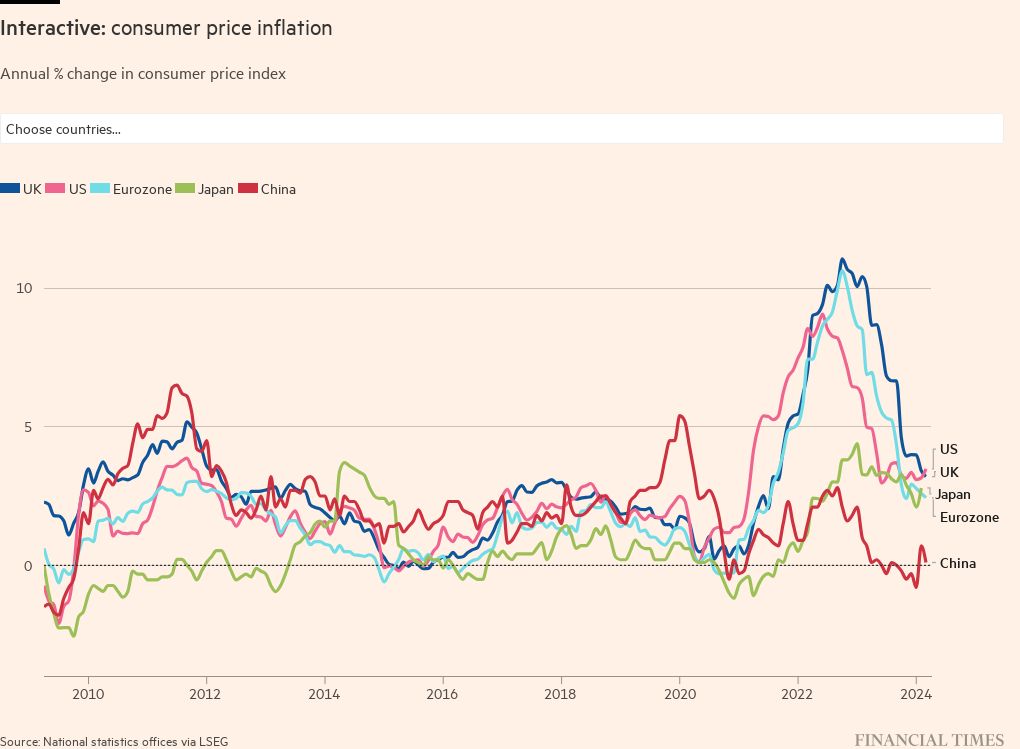

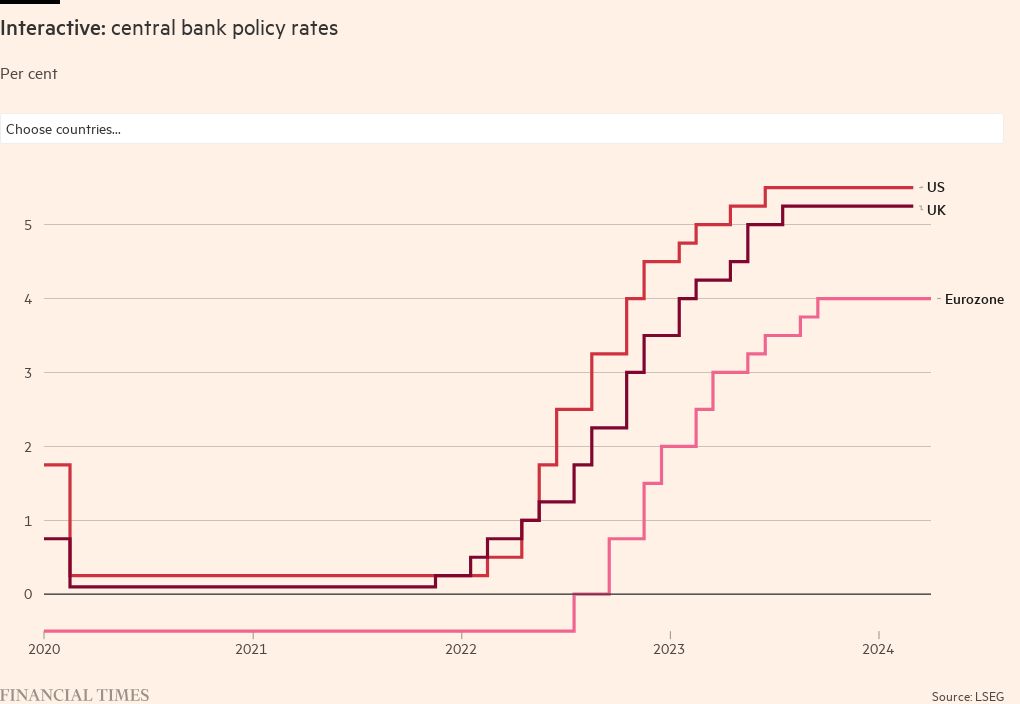

Central banks around the world are expected to reduce borrowing costs as global inflation eases from multi-decade highs reached in many countries over the past two years.

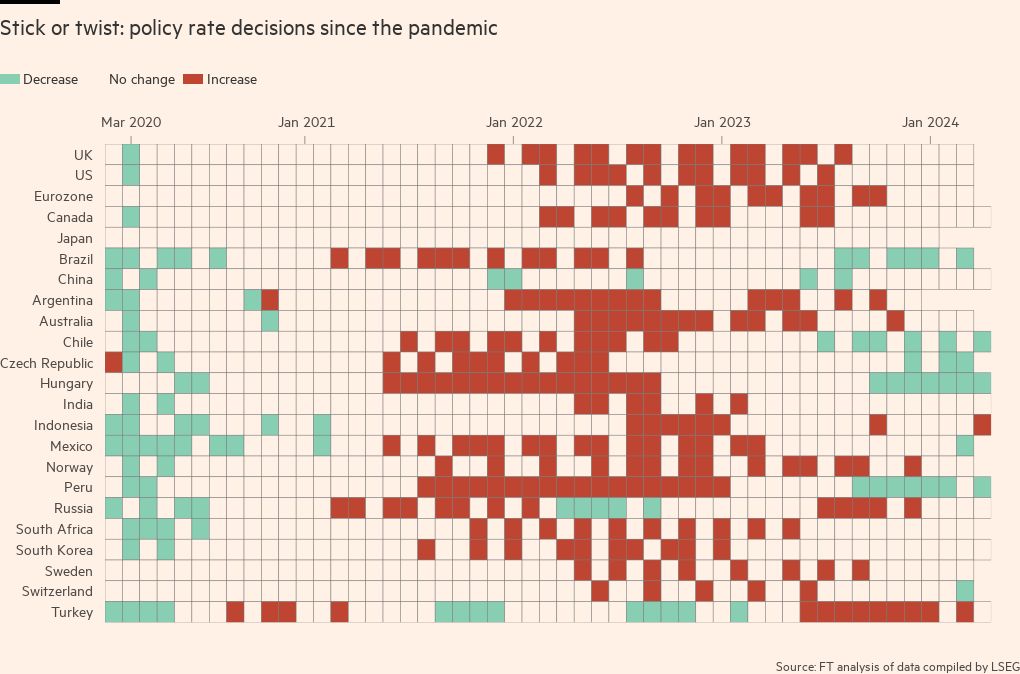

Some institutions, particularly in emerging markets, have already started cutting rates, but many more are expected to follow this year, including the US Federal Reserve, the European Central Bank and the Bank of England.

The FT’s global inflation and interest rate tracker provides a regularly updated visual description of consumer price inflation and central bank policy rates around the world.

This page covers the factors that influence policy makers’ decisions on financing costs, showing how central banks have responded to rising prices with a synchronized increase in interest rates.

Rising financing costs have helped ease the rapid pace of price growth that has swept the world over the past three years during the pandemic and war in Ukraine.

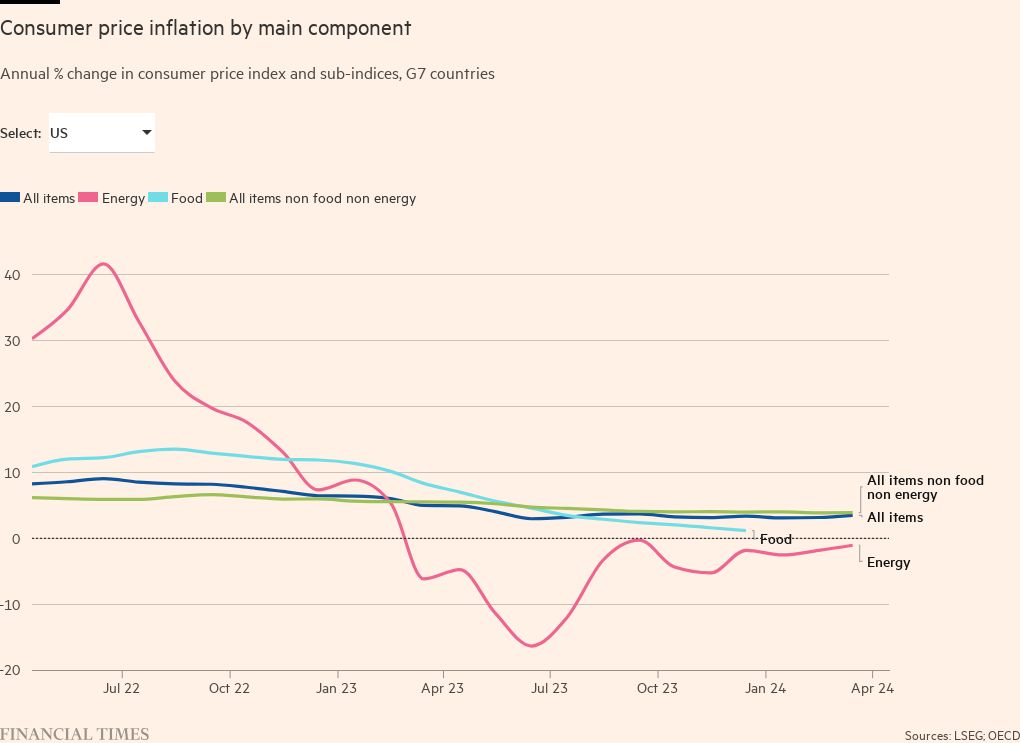

While inflation has fallen from its peak in most countries, many policymakers have warned that the final leg of the journey to central banks’ target – which in most advanced economies is 2% – will be the most difficult. .

You can use this page to track inflation and interest rates in most individual countries.

This page also tracks measures that are closely monitored for signs of how inflation and policy rates may evolve in the coming months.

The latest data for the world’s largest economies shows inflation remains elevated in some countries, excluding food and energy, a key measure of underlying price pressures.

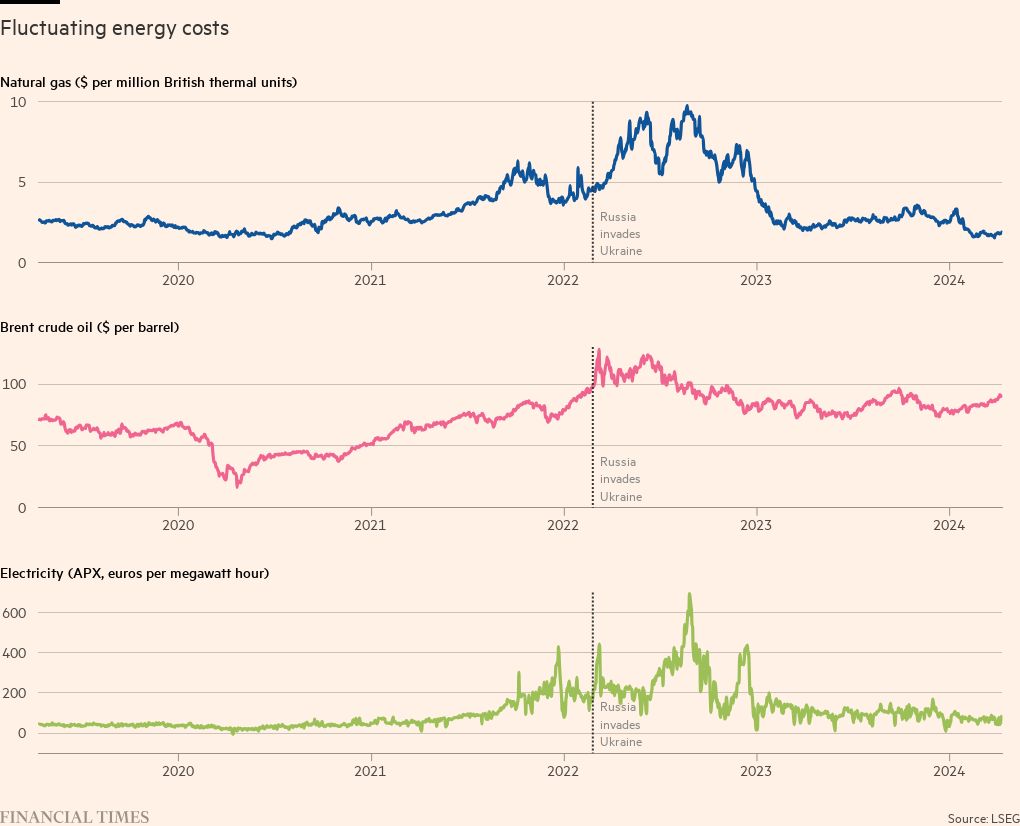

Wholesale energy costs provide a timely measure of the pricing pressures consumers may face in the coming months.

Rising energy prices have been the main driver of inflation in many countries in recent years, but gas and electricity costs have now fallen from peaks reached during the energy crisis that emerged after Russia invaded Ukraine.

This page also tracks 2-year government bond yields, which are heavily influenced by market expectations of interest rates over that period.

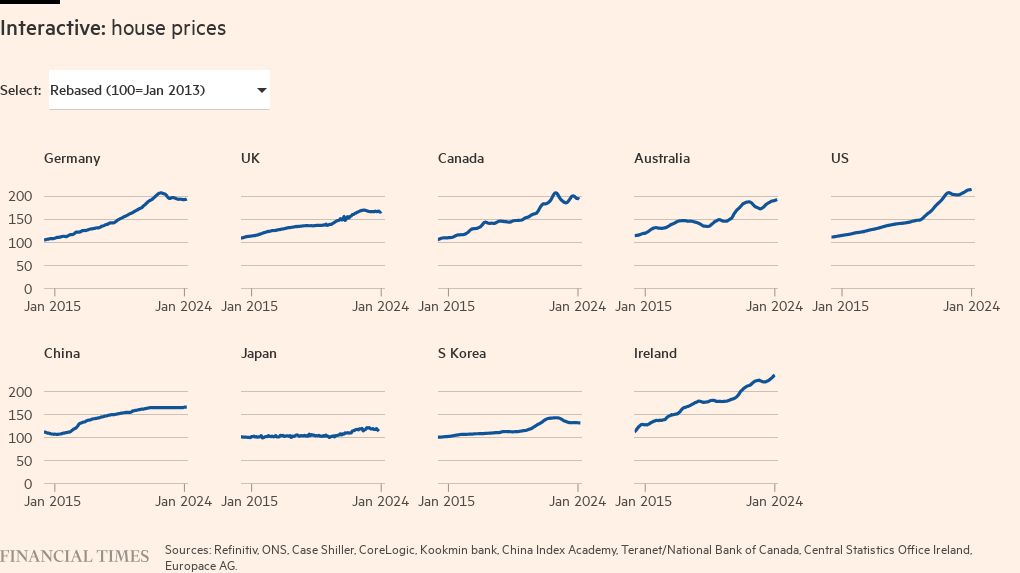

Asset prices were another cause for concern, especially for homes. The cost of housing has soared in many countries during the pandemic, but high mortgage rates have led to a significant slowdown in home price growth in several countries.