CHANNEL

The Select Industrial Sector (XLI) is declining -1.98% for the week ending April 19, which saw airline stocks among the biggest gainers. Meanwhile, the SPDR S&P 500 Trust ETF (SPY) tumbled -3.07%.

XLI was among 8 of 11 S&P 500 sectors closed the week in red. Year to date, or YTD, both are in green, XLI +5.68%INDICATOR LIGHT +4.18%.

The top five gainers in the industrials sector (stocks with a market capitalization greater than $2 billion) all gained more than +7% each this week. Year to date, all these 5 stocks are in the green.

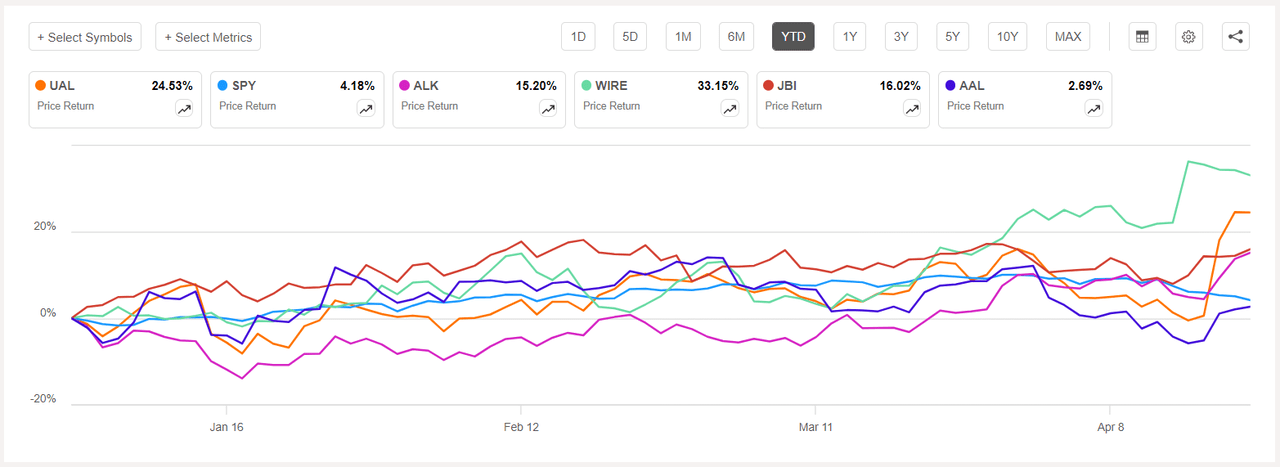

United Airlines (NASDAQ:UAL) +22.92%. Shares of the Chicago-based company skyrocketed +17.45% on Wednesday, after first-quarter results (post-market Tuesday) beat estimates. The stock rose again Thursday (+5.50%) after United announced it would receive compensation from Boeing due to the Federal Aviation Administration’s grounding of its Boeing 737 MAX 9 plane.

The airline had said in its earnings that the results reflected the impact of about $200 million from the grounding of the 737 MAX 9, without which the company would have reported a quarterly profit. CURRENT YEAR, +24.53%.

UAL has an SA Quant Rating, which takes into account factors such as Momentum, Profitability and Strong Buy Rating, among others. The stock has a rating factor of A+ for profitability and A for growth. Meanwhile, the average rating of Wall Street analysts is Buy, where 21 out of 21 analysts label the stock as Strong Buy.

Alaska Air (ALK) +8.98%. Shares of this airline also rose on Wednesday (+4.71%) and then Thursday (+4.03%) after first-quarter results came in better than Wall Street expectations and the company set upbeat forecasts for second-quarter and fiscal 24 earnings. The day also saw shares of Hawaiian Holdings decline after a report on the Justice Department’s review of its planned sale to Alaska Air. CURRENT YEAR, +15.20%.

The SA Quant Rating on ALK is Buy with a score of C+ for Momentum and A- for Valuation. The average rating of Wall Street analysts is also positive, with a Buy rating, where 6 out of 12 analysts see the stock as Strong Buy.

The chart below shows the year-to-date price-earnings performance of the top five earners and SPY:

Encore Thread (THREAD) +8.97%. Shares of the McKinney, Texas-based company jumped 11.59% on Monday after it announced that Italian firm Prysmian (OTCPK:PRYMY) was acquiring it in a deal with an enterprise value of about $3.9 billion of Euro. CURRENT YEAR, +33.15%.

The SA Quant Rating on WIRE is Hold with a score of A- for profitability and D+ for valuation. The average rating of Wall Street analysts agrees and also has a Hold rating, where 3 out of 3 analysts see the stock as such.

Janus International (JBI) +7.45%. Shares of the building products maker gained the most Tuesday (+4.04%). CURRENT YEAR, +16.02%. The SA Quant Rating on JBI is Buy, while the average rating from Wall Street analysts is Strong Buy.

American Airlines (AAL) +7.30%. Another airline stock that gained this week after United Airlines’ earnings was Fort Worth, Texas-based American Airlines, which rose +6.60% on Wednesday. CURRENT YEAR, +2.69%. The SA Quant rating on AAL is Strong Buy, while the average rating from Wall Street analysts is Buy.

The top five industrial stocks falling this week (market capitalization above $2 billion) all lost more than -10% Everything is fine. Year to date, 3 of these 5 stocks are in the red.

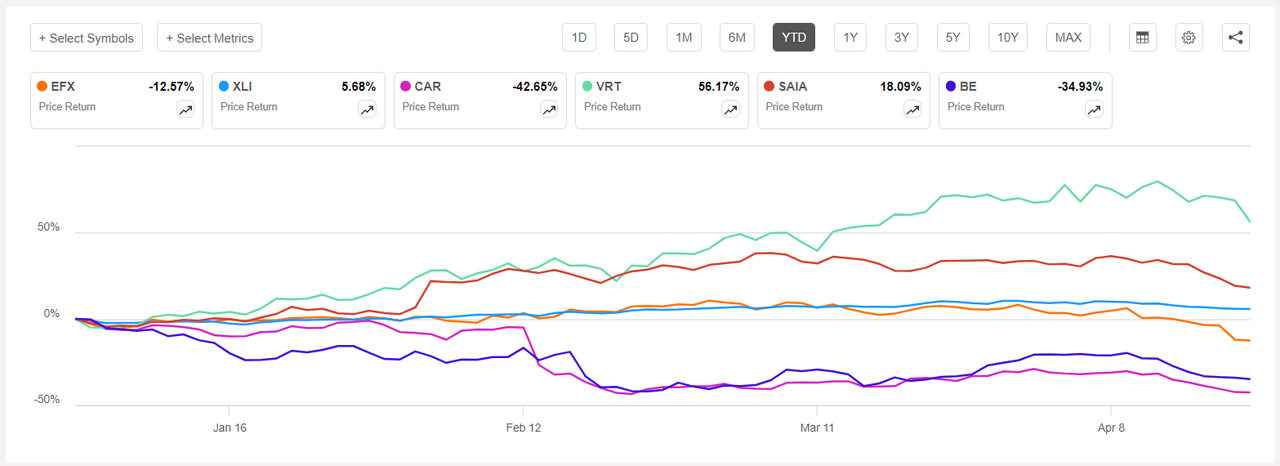

Equifax (New York Stock Exchange: EFX) -12.47%. Shares of the data and workforce solutions provider fell the most on Thursday (-8.49%) after first-quarter revenue missed estimates and the company issued weak guidance for the second quarter. CURRENT YEAR, -12.57%.

The SA Quant Rating on EFX is Hold with a grade factor of B+ for Profitability and B for Momentum. The average rating of Wall Street analysts is different and has a Buy rating, where 11 out of 21 analysts consider the stock as Strong Buy.

Avis Budget (CAR) -11.40%. Shares of the car rental company fell over the week. Year to date, shares are down -42.65%, the most among the five worst performing stocks this week in this period. The SA Quant Rating on CAR is Hold with a rating of F for growth and A+ for valuation. The average rating of Wall Street analysts disagrees and has a Buy rating, where 4 out of 8 analysts label the stock as a Strong Buy.

The following chart shows the year-to-date price/yield performance of the five worst decliners and XLI:

Vertive (VRT) -10.59%. Shares of the company, which provides products and services for data centers and communications networks, fell the most on Friday -7.41%. However, the stock has risen since the beginning of the year +56.17%. The SA Quant Rating on VRT is Hold, with a factor grade of B+ for profitability and A+ for growth. The rating contrasts with Wall Street analysts’ average Strong Buy rating, where 9 out of 13 analysts label the stock as such.

Skirt (SKIRT) -10.42%. Shares of the trucking company have fallen all week, in a period that has seen peers JB Hunt and Knight-Swift Transportation post weak demand and pricing readings with their respective earnings and guidance updates. CURRENT YEAR, +18.09%. The SA Quant rating on SAIA is Strong Buy, while the average rating from Wall Street analysts is Buy.

Flowering Energy (BE) -10.34%. The stock has fallen over the past eight business days and fell the most this week on Monday (-4.66%). CURRENT YEAR, -34.93%. The SA Quant Rating on BE is Sell, which differs from Wall Street analysts’ average rating of Buy.