As the market prepares for another earnings-filled week, investors are eagerly awaiting reports from a wide range of companies across various industries. Big names like Tesla (NASDAQ:TSLA), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta platforms (NASDAQ:META) will be among the highlights, along with tobacco giants Philip Morris International (PM) and Altria Group (MO).

The week ahead is also packed with gains from technology and communications giants such as IBM (IBM), AT&T (T), Intel (INTC), and Texas Instruments (TXN). Healthcare companies such as AbbVie (ABBV), Merck & Co. (MRK), Bristol-Myers Squibb Company (BMY), Gilead Sciences (GILD), AstraZeneca (AZN), AbbVie (ABBV) and Thermo Fisher Scientific (TMO) will also participate in the report .

Additionally, the energy sector will be in focus, with companies such as Exxon Mobil (XOM), Chevron (CVX), Valero Energy (VLO), and Phillips 66 (PSX) releasing their earnings reports.

Industrial companies, including General Electric (GE), Boeing (BA), Caterpillar (CAT), and Union Pacific (UNP), will also announce their earnings, providing insight into the state of the industrial economy.

Additionally, the consumer goods sector will be represented by companies such as PepsiCo (PEP), Kimberly-Clark (KMB), Colgate-Palmolive (CL), Ford (F) and General Motors (GM), offering a glimpse into consumer spending consumers and demand.

The airline sector will also be in focus, with companies such as American Airlines Group (AAL), Southwest Airlines (LUV) and JetBlue (JBLU) announcing their earnings, providing insights into the performance of the travel sector. Package delivery giant United Parcel Service (UPS) is also on the docket, providing key insight into the economy from its vantage point as a critical logistics provider.

Below is a summary of key quarterly updates scheduled for the week of April 22-26:

Monday 22 April

Cleveland Cliffs (CLF)

Cleveland-Cliffs (CLF) will report first-quarter earnings results on Monday, after the market closes. Analysts expect a profit for the quarter, while revenues are expected to remain roughly stable.

The stock earns a Hold rating from Seeking Alpha’s Quant Rating system, in line with the consensus recommendation of Wall Street analysts.

According to a recent article by Seeking Alpha contributor Joseph Parrish, Cleveland-Cliffs is considered an undervalued investment opportunity due to its pricing power and ability to generate positive free cash flow. Parrish expressed a bullish outlook for the company, suggesting it will prevail regardless of market conditions.

- Consensus EPS Estimates: $0.21

- Consensus revenue estimates: $5.34 billion

- Earnings Analysis: The company has exceeded EPS expectations in 4 of the last 8 quarters and revenue in 5 of those reports.

Also reporting: Verizon Communications (VZ), AGNC Investment (AGNC), Nucor Corporation (NUE), SAP SE (SAP), Alexandria Real Estate Equities (ARE), Albertsons Companies (ACI) and more.

Tuesday 23 April

Tesla (TSLA)

Elon Musk’s electric vehicle giant Tesla (TSLA) is expected to reveal its first-quarter earnings after the closing bell on Tuesday, with analysts expecting a significant year-over-year decline in EPS. This is largely due to the impact of the price war.

Previously boasting a market capitalization above $1 trillion, Tesla now finds itself as the weakest performer within the prestigious “Magnificent 7” group of technology and growth stocks. Year to date, Tesla’s stock price has fallen 40%, resulting in its market capitalization falling below $500 billion.

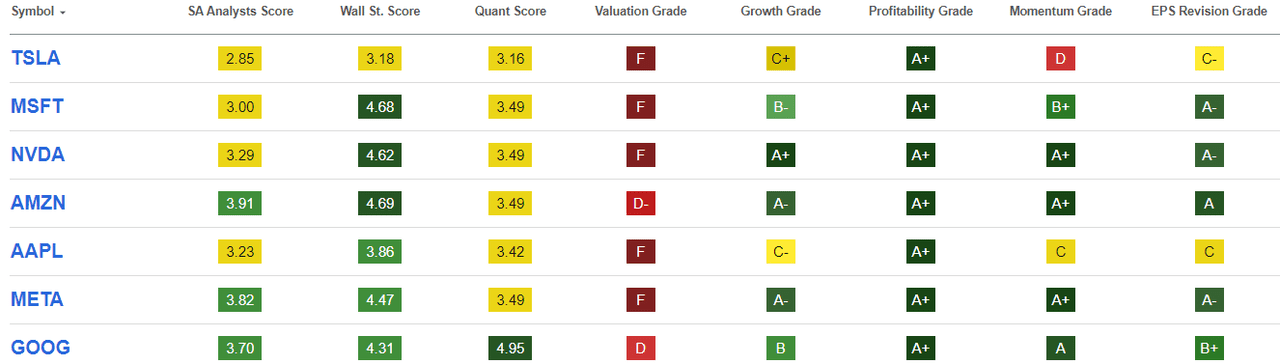

Both the Seeking Alpha Quant Rating system and sell-side analysts have a cautious attitude on the stock, assigning Hold ratings.

Recently, Deutsche Bank lowered its rating on Tesla to Hold, citing the high probability that the Model 2 launch will be postponed and the company’s shift in strategic priority towards the Robotaxi business. Analyst Emmanuel Rosner warns that the delay in Model 2 efforts may not lead to any new vehicles in Tesla’s consumer lineup for the foreseeable future, putting downward pressure on volumes and prices for several more years. Deutsche Bank also cut its price target on Tesla from $189 to $123, with lower expectations for deliveries, revenue and EPS.

“The company missed deliveries for the first time in four years, indicating the potential exhaustion of price cuts, and it will take time to fully assess the effects of recent layoffs,” says SA author Christopher Robb.

- Consensus EPS Estimates: $0.50

- Consensus revenue estimates: $22.52 billion

- Earnings Analysis: Tesla has beaten EPS estimates in 5 of the last 8 quarters, reporting revenue just three times in that span.

Also reporting: General Electric (GE), Visa (V), General Motors Company (GM), Lockheed Martin (LMT), PepsiCo (PEP), Freeport-McMoRan (FCX), Philip Morris International (PM), United Parcel Service (UPS), Texas Instruments (TXN), Halliburton Company (HAL), Spotify Technology SA (SPOT), Kimberly-Clark (KMB), JetBlue Airways (JBLU), Xerox (XRX), PulteGroup (PHM), The Boston Beer Company (SAM), Ryder System (R) and more.

Wednesday 24 April

Meta platforms (META)

Meta Platforms (META), Facebook’s parent company, will announce first-quarter results after the closing bell on Wednesday. After an impressive fourth-quarter performance, which included the initiation of a dividend, the social media giant forecast first-quarter revenue in the range of $34.5 billion to $37 billion.

The stock has performed well, rising 42% this year and more than doubling in the past 12 months. Wall Street analysts are bullish and maintain a buy recommendation, while the SA Quant Rating System suggests holding the stock.

Truist Securities expects Meta (META) to beat revenue expectations for the first quarter. The brokerage raised its revenue projection to $36.54 billion from $36.12 billion and its EPS estimate to $4.28 from $4.18. Truist remains bullish, giving the stock a buy rating and raising its price target to $550 from $525, crediting Meta’s AI investments for increasing user engagement (Facebook usage increased by 3 % y/y) and ad performance.

SA author Dair Sansyzbayev notes that META is strong in revenue growth and cost discipline, with a competitive advantage due to its alignment with the digital revolution. The Llama 3 language model is still in development and valuation analysis suggests the stock is attractively priced, making the current share price a good deal.

- Consensus EPS Estimates: $4.34

- Consensus revenue estimates: $36.16 billion

- Earnings Analysis: Meta has exceeded EPS expectations in 5 of the last 8 quarters, beating revenue estimates in 6 of those reports.

Also reporting: AT&T (T), Ford (F), The Boeing Company (BA), IBM (IBM), QuantumScape Corporation (QS), Lam Research Corporation (LRCX), ServiceNow (NOW), Biogen (BIIB), Chipotle Mexican Grill (CMG ), Hilton Worldwide Holdings (HLT), CME Group (CME), Hasbro (HAS), Humana (HUM) and others.

Thursday 25 April

Alphabet (GOOG) (GOOGL)

Alphabet (GOOG) (GOOGL) will announce first-quarter results Thursday after the closing bell. Analysts expect a strong quarter, with a 28% increase in topline and 13% increase in profit.

Google’s parent company has shown exceptional performance over the past year, boasting more than 50% growth in its stock price over the past twelve months, outpacing the S&P 500 Index’s roughly 21% return.

According to SA Quant Ratings, Google has a SA Quant Score of 4.95 (out of 5), indicating a Strong Buy rating. Wall Street analysts also maintain a bullish stance on the stock, with a buy consensus rating.

However, Dair Sansyzbayev, an author at Seeking Alpha, suggests caution, noting valuation concerns and arguing that “a delay in the AI race is a big threat to Google’s prospects in the cloud business. Another author, Damir, also Tokic, takes a bearish view, citing ChatGPT as a potential threat to Google Search’s ad-based model.

- Consensus EPS Estimates: $1.50

- Consensus revenue estimates: $78.68 billion

- Earnings Analysis: Google has exceeded EPS expectations in 4 of the last 8 quarters, beating revenue estimates in 5 of those reports.

Microsoft (MSFT)

Microsoft (MSFT) trails Alphabet on the earnings list, and expects to release quarterly earnings data after the market closes on Thursday. Analysts expect growth of more than 15% in both top and bottom lines.

While Seeking Alpha’s Quant Rating system remains cautious on the stock, giving it a Hold outlook, Wall Street analysts are bullish, maintaining a Strong Buy consensus recommendation.

Recently, analysts at Citi predicted that Microsoft’s AI revenue would exceed expectations.

SA writer Stuart Allsopp has an extremely bearish view on Microsoft, citing valuation concerns. Allsopp believes investors are relying on unrealistically high growth rates and low required rates of return many decades into the future to justify current stock values.

- Consensus EPS Estimates: $2.84

- Consensus revenue estimates: $60.85 billion

- Earnings Analysis: Microsoft has outperformed EPS estimates in 7 of the last 8 quarters and revenue in 6 of those quarters.

Also reporting: Intel (INTC), Altria Group (MO), Gilead Sciences (GILD), Merck & Co. (MRK), Bristol-Myers Squibb Company (BMY), Caterpillar (CAT), Roku (ROKU), Teladoc Health (TDOC), American Airlines Group (AAL), Snap (SNAP), Southwest Airlines (LUV), Newmont Corporation (NEM), Comcast Corporation (CMCSA), Valero Energy (VLO), AstraZeneca PLC (AZN), Union Pacific (UNP), Royal Caribbean Cruises (RCL), Northrop Grumman (NOC), Deutsche Bank (DB), Capital One (COF) and more.

Friday 26 April

Oil giants Chevron (CVX) and Exxon Mobil (XOM) are preparing to unveil their first-quarter earnings before the market opens on Friday. Seeking Alpha’s Quant Rating system takes a cautious stance on the stocks, with a Hold rating for both. In contrast, Wall Street analysts remain optimistic, assigning both stocks a buy rating.

In the current market scenario, analysts expect year-over-year declines in earnings per share and revenue for both CVX and XOM.

According to a bullish SA writer, The Asian Investor, XOM’s low valuation and potential for higher capital returns make it an attractive investment ahead of the first-quarter report.

The Asian investor expects Chevron to report robust earnings, driven by rising oil prices and supply cuts by OPEC+. They also point out that the company is likely to see a significant increase in cash flow and has a proven track record of returning cash to shareholders through share buybacks and dividends.