Key points

- Piedmont Lithium has received regulatory approval for its Carolina Lithium project after nearly 3 years.

- Piedmont plans to be the first vertically integrated operation to extract and process spodumene concentrate to produce up to 30,000 tonnes of lithium hydroxide per year.

- Lithium Americas is almost fully funded for its Thacker Pass project in Nevada, known as the largest discovered source of lithium in the United States, capable of producing up to 40,000 metric tons of lithium in Phase 1.

- 5 stocks we prefer to Lithium Americas

The electric vehicle (EV) trend has put a spotlight on the demand for lithium used in electric vehicle batteries. Fears of decreasing lithium supply and growing demand caused lithium carbonate prices to rise to as high as $81,360 per tonne in November 2022. However, lithium prices plummeted to nearly $10,000 per tonne in 2023. However, lithium will continue to be in short supply as the electric vehicle market has a long road to growth.

Lithium stocks have also seen their prices rise and fall along with lithium prices. If you believe electric vehicles will become mainstream, lithium stocks may find a reprieve in 2024. Here are two lithium stocks in the basic materials sector to watch as lithium prices rebound.

Lithium Piedmont

Piedmont Lithium Inc. NASDAQ:PLL is a development-stage exploration company specializing in the discovery, excavation and production of lithium. Piedmont made headlines when it struck a deal to supply spodumene concentrate Tesla Inc. NASDAQ:TSLA until 2025. China dominates the lithium industry, which has caused concern in the United States. The United States believes that securing the battery supply chain domestically is a matter of national defense. It signed an agreement with competitor Albemarle under the Defense Production Act to support Albemarle Co. NYSE: ALB opening of the Kings Mountain lithium mine in North Carolina to increase domestic production.

Carolina lithium project

Piedmont’s largest asset is its 100% ownership of the Carolina Lithium Project, which includes 3,706 acres in North Carolina. The Carolina Tin-Spodumene Belt is located northwest of Charlotte, North Carolina. The project is located within the Carolina Tin-Spodumene Belt and the US Battery Belt. It was designed as a fully integrated production unit of mini, lithium hydroxide and spodumene concentrate.

Vertical integration: the first in the world.

Lithium hydroxide is the compound used in lithium ion batteries found in electric vehicles, energy storage systems, smartphones, and portable electronic devices. The spodumene concentrate must undergo a series of processing steps to extract the lithium hydroxide. Mining companies will mine the spodumene concentrate and then ship it to China to mine lithium hydroxide. Piedmont plans to be the first vertically integrated company for both the extraction and processing of lithium hydroxide. It will be the first integrated site in the world. The company has been struggling with regulators to get its lithium project underway since it applied for approval nearly three years ago.

Permit approved after almost 3 years

On April 15, 2024, the North Carolina Department of Environmental Quality’s Division of Energy, Mineral and Land Resources provided long-awaited mining permit approval. Piedmont submitted the application nearly three years ago, on August 30, 2021. The permit allows Piedmont to move forward with the construction, operation and reclamation of the Carolina Lithium Project in Gaston County, North Carolina.

Keith Phillips, CEO of Piedmont Lithium, commented: “We plan to develop Carolina Lithium as one of the most sustainable, low-cost lithium hydroxide assets in the world and as a critical part of America’s electric vehicle supply chain. It is expected that the project will contribute billions of dollars in economic output and several hundred jobs to the growing electrification economy of Gaston County and North Carolina.” Piedmont must obtain zoning variances, which could cost up to 1 billion dollars, and the financing of the project.

Daily rectangle template

The PLL daily candlestick chart illustrates a rectangular pattern. The PLL initially rose more than 30% following the Carolina Project permit approval on April 15, 2024, but fell from a high of $17.66 below the rectangle’s upper trend line to $15.58 when investors sold the news. The PLL then fell to the lower trend line at $11.61 just 4 days later. The daily relative strength index (RSI) has also turned bearish, dropping to the 40 band. Pullback support levels are at $10.31, $9.19, $7.84, and $7.00

Analyst recommendations and price targets for Piedmontese lithium can be found on MarketBeat.

Lithium Americas

Lithium Americas Co. NYSE: LAC is the American spin-off of the original Lithium Americas. The other spin-off is Lithium Americas Argentina Co. NYSE:LAAC. Lithium Americas is a standalone operation in the United States. Its primary focus is the Thacker Pass project in Nevada, the largest known source of lithium in the United States.

Thacker Pass

The Thacker Pass mine site involves two phases. The first phase is expected to produce 40,000 tonnes of lithium carbonate extract (LCE) per year by 2028 at full capacity. This phase requires $2.9 billion in funding. Its second phase is expected to produce an additional 40,000 tonnes of production. The company announced that it has received a conditional commitment from the U.S. Department of Energy to fund $2.2 billion.

On January 1, 2023, General Motors Co. NYSE:GM announced an equity investment of $650 million in two tranches for the first ten years of production at the spot rate. GM planned to use lithium in Ultium battery cells. Thacker Pass is expected to begin in the second half of 2026. Construction for Phase 1 is underway, with DoE lending expected in the second half of the year.

Prices of the offer of mats

Lithium Americas caused its stock to drop nearly 30% on April 18, 2024, when it priced its $275 million stock offering at $5.00 per share for 55 million shares. Lithium America shares were trading at $6.63 at the close prior to the announcement. The low offering price soured investor sentiment, sending the shares below the minimum offering price to $4.66. This latest offering should technically fund Phase 1 of the Thacker Pass project, but dilution and execution issues keep the stock depressed.

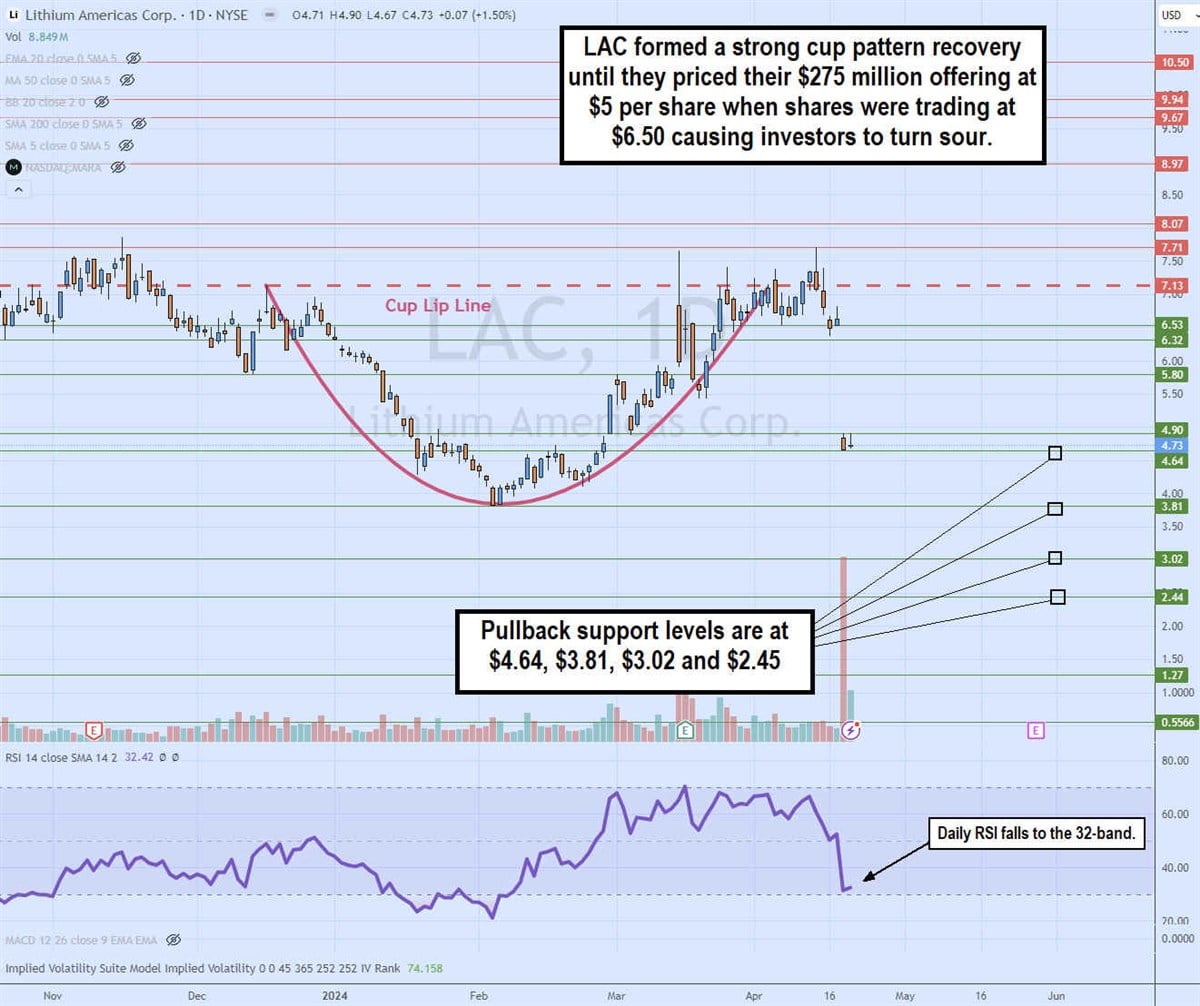

Daily mug template

The daily candlestick chart on LAC had a cup pattern. The cupped lip line formed at $7.13 on December 15, 2023. The stock dropped to a low of $3.81, forming a rounded bottom that eventually kicked off a rally towards the cupped lip line per cup by April 2024. Shares maintained their rally around $6.50 until the collapse. on the announcement of the offer of $5 per share. The shock triggered heavy selling of more than 30 million shares traded. Whether the sell-off manages to bottom out and wrap around a handle will depend on the $4.64 support. Pullback supports are at $4.64, $3.81, $3.02, and $2.45.

Before you consider Lithium Americas, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Lithium Americas wasn’t on the list.

While Lithium Americas currently has a “Hold” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Need to extend your 401K or Roth IRA plan? Use these time-tested investment strategies to increase the monthly retirement income generated by your stock portfolio.

Get this free report