Key points

- Coca-Cola (NYSE: KO) has seen a significant turnaround in its stock performance, up nearly 8% over the past three months.

- Technical analysis suggests that Coca-Cola stock is poised for a notable breakout, having broken through short-term resistance and diverging from its major simple moving averages (SMA).

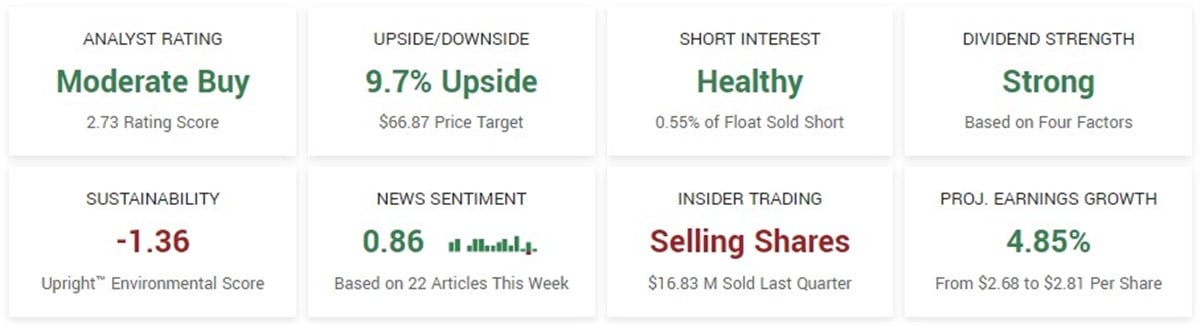

- Analysts are bullish on Coca-Cola’s future, with a Moderate Buy consensus rating and a robust consensus price target of $66.87.

- 5 stocks we prefer to Coca-Cola

Coca-Cola shares NYSE: KOthe highest-rated dividend stock, household brand and consumer staples giant, has pulled off a remarkable turnaround and comeback of late, with its shares up nearly 8% over the three previous months.

After plummeting to new 52-week lows in October last year, after breaking below previous significant support near $60, the stock briefly traded below $52 before reversing lows. Since then, the stock has done nothing but rise and reclaim the all-important $60 support area.

From a technical analysis perspective, KO stock looks set for a significant breakout after the stock recently broke above near-term resistance and broke away from its converging 200-day and 50-day simple moving averages (SMAs).

With the overall market trading at all-time highs and the Consumer Staples sector firmly in the green year-to-date, could KO stock be a buy for further upward momentum throughout the year?

A favorite among value investors

Globally renowned, The Coca-Cola Company is a leading beverage company in more than 200 countries. Evolving beyond its iconic soft drinks, the company now offers a wide range of non-alcoholic beverages. From sparkling soft drinks to a range including flavored water, sports drinks and coffee, Coca-Cola’s portfolio includes various brands such as Fanta, Fresca, Sprite and others.

Its shares have long been a favorite of investors seeking stability. With moderate volatility, as seen in its 52-week range of $51.55 to $64.99, and a Beta of 0.60, it has also offered investors a sense of reliability. The stock’s impressive dividend yield may best reflect that reliability. KO is a dividend aristocrat with a sixty-two year track record of increasing dividends and currently has an above-average dividend yield of 3.02%.

While its mature status means limited room for rapid expansion, the company remains adept at capitalizing on growth avenues through strategic marketing, innovation in flavor profiles and operational efficiency.

Analysts are optimistic about the KO

Based on eleven analyst ratings, Coca-Cola shares have a Moderate Buy rating. The stock has an impressive consensus price target of $66.87, predicting near double-digit upside. The low forecast of $60 corresponds to the all-important support level on its chart, while a high estimate of $74 predicts an impressive 23% upside.

Coca-Cola’s consensus rating of Moderate Buy is a cut above the rest. The consensus rating for consumer staples companies is currently Hold, as is the consensus rating for the S&P 500.

More recently, analysts from Barclays and Citigroup weighed in on the stock. On January 16, analysts at Barclays increased their KO target from $60 to $66, predicting an upside of more than 10% at the time of the report date. The following day, Citigroup analysts raised their target from $67 to $68, expecting more than 13% at the time of the report’s release.

KO reports earnings this month

Coca-Cola will announce its earnings later this month, on February 13, before the market opens, covering the fiscal quarter ending in December 2023. Analysts expect earnings per share (EPS) of $0.48 per the quarter, compared to $0.45 reported in the prior quarter. the same quarter last year. Looking ahead, Coca-Cola’s earnings are expected to increase from $2.68 per share to $2.81 per share next year, indicating a growth rate of 4.85%.

On the valuation front, Coca-Cola currently holds a trailing P/E ratio of 24.49 and a forward P/E ratio of 22.75. The price/earnings/growth ratio is 3.42.

Before you consider Coca-Cola, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Coca-Cola wasn’t on the list.

While Coca-Cola currently has a “Moderate Buy” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies are on the list.

Get this free report