Key points

- Corbus Pharmaceuticals is up more than 300% year to date after releasing promising data from its Phase 1 study of CRB-701 on January 26.

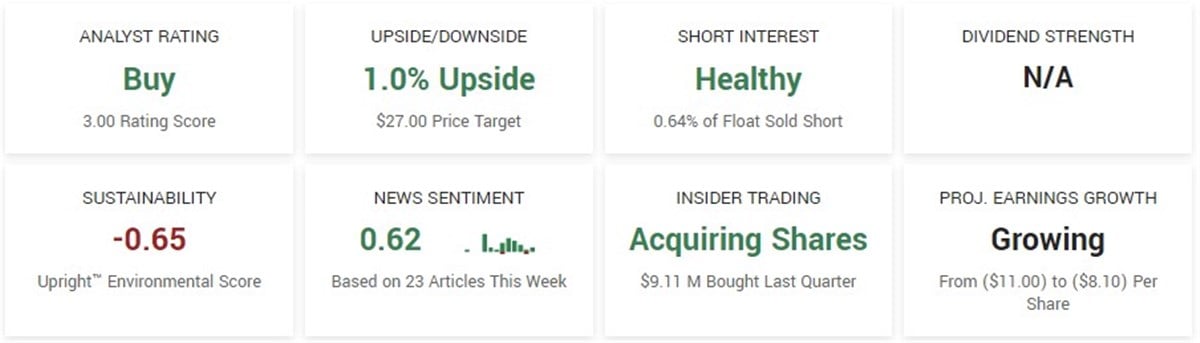

- Oppenheimer’s target to increase to $51, coupled with significant insider buying, signals optimism for Corbus Pharmaceuticals.

- The recent insider purchase of over $9 million indicates strong confidence in the future of Corbus Pharmaceuticals.

- 5 stocks we like better than Corbus Pharmaceuticals

Shares of Corbus Pharmaceuticals NASDAQ: CRBP have already recorded a dramatic increase of over 300% since the beginning of the year. This is thanks to new news released two Fridays ago, January 26th. The company has released early but promising data from its Phase 1 study involving cancer patients treated with its CRB-701 antibody-drug conjugate.

This particular drug conjugate is among three key drugs currently undergoing clinical trial phases, but its progress is significantly accelerated in terms of its expected approval prospects, supported by these promising results.

With the recent groundbreaking news and notable increase in the company’s price, trading volume, and overall valuation, we dive deeper into this recent stellar performance to assess whether it represents a potential investment opportunity or whether it may be overvalued.

What is it Corbus pharmaceutical products?

Corbus Pharmaceuticals Holdings is a biopharmaceutical company dedicated to fighting serious diseases. The company is actively developing several products, including CRB-701, an antibody-drug conjugate (ADC) designed to target the expression of nectin-4 on tumor cells, which is currently undergoing Phase I clinical trials.

Additionally, CRB-601, an anti-integrin monoclonal antibody, is being developed to block the activation of TGFß expressed on tumor cells to treat solid tumors. Additionally, CRB-913, a small molecule endocannabinoid drug, is in development for the treatment of obesity and related metabolic diseases.

The Company operates under a licensing agreement with Jenrin Discovery, LLC, which enables the development and commercialization of licensed products, including the Jenrin library, which includes approximately 600 compounds and numerous issued and pending patent applications registration.

The company’s stock has an average daily volume of 2.25 million shares and a market capitalization of approximately $118 million. Thanks to the recent catalyst and price action, the stock is now up 335% from the previous month and trading near the high end of its 52-week range.

Recent developments trigger a turning point for the company

For Corbus these results could not have come at a better time. Despite a lackluster performance on its long-term chart, aided primarily by pandemic-induced optimism, the company now finds itself on the verge of a potential recovery. The absence of serious safety events, combined with strong signs of efficacy for CRB-701, has reignited investor interest, providing a glimmer of hope for those who have weathered the storm with this biotech player.

Corbus’ CEO highlighted the potential superiority of CRB-701 in treating cervical cancer tumors over existing options, suggesting significant benefits for both patients and the company. This narrative has captured the market’s attention, positioning CRBP stock as one to watch in the coming months as more trials unfold.

Alongside this surge, it is imperative to take a cautious approach, recognizing the inherent risks associated with investing in clinical-stage biotech companies. While recent developments signal a promising trajectory for Corbus Pharmaceuticals, prudent risk management remains critical amid potential near-term stock volatility.

Analysts are bullish and insiders are buying

Analysts have maintained a bullish outlook on the stock for several months since coverage began, consistently assigning it a buy rating. Currently, two analyst ratings support this sentiment. Following the recent catalyst, Oppenheimer analysts have taken proactive steps by substantially increasing their target for CRBP. Analysts at Oppenheimer raised their target from $20 to $51, predicting a notable upside potential of 123.68% at the time of the report.

In addition to the optimistic views shared by analysts, recent internal activity signals further positive outlook for the company and its investors. In particular, no insider sales have been recorded in the last twelve months. In contrast, domestic purchases totaling more than $9 million were documented during this period. This purchase came following the recent news on January 26, with Cormorant Asset Management, LP, a major shareholder of the company, purchasing 282,632 shares at an average price of $32.24. This transaction amounted to a total investment of $9,112,055.68.

Before you consider Corbus Pharmaceuticals, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Corbus Pharmaceuticals wasn’t on the list.

While Corbus Pharmaceuticals currently has a “buy” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Are you looking to generate income with your stock portfolio? Use these ten actions to generate a safe and reliable source of investment income.

Get this free report