Stock index futures trading early Friday indicates the S&P 500 will begin the session several points above the 5,000 mark.

Overcoming – and closing above – the big round numbers of the stock indices inevitably encourages optimists to hope that what was considered resistance can become support.

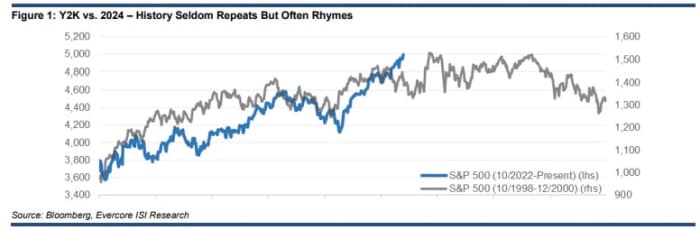

It can also produce reflections on how the past can provide a clue to what comes next. Julian Emanuel, strategist at Evercore ISI, sees a similarity between the Y2K stock market surge of the late 1990s and today’s market, though he acknowledges the standard caveat: History rarely repeats itself but it often rhymes.

“The relentless momentum that carried the S&P 500 to the round number of 5,000 has few equals in history, the most glaring example being the Internet-fueled rally from a similar market bottom in October 1998 versus the crucial bottom of October 2022” , Emanuel says in a note sent to customers this week.

Recall that the Y2K phenomenon occurred during the nascent dot-com boom, when some technology stocks received further propulsion from expectations that companies would spend billions to ensure their computer systems could make the leap to 2000 at the start of the new millennium . Do we have a similar frenzy when it comes to artificial intelligence?

Here’s Emanuel’s chart showing the trajectory of the S&P 500 from the October lows he’s citing. If the rhyme is rich, then today’s market may struggle to make further progress in this cycle.

Source: Evercore ISI

Emanuel is quick to notice the differences. Today’s valuations may be as high as 22 times trailing twelve-month earnings, but they are well below the 28 times seen at the height of the Y2K/dot-com bubble.

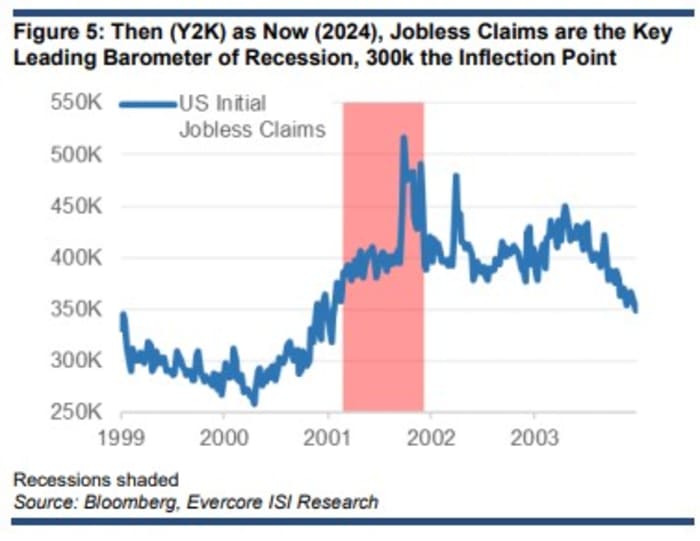

And after the Y2K/dot-com bubble burst in early 2000, there was a spike in weekly initial claims for unemployment benefits a full year before the 2001 recession. Current jobless claims, of about 210,000, and stoic consumer confidence data still suggests few signs of such stress.

Source: Evercore ISI

However, he is still concerned about the similarities between now and then. “Parallel pricing, positive sentiment about the long-term potential of generative AI, and investors’ newfound confidence that money can be made in stocks – as was the case in 1999 – despite a 10% Treasury yield years firmly fixed at 4%+, continues to expose stocks to inflation, earnings and Fed policy disappointments,” says Emanuel.

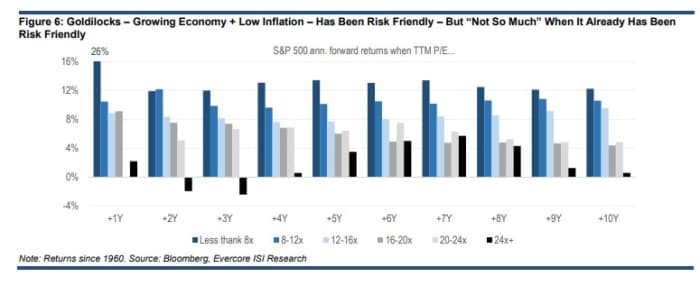

In fact, he believes the current “Goldilocks” market valuation paradigm is consistent with zero% average future stock returns, regardless of whether or not a recession is avoided.

Source Evercore ISI

Consequently he is in favor of defense. “We maintain our year-end S&P 500 price target of 4,750 and reiterate our preference for communications services, consumer staples and healthcare, sectors that have historically outperformed in the period between the last rally of the Fed and the first rate cut,” says Emanuel.

Markets

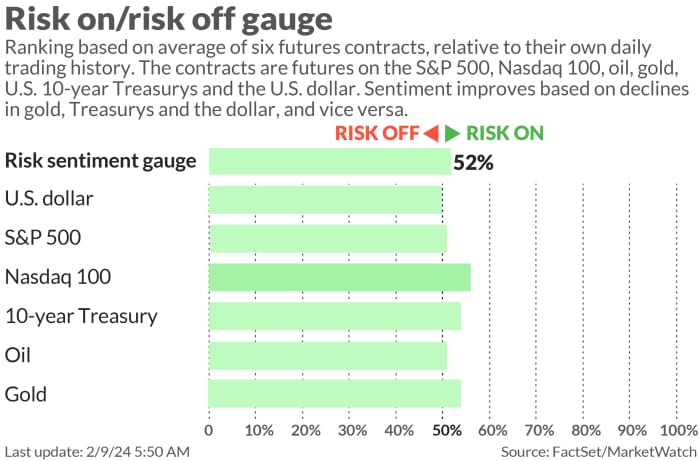

US stock index futures ES00

YM00

NQ00

were firmer early Friday as benchmark Treasury bond yields

fallen. The American dollar

remained little changed, while oil prices CL

dipped and gold GC00

traded around $2,030 an ounce.

|

Performance of key assets |

Last |

5 Q |

1 m |

Current year |

1 years |

|

S&P500 |

4,997.91 |

0.79% |

4.48% |

4.78% |

22.18% |

|

Nasdaq composite |

15,793.71 |

1.05% |

5.48% |

5.21% |

34.78% |

|

Ten-year treasure |

4,168 |

2.48pm |

10.38pm |

28.66 |

42.98 |

|

Gold |

2,046.60 |

-0.51% |

-0.34% |

-1.22% |

9.07% |

|

Oil |

76.32 |

5.41% |

4.89% |

7.00% |

-4.31% |

|

Data: MarketWatch. Change in Treasury bond yields expressed in basis points |

|||||

For more market updates and actionable trade ideas for stocks, options and cryptocurrencies, Subscribe to Investor’s Business Daily’s MarketDiem.

The buzz

A review of seasonal factors in the U.S. consumer price index showed that inflation in December was 0.2% month-on-month versus the previously reported 0.3%; news that put pressure on bond yields and lifted stock index futures.

Dallas Fed President Lorie Logan will speak at 1:30 p.m.

There are some big premarket moves for stocks of companies that reported results after Thursday’s close. Investors liked what Cloudflare NET

had to say and its shares rose 25%. But numbers and statements from Expedia EXPE,

down 14%, AFRM say,

11% discount and Pinterest PIN,

dropping 11%, they were poorly received.

The Children’s Place PLCE evaluation

was nearly halved early Friday after the children’s clothing chain issued a profit warning for the fourth quarter and said it was working with lenders to secure new financing.

Masonite International DOOR shares

are up 34% after door maker agreed to be acquired by building materials company Owens Corning OC

in an all-cash deal worth $3.9 billion.

Chinese markets are closed for a week to celebrate the Lunar New Year.

The best of the web

The spectacular collapse of a $30 billion real estate empire.

$3 for a single McDonald’s hash brown? Customers are fed up and pushing back.

Donald Trump’s victory risks a repeat of Britain’s gilt crisis for Treasuries, Europe’s largest fund manager says.

The graph

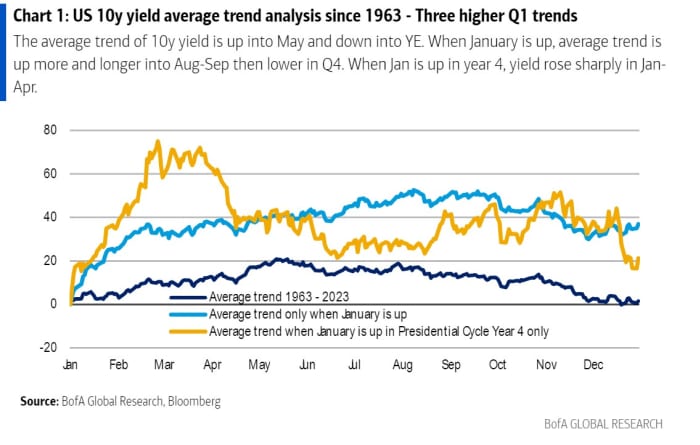

Many investors will have heard about January’s effect on stocks: a strong first month often means a good year overall. Well, according to Paul Ciana, technical strategist at BofA Securities, a similar thing happens for the yield on 10-year Treasury bonds. He ran the numbers going back to 1963, and as the chart below shows, when the benchmark yield is rising in January, the trend from February through the end of the year was higher in 61% of cases by +81 points basis on average.

The best tickers

Here are the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

PLTR |

Palantir Technologies |

|

ARM |

Arm holds |

|

MARA |

Digital marathon |

|

TSM |

ADR for Taiwan semiconductor manufacturing |

|

AAPL |

Apple |

|

AMC |

AMC Entertainment |

|

NIO |

NIO ADR |

|

GME |

GameStop |

Random readings

“My AI boyfriend is boring me to death.”

Chernobyl’s cancer-resistant mutant wolves.

Turning the air blue. The next phase of football’s downfall.

American CEOs visiting China can’t escape it: They have to dance on stage.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your email inbox. The emailed version will be sent around 7:30 am est.

Check out MarketWatch’s On Watch, a weekly financial news podcast we all watch. This episode: The beginning of the artificial intelligence boom and one of the sweetest stars of the Super Bowl. Earnings season sees Big Tech talk about generative AI. But will chatbots become big business? Additionally, we’re excited about the candy relic growing from $50 million to $500 million in annual sales.