The S&P 500 (SPY) continues to impress on this recent bull run. Yet the level of 5,000 is nearly 50% above the bear market lows and many value investors are saying that stocks are getting expensive. So will stocks race above 5,000 or will this level prove to be a long red light? 43 year investment veteran Steve Reitmeister shares his views of him in the commentary below along with a preview of this top 12 stocks to buy at this time.

There is no surprise that the market is flirting with 5,000 for the S&P 500 (SPY). Just too attractive of a level not to achieve at this time.

The problem is that this is a very hollow rally like we saw for the majority of 2023 where almost all the gains were accruing to the Magnificent 7 mega cap tech stocks.

Unfortunately, the vast majority of stocks are actually in the red which can best appreciated by the loss for the Russell 2000 index in the new year.

Let’s discuss what this means for the market outlook and how we still chart a course to outperformance in the days and weeks ahead.

Market Commentary

Thursday offered the first attempt for stocks to break above 5,000. In fact, the index got to 4,999.89 late in the session before resistance kicked in.

Friday was much the same floating just below that 5,000 level. Taking little shots here or there. Yet at the close it fell short once again.

In the long run stocks will climb well above 5,000 as most bull markets last over 5 years and we are still at the very early stages of this bullish phase. That is not the current contemplation. Rather it is about how long it will take to breakout above 5,000?

I explored this concept in my previous article: Are Stocks Stuck til Summer?

The answer to the above question is YES…I think that 5,000 will prove to be a solid lid on stock prices until the Fed starts lowering rates.

No…I am not calling for a correction like some commentators. Perhaps a 3-5% pullback ensues then we play in a range of 4,800 to 5,000 until we get a green light from the Fed on lower rates. This is what would give investors a good reason to step on the gas pedal attaining new highs above 5,000.

Right now, I sense we will just be idling at a red light. Changing the radio station. Sneaking a quick peek at our phones. Staring at people in other cars. Etc.

But once the Fed lowers rates it means more rate cuts are to follow which increases economic growth > earnings growth > stock prices. On top of that lower bond rates makes stocks the more attractive investment by comparison.

This chain of events is the clear green light for stocks to race ahead. Until then I think that many will be worried about how long the Fed will sit on their hands. Many are already surprised they have waited this long.

Then again, when you look at the Fed’s long term track record where 12 of 15 rate hike regimes have ended in recession, then you start to appreciate that these guys often overstay their welcome with rate hikes.

Let’s not forget that there are also 6-12 months of lagged effects on their policies so even if the economy looks OK at the time that rates are cut it is still possible for a recession to form.

That is not my base case at this time. I do sense that this Fed has a better appreciation of history and is managing the dual mandate of moderate inflation and full employment quite well. Meaning that I suspect a soft landing is the most likely outcome, followed by acceleration of the economy…corporate earnings…and yes, share prices.

The point is that the Fed policies are at the center of investment equation at this time. And the key to understanding what the Fed will do is keeping an eye on economic developments. In particular, inflation and employment metrics.

Right now, employment is quite healthy…maybe too healthy for the Fed’s liking. Not just the surprisingly high 353,000 jobs added last month, but also the eerily high wage inflation readings that spiked up to 4.5% year over year.

No doubt the Fed is not fond of this sticky form of wage inflation and would like to see more easing of that pressure before they start lowering rates. The next reading of wage inflation will be on Friday March 7th.

Before that time, we will get the next round of CPI (2/13) and PPI (2/16) inflation readings. Those have been moving in the right direction for some time. In fact, PPI is the leading indicator for the more widely followed CPI, was all the way down to 1% inflation rate at last months reading.

For as good as that is, the Fed is not as fond of CPI and PPI as traders are. They prefer readings from the PCE inflation reading which doesn’t come out til 2/29.

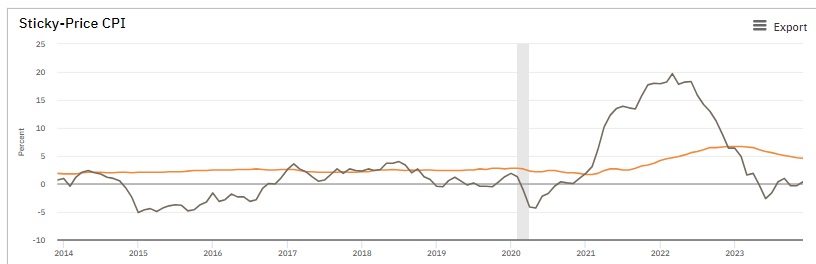

But really they have even more sophisticated ways of reading inflation which can better be appreciated by the Sticky-Price CPI monitoring done by the Atlanta Fed.

As the chart below shows, Sticky Inflation (orange line hovering around 5%) is, well, too darn sticky at this time. Meaning that academics and economists at the Fed are likely concerned that inflation is still too persistent and that more patience is required before lowering rates.

To sum it up, I suspect that 5,000 will prove to be a point of stiff resistance for a while. This should lead to an extended trading range period with investors awaiting the green light from the Fed to start lowering rates.

Yes, it is always possible for stocks to race ahead without this clear go ahead by the Fed. That is why its wise to stay in a bullish posture to enjoy the gains whenever they unfold.

I am saying to just not be that surprised if we don’t continue to rise given 3 straight months of very bullish conditions coupled with facing an obvious place of stiff psychological resistance at 5,000.

At this stage the Magnificent 7 have had their fun. I wouldn’t be surprised if some profits are taken there and moved to smaller stocks. What you might call a sector rotation or change in leadership. There were some good signs of that starting to be the case on Thursday as the Russell 2000 rose +1.5% on the session while the large cap focused S&P 500 hovered around breakeven.

Also, I suspect there will be a greater eye towards value as many market watchers are pointing out that earnings growth is muted and thus at this level the overall market is pretty fully valued. That is especially true for the Magnificent 7 that no value investor could stomach their exorbitant multiples.

This too calls for a rotation to new stocks that are more deserving of higher prices. It is precisely these kinds of “under the radar” growth stocks trading at reasonable prices that I cherish.

To discover which ones I am recommending in my portfolio now, then read on below…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything in between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $1.33 (+0.27%) in premarket trading Friday. Year-to-date, SPY has gained 5.12%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background by him, along with links to his most recent articles and stock picks by him.

Blackberries…

The post 5,000 Green or Red Light for Stocks??? appeared first on StockNews.com