Key points

- Uber reported actual GAAP profits from core operations in the fourth quarter of 2023, completing its path to profitability after 14 years in business.

- Uber crushed analysts’ EPS estimates by 50 cents, growing revenue 15.4% year-over-year to $9.4 billion.

- Uber’s sequential mobility bookings fell 30% to 28% in the fourth quarter of 2023, causing growth deceleration concerns similar to Alphabet’s sequential growth decline in cloud revenue in the third quarter and advertising revenue in the fourth quarter of 2024.

- 5 stocks we like better than Uber Technologies

Leading operator of rideshare and delivery platforms Uber Technologies Inc. NYSE:UBER reported a stellar earnings report to complete its first profitable year of business in 14 years. Uber has achieved its goal of revolutionizing the transportation industry while navigating its path to profitability. While Uber showed GAAP profits in the prior quarters of 2023, these were primarily due to unrealized gains in its stock holdings.

These earnings had nothing to do with the core business, nor were they cash transactions that contributed to cash flow. However, Q4 2023 earnings actually derive profits from its core operations. Uber shares rallied more than 40% ahead of its recent earnings report, with the S&P 500 hitting new highs. This explains the initial “sell the news” reaction to a strong earnings report. However, investors are also wondering whether the sequential quarterly decline in mobility bookings is an early sign of decelerating growth.

Actual GAAP profitability from core operations.

The real historical milestone in the fourth quarter of 2023 was that Uber actually made GAAP profits from its core operations in the quarter. They proudly announced GAAP profitability instead of emphasizing adjusted EBITDA when their investments were in the red. Most of this GAAP profitability, above $1 billion, comes from increasing its equity holdings in various companies.

Uber-owned locations

As the stock market rises, these unrealized gains could continue to grow. But when the market stabilizes or declines, the company can generate negative earnings. It’s worth noting that Uber is still underwater in its stock holdings. Many of these positions were taken as a result of asset swaps or direct cash investments.

Its stake in Chinese rideshare operator Didi fell 12%. Its stake in Southeast Asia’s leading rideshare operator, Grab Holdings Inc. NASDAQ: TAKE, is down 14%. Its stake in the autonomous driving technology company Aurora Innovation Inc. NASDAQ:AUR is down 22%. Its stake in the air taxi operator Joby Aviation Inc. NYSE: JOBY is down 4%. Uber’s stake in electric scooter and e-bike operator Lime fell 29%. Total book value of equity holdings is $6.1 billion, up from $5.1 billion sequentially.

Oligopoly turns into monopoly

Uber has taken such a huge lead over its rival Lyft Inc. NASDAQ:LYFT which is not even considered an oligopoly. This is also reflected in its stock prices, as Uber’s stock hits all-time highs in the 70s while LYFT continues to languish at low-teens levels. Uber’s market capitalization is $146 billion versus Lyft’s $5 billion. Uber has grown its lead to more than 5 times that of Lyft across many financial metrics.

Path to profitability achieved.

On Friday, February 7, 2024, Uber posted fourth-quarter 2023 GAAP EPS of 66 cents, beating consensus analyst estimates of 16 cents by 50 cents. Revenue rose 15.4% year over year to $9.94 billion, beating analysts’ expectations of $9.76 billion. Adjusted EPS was $1.3 billion, up $618 million year-over-year. Adjusted EPS margin as a percentage of gross bookings rose to 3.4%, compared to 2.2% in the year-ago quarter. At the end of the quarter, cash, short-term investments and cash equivalents totaled $5.4 billion.

Growth metrics

Uber considers the total dollar amount of rides and deliveries before applying fees and deductions such as Gross Bookings. In the fourth quarter of 2023, gross bookings grew 21% year over year in constant currency to $37.6 billion. Gross mobility-related bookings increased 28% year over year to $19.3 billion. Gross delivery bookings increased 17% year over year to $17 billion.

Delivery increased its market share in ten of the top ten markets. The food delivery business has grown to $7 billion in revenue, and advertising is surpassing $1 billion in annual revenue. The platform’s monthly active customers (MAPC) increased 15% year-over-year to 150 million. Total trips grew 24% year-on-year to 2.6 billion. Monthly trips for MAPC grew 8% to 5.8.

A meticulous news selling reaction parallels Google’s reaction

Uber shares initially saw profit taking the following morning on fears of slowing booking growth as they fell sequentially from 30% in Q3 2023 to 28% in Q4 2023. The same selling reaction as of new occurred twice in a row with Alphabet Inc. NASDAQ:GOOGL when cloud revenue growth fell sequentially from 28% to 22% in Q3 2023 and when advertising revenue growth fell sequentially to 11% in Q4 2023.

Outlook for the first quarter of 2024

Uber expected gross bookings for the first quarter of 2024 to be between $37 billion and $38.5 billion, reflecting year-over-year growth of 20%. Adjusted EBITDA is expected to be between $1.26 billion and $1.34 billion.

Uber CEO Dara Khosrowshahi commented: “2023 was a turning point for Uber, proving that we can continue to generate strong, profitable growth at scale. Our audience is larger and more engaged than ever, with our platform powering an average of nearly 26 million people per day.” trips last year.”

Analyst reactions

Needham reiterated a buy rating on Uber and raised his price target to $90 from $71. This was driven by better-than-expected fourth quarter results and first quarter 2024 guidance, which raised 2024 adjusted EBITDA estimates by 4% to $6 billion and 2026 estimates by 2% to 10.4 billion dollars.

Uber Technologies analyst ratings and price targets I’m on MarketBeat. Uber Technologies peers and competitor actions can be found with MarketBeat Stock Screener.

Ascending triangle daily breakout pattern

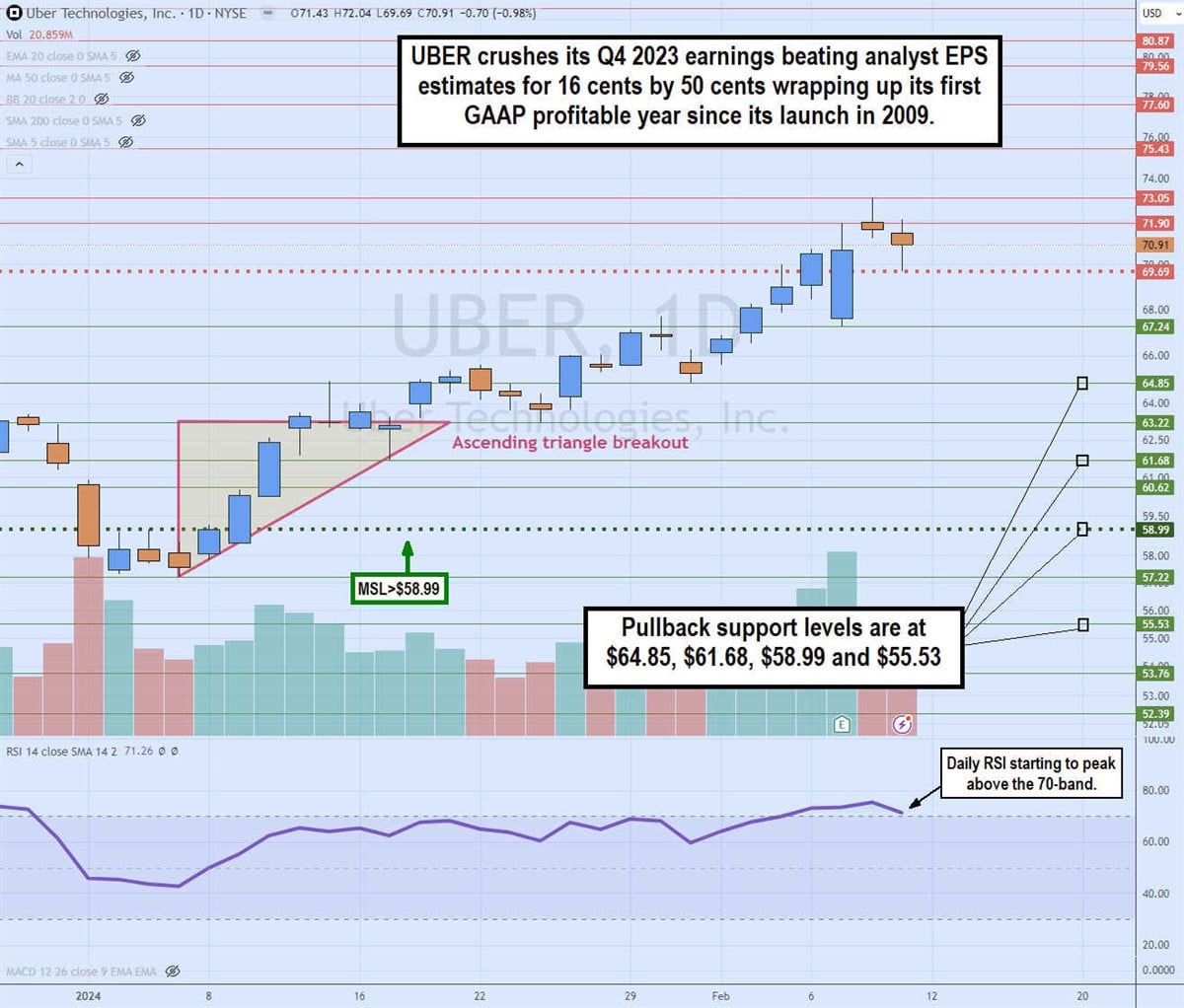

UBER’s daily candlestick chart illustrates an ascending triangle breakout pattern ahead of its Q4 2023 earnings report. Uber shares have risen more than 40% since the release of its Q3 2023 earnings report through upon publication of the fourth quarter. The ascending trend line formed from the $50.22 low on January 5, 2024. The daily market structure low (MSL) breakout triggered above $58.99. Shares rallied to flat upper trendline resistance at $63.22. The daily relative strength index (RSI) rose to the 70 band and stayed just below it as UBER stock floated higher towards the $64.85 level.

UBER launched to all-time highs on February 1, 2024, when the RSI broke above the 70 band heading into the earnings release. UBER initially peaked on a selling reaction to the new post-release, when shares fell to $67.24 before rebounding to an all-time high of $73.05 the next day. The maximum level of the daily market structure (MSH) sells the subsequently formed trigger at $69.69. The pullback support levels are at $64.85, $61.68, $58.99 and $55.53.

Before you consider Uber Technologies, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Uber Technologies wasn’t on the list.

While Uber Technologies currently has a “Moderate Buy” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Which stocks could thrive in today’s challenging market? Click the link below and we’ll send you MarketBeat’s list of the ten stocks that will lead in any economic environment.

Get this free report