Key points

- Calendar spreads allow traders to reap weekly or monthly options rewards with a defined risk.

- Calendar spreads are similar to the multi-leg long call diagonal debit spread, but they use the same strike prices, which makes them horizontal, which is why they are also called horizontal spreads.

- While long call calendar spreads have limited upside, the downside risk is limited to the cost of the spread.

- 5 stocks we prefer to Intel’s

There are many ways to collect income from stocks. Dividends come to mind first because they pay a small percentage of the stock price and number of shares owned in cash, usually on a quarterly basis. However, capital is required to purchase and hold the underlying shares. If you already own shares in any stock sector, you can write covered calls to collect monthly or weekly income from options premiums depending on expiration dates.

Long Call Diagonal Debit Spreads (LCDDS)

If you don’t own the shares, you can consider trading long call diagonal debt spreads (LCDDS) for one-third of the capital needed to own the shares. This involves buying an in-the-money (ITM) call option on long-term long-term stock appreciation (LEAPS) stocks in the prior month and selling an early call in the out-of-the-month money (OTM). Since we use different strike prices, these are diagonal options. When we use the same strike price with different front and back month expiration dates, it is called a calendar spread or horizontal spread.

The calendar spreads

In this article we will look at how to collect weekly or monthly income using long call options calendar spreads. They are also called time spreads, horizontal spreads and vertical spreads with different maturities. If you understand the LCDDS strategy, calendar spreads should be easier to understand.

Neutral in the short term and bullish in the long term

Call option calendar spreads are generally market neutral or flat to bearish in the short term and bullish in the long term. This is because it is a two-legged strategy that involves selling a near-expiry or late-month OTM call option to collect a premium and buying a long-dated or late-month call option in the same strike.

The short call option experiences greater time decay (theta) as it approaches expiration. It ultimately becomes worthless if the underlying security remains at or below the strike price at expiration and you can keep the premium. Your long call option can be closed at the same time as your short call option or rolled over. You can make another OTM short call to collect another reward. Ideally, if the long call option rises significantly after the short call expires, you could profit as well. The long call option increases in value if the underlying stock rises above the strike price before its expiration.

Call options calendar mechanisms become widespread

This strategy attempts to collect premiums as income on the short call option, while the long call option has the potential to increase net earnings. Like the LCDS, you are shortening the OTM front month call to collect income from the premium. Instead of going long an ITM LEAP call, you would go long the same strike price but farther out a week to a month.

Put on the market

Let’s take an example with the semiconductor leader Intel Inc. NASDAQ: INTC. In this example, INTC trades at $43.31 on February 13, 2024.

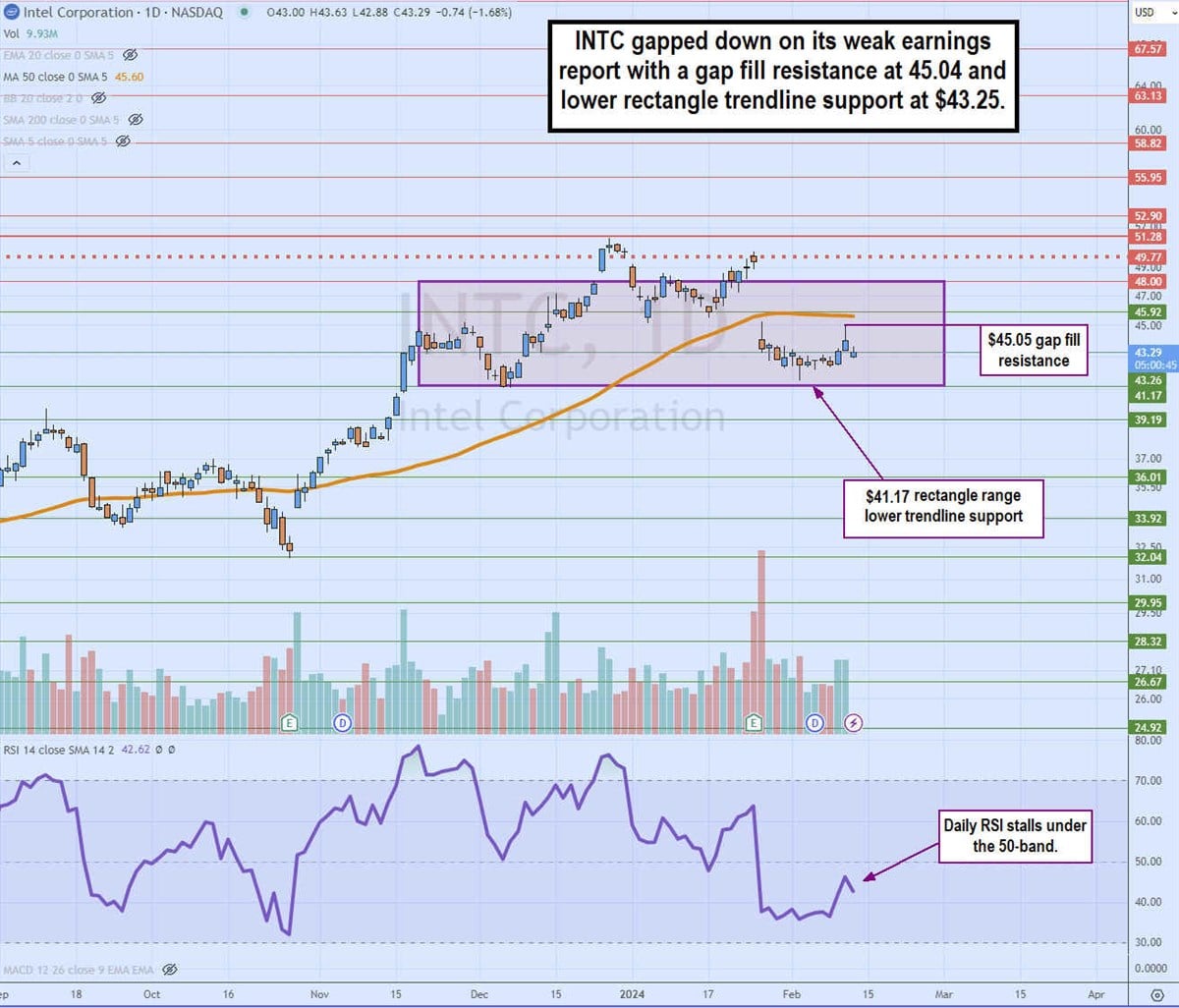

The daily candlestick chart on INTC illustrates a rectangular pattern with gap filling resistance around the daily 50-period moving average (MA) resistance at $45.60 and gap filling resistance at $45.05. The lower support of the rectangle trend line is at $43.26. The daily Relative Strength Index (RSI) is stuck below the 50 band and is flat. INTC is trading in a range between $44.03 and $42.14.

Based on the resistance levels at $45.05 and the top of the recent trading range around $44.03, we can opt for a strike price of $44.50. This provides us with enough resistance, especially with the RSI momentum stalling at the 50 band as the bounce fades a bit. The trade will be:

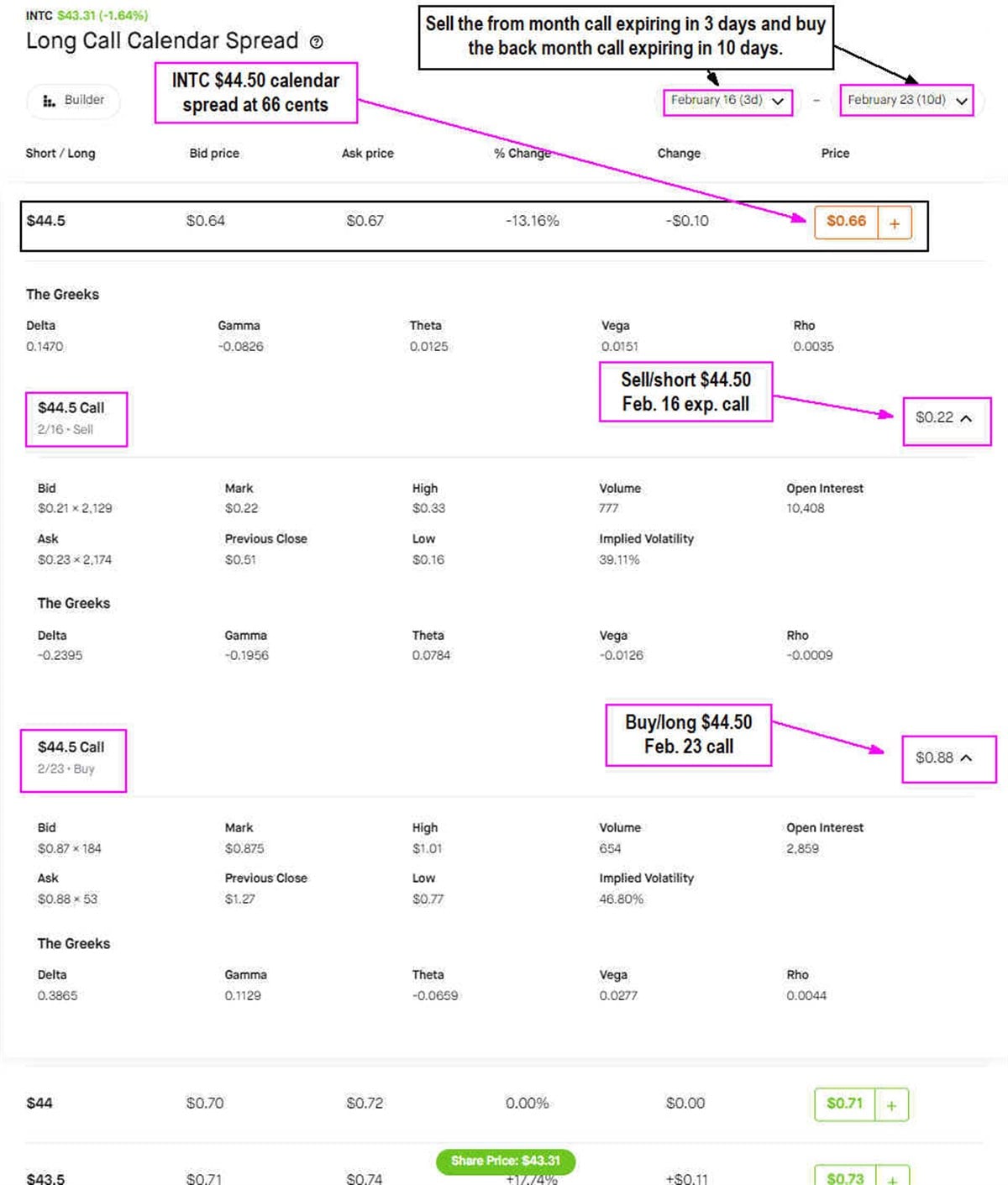

Buy INTC $44.50 long calendar call spread expiring Feb. 16/Feb. 24 at 66 cents.

If we consider the call expiring on February 16, 2024, expiring in 3 days for the previous month and the call expiring on February 23, 2024, expiring in 10 days for the rear month, it will cost us 66 cents. This is the spread between the $44.50 22 cent short call and the $44 88 cent long call.

Potential results

This is a narrow calendar spread in terms of expiry, being only 3 days in and 10 days out. At the beginning it is wise to use more time between the first and subsequent months to become familiar with this strategy. Tighter deadlines leave little room for error. The easy part is that the first month expires worthless. The hardest part is managing the previous month’s call if you don’t close both positions by the previous month’s expiration.

The best situation would be for INTC to rise and stay slightly below $44.50 in 3 days to maintain the short call premium of 22 cents and then rise to the gap fill area at $45.03 or the daily MA at 50 periods $45.60 in 10 days to close. exit the long call with a profit. If volatility increases, it provides an even greater premium for cashing out before the call’s long expiration.

The key is to pull the trigger to close one leg or both legs on the first expiration, or close the short leg and switch to the long leg if INTC has a strong spike to get more profits on the long call, or flip the long leg. call and sell another short call again.

Outcome at deadline(s)

Since there are two phases and two expiries, let’s look at the potential outcomes if the underlying price of INTC rises or falls.

If INTC rises to $44.31 at February 16 expiration in 3 days, we will maintain the 22 cent premium on the short call. We can close the long call option on the same day with an additional premium of 25 cents for a total of 47 cents profit on an investment of 66 cents or a 71% profit..

Here’s the calculation: Since the INTC has risen $1 since we entered the calendar spread at $43.31, the long call option would be worth $1.13 after taking Greek options into account. A rough estimate with a $1 move on INTC with a Delta of 0.3865 minus -0.659 Theta x 3 days would imply an additional net premium of 25 cents over the cost of 88 cents.

If INTC rises to $45.31 on the expiration day of February 16 in 3 dayswe would lose 59 cents on the short call at 44.50 (81 cents – 22 cent premium) but gain an 80 cent premium on the long call at 44.50 for a net gain of 21 cents on an investment of 66 cents or 32% profit..

Higher stock price gains could equate to fewer profits, but losses are limited.

This is an example of how a calendar spread earns more with a moderate bounce but earns less with a giant bounce before the first expiration. However, your loss is also limited to the spread price paid for the calendar spread should disaster strike and INTC collapse to lower rectangle support at $41.17.

There are many ways to play these scenarios, such as taking the long call to expiration, flipping it, or both calls. It’s all about execution as you become more experienced and seasoned with calendar spreads.

Before considering Intel, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Intel wasn’t on the list.

While Intel currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

Are you thinking about investing in Meta, Roblox or Unity? Click the link to find out what streetwise investors need to know about the metaverse and public markets before making an investment.

Get this free report