The S&P 500 (SPY) continues to dance around 5,000. However, many market commentators are wondering when these large caps will relinquish the lead to small caps after a 4-year lead. Recall that, going back 100 years, there is a clear and strong advantage in smaller stocks. Find out what Steve Reitmeister predicts for next year, including a preview of the top 12 stocks to buy now. Continue reading below for more information.

If stocks were to break above 5,000 for the S&P 500 Index (TO SPY) Now?

No… that’s not very logical as the start date for the Fed’s rate cuts keeps getting pushed further and further into the future. However, it is an important lesson to understand that when you are in a bull market, it is best to stay invested as you never know when the next bull run will take place.

This means that more and more evidence confirms that market timing is a”Fools’ Commission“. So, the wise thing is to simply stay bullish during bull markets.

That doesn’t mean all stocks will go up. So, let’s spend our time today discussing the stocks that have the best chance of outperforming in 2024.

Comment on the market

This has been an interesting week for the market. After topping 5,000 for two consecutive sessions, stocks were jolted by Tuesday’s much warmer-than-expected CPI report, which pushed back the likely start date for rate cuts.

The -1.37% drop for the S&P 500 was quite harsh. But even more brutal was the -3.96% decline in small caps.

This “It seemed” to set the stage for a period of consolidation below 5,000 and perhaps a stiffer 3-5% pullback as investors wait for a clearer signal to move forward. Yet on Wednesday investors obviously had a case of amnesia as stocks they closed the session at 5,000.62. And then on Thursday it pressed further higher to 5,029.73.

If you want a narrative to explain this, then it might be distorted that Thursday’s much weaker-than-expected retail sales report should help solve the inflation problem. However, this doesn’t hold much water, as GDPNow estimates still predict growth of +2.9% in the first quarter.

This is a little too hot for the Fed’s liking. This means that these are above-trend growth levels for the US economy that bring with them greater inflationary pressures.

No doubt the Fed would prefer a real”soft landing” GDP growth closer to 1% which would result from a greater moderation of inflationary pressures.

This brings us back to the “animal spirits” part of investing:

Bull markets will be bullish… and bear markets will be bearish.

No one is arguing that we are not in a bull market right now. So, no matter how logical it may seem for the recent stock rally to calm down until the timing of the Fed’s rate cuts becomes clearer… it’s also unwise to bet against that primary uptrend.

To summarize…remain bullish as long as there are no recession concerns that would increase the chances of a recession forming.

That said, I’ll stick with my previous predictions for 2024 that there won’t be a huge upside for the S&P 500 after huge gains over the past 17 months from the October 2022 lows. Instead, large caps, and particularly the mega Magnificent 7s cap, which dominate the index are fully valued or overvalued by most objective standards.

I suspect that 5,250 (about 10% higher than the 2023 close) represents a generous upside for the market this year. Instead, I predict that large-cap companies’ 4-year advantage over smaller-cap companies will end.

This began to change during the late 2023 rally. However, as the calendar turned to 2024, investors returned to their old habits.

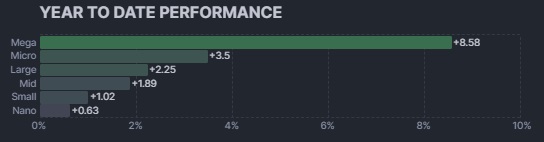

This is a concentration in the Magnificent 7 titles which has the mega caps that are positioned well ahead of the group. This is clearly visible in the graph below:

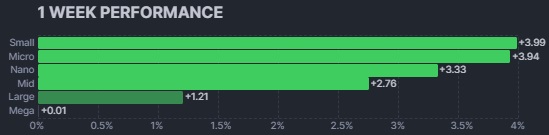

The good news is that last week small caps took the baton to lead the rush into equity investing. And yes, Mega Capitals pressed pause at the same time.

My gut still firmly believes that this recent trend has legs. That investors will have to look further and wider to find stocks worthy of greater upside.

This will take them to small and mid-cap companies that have impressive growth prospects. The key is much more reasonable valuations compared to their large-cap peers. The combination of superior growth + attractive valuation = greater upside potential.

This investing playbook is at the heart of how I manage my portfolios this year. And it willingly leans on the strength of our POWR rating system.

This quantitative system analyzes 5,300 stocks based on the same 118 factors. That means he can analyze the fundamental and price action merits of Apple and NVIDIA with the same yardstick he can measure a $500 million market cap.”under the radar“selection.

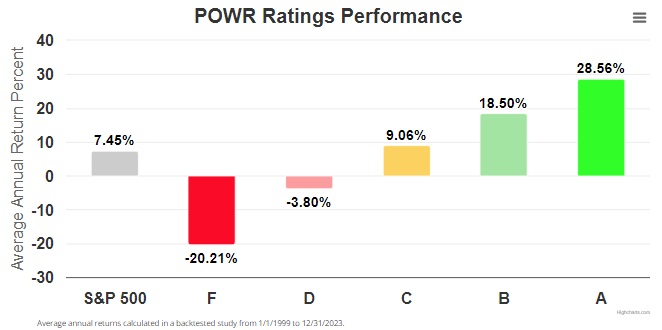

In fact, it is the daily analysis of 118 different factors for each stock that uncovers those with stellar growth and value characteristics that indicate future outperformance. And so, why does this POWR Ratings performance graph dating back to 1999 speak for itself:

Which top POWR rated stocks am I picking right now?

Continue reading below for the answers…

What to do next?

Check out my current 12-stock portfolio filled to the brim with the outperformance advantages found in our unique POWR Ratings model. (Nearly 4 times better than the S&P 500 Index dating back to 1999)

This includes 5 recently added hidden small caps with huge upside potential.

I also have 1 specialty ETF that is incredibly well positioned to outperform the market in the weeks and months ahead.

This is all based on my 43 years of investing experience watching bull markets… bear markets… and everything in between.

If you’re curious to learn more and want to see these 13 hand-picked lucky trades, click the link below to get started right away.

Steve Reitmeister’s Trading Plan and Top Picks >

Wishing you a world of successful investing!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO of StockNews.com and editor of Reitmeister Total Return

SPY shares traded at $500.82 per share on Friday morning, down $1.19 (-0.24%). Year to date, SPY has gained 5.37%, compared to a % gain in the benchmark S&P 500 index over the same period.

About the author: Steve Reitmeister

Steve is better known to StockNews audiences as “Reity.” He is not only the CEO of the company, but also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Find out more about Reity’s background, along with links to her most recent articles and headline picks.

Moreover…

The mail Are small-cap stocks ready to lead? appeared first StockNews.com