Gary Hershorn/Corbis News via Getty Images

Restaurant stocks could have an edge in their favor to help offset some concerns about consumer spending trends.

The January consumer price index report indicated a core rate increase of 3.9% year-over-year, compared to the +3.7% expected by economists and the pace of +3.9% recorded in December. While the food delivery category only saw a 1.2% increase from a year ago, the food away category outpaced overall inflation with a 5.1% increase for the month. On a two-year basis, out-of-home food CPI growth slowed slightly in January from December’s pace, but still grew a brisk 13.7%.

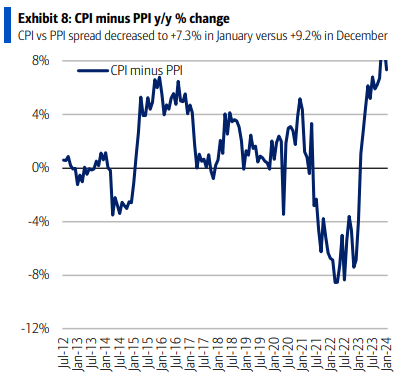

What may be even more relevant for the restaurant industry is that the spread between the CPI and the Producer Price Index remains very high at 7.3 percentage points (chart below from Bank of America).

A positive CPI-PPI gap is a margin incentive for some restaurant companies depending on their pricing power and commodity hedges in place. Analysts believe that if the CPI-PPI spread continues to be relatively wide, there could be more earnings surprises in the restaurant industry in the future

The restaurant industry has seen some rising stars this year. Shake Shack (NYSE:SHAK) increased 33% year over year. The chain reported that system-wide sales rose 21.4% in the fourth quarter to $442.1 million. Same-building sales rose 2.8% during the quarter from a year ago, enough to beat consensus expectations of +2%. On the expense front, food and paper costs fell to 29.1% of sales from 29.5% a year ago and labor costs fell to 28.5% of sales from 28.9% one year ago. Occupancy and related expenses fell from 7.9% to 7.7% of sales. Total expenses were 100.5% of sales in the fourth quarter compared to 102.6% a year ago. Shack-wide operating profit was $54.6 million, or 19.8% of Shack sales compared to 19.0% a year ago.

Other big gainers this year in the restaurant sector include FAT Brands (FAT) +48, Kura Sushi (KRUS) +37%, CAVA Group (CAVA) +29%, Wingstop (WING) +26%, First Watch Restaurant Group (FWRG ) +22%, Potbelly (PBPB) +20% and Texas Roadhouse (TXRH) +21%.

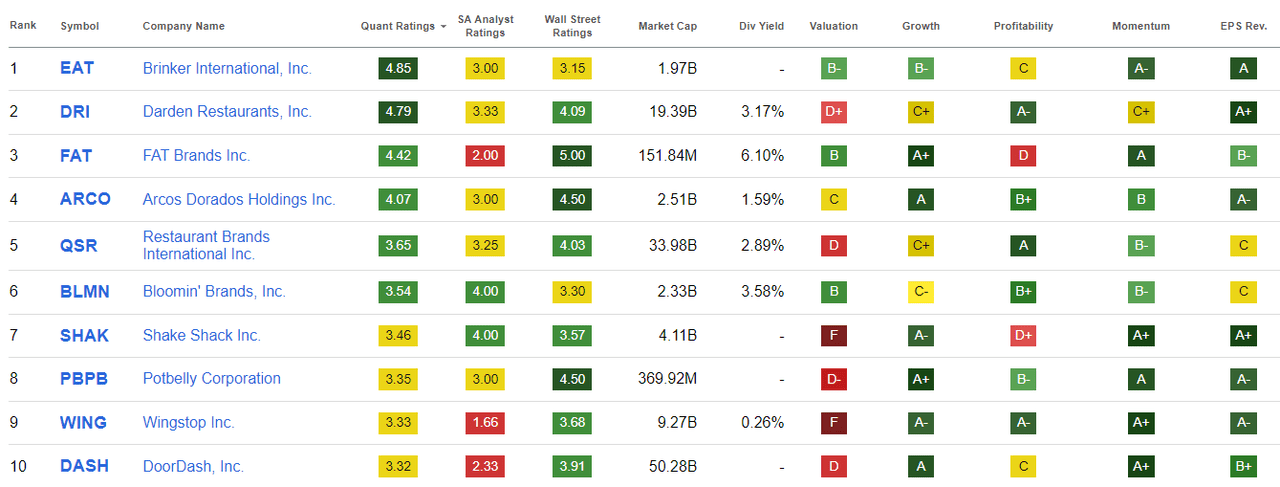

Restaurant stocks that Seeking Alpha analysts have recently expressed positive results on include Domino’s Pizza (DPZ) (analysis), Jack in the Box (JACK), Red Robin Gourmet Burgers (RRGB) (analysis), and Yum! Marche (YUM). Based solely on quantitative analysis, Brinker International (EAT) and Darden Restaurants (DRI) top the list of attractive stocks in the restaurant industry.

IPO Watch: Fresh off producing one of the Super Bowl commercials that generated the most buzz on social media, Dunkin’ Donuts could go public again as part of Inspire Brands, sources told Bloomberg. Private equity firm Roark Capital is said to have held preliminary discussions with potential advisors about listing Inspire Brands in late 2024 or 2025. Inspire Brands owns Dunkin’ Donuts, Arby’s, Baskin-Robbins, Buffalo Wild Wings, Sonic and Jimmy John’s restaurant chains. Roark Capital also owns Focus Brands, which includes Auntie Anne’s, Cinnabon and Jamba. In addition to all these investments, the PE firm also holds a stake in The Cheesecake Factory (CAKE).