Sean Justice/The Image Bank via Getty Images

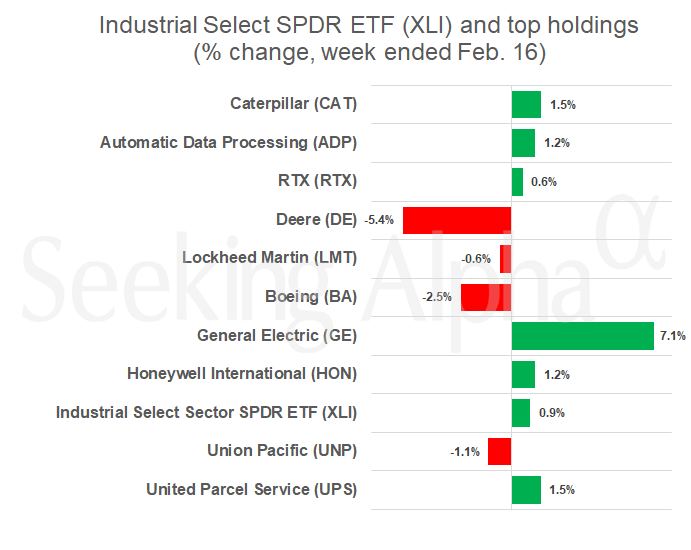

General Electrical (NYSE:GE) rose 7.1% this week, recording the biggest decline among large-cap industrial stocks. The SPDR Industrial Select Sector ETF (NYSEARCA:XLI), whose holdings include some of the largest U.S. companies in the sector, rose 0.9% for the week.

THE gain contrasted with declines in the broader market. After reaching record levels, the Standard & Poor’s 500 stock index (SP500) and the Dow Industrials Average (DJI) this week ended in negative territory after multiple inflation readings led investors to reconsider the timing of rate moves by the Federal Reserve. The Nasdaq Composite (COMP.IND) fell 1.3% on the week.

Wholesale prices rose faster than expected in January, a report showed on Friday. That helped confirm an inflationary signal in Tuesday’s consumer prices report.

GE ( GE ) has posted earnings every day this month except February 6, and closed at a record on Friday. The company rose 3.3% on Wednesday after Thai Airways confirmed it had ordered Boeing (NYSE: BA) widebody aircraft with engines manufactured by GE Aerospace (GE). GE is expected to split into two separately listed companies later this year.

Deere (NYSE:DE) fell the most this week among large-cap industrial stocks. The farm equipment maker fell 5.2% on Wednesday – its biggest daily decline in 10 months – after the company disappointed investors with its full-year outlook. Management expects net income of $7.5 billion to $7.75 billion for 2024, compared to Wall Street analysts’ average estimate of $7.83 billion.

Lockheed Martin (NYSE: LMT) has been trending downward this week. The defense contractor declined Wednesday to report that the Biden administration plans to order fewer F-35 fighter jets due to budget constraints.

Boeing (BA) fell 2.5% this week as the plane maker grapples with quality issues and tighter regulatory oversight following an in-flight emergency on an Alaska Airlines (NYSE:ALK) flight on January 5th. Commercial aircraft deliveries fell 29% from a year earlier in January.