Monty Rakusen/DigitalVision via Getty Images

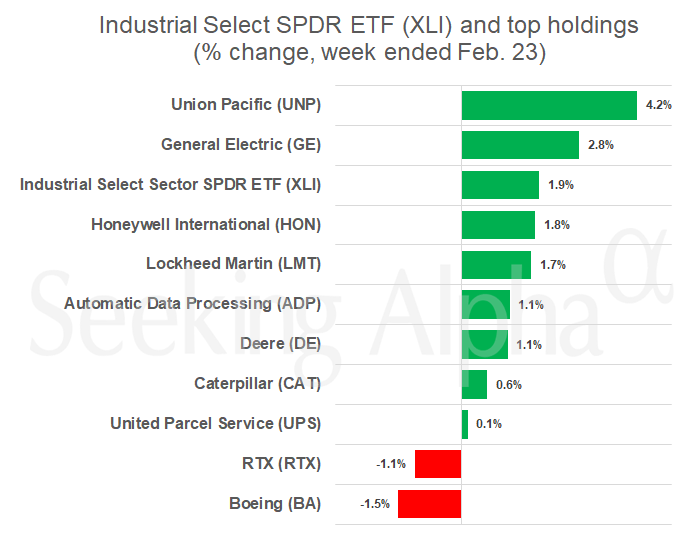

Pacific Union (NYSE:UNP) rose 4.2% this week for the biggest gain among large-cap industrial stocks. Freight rail, a gauge of manufacturing activity, closed at a record high. The SPDR Industrial Select Sector ETF (NYSEARCA:XLI), whose shareholdings include some of the largest U.S. companies in the sector, rose 1.9% on the week and closed at a record high.

The performance mirrored gains in U.S. stocks, with the Standard & Poor’s 500 stock index (SP500) and the Dow Industrials Average (DJI) closing at record levels on Thursday and Friday. The Nasdaq Composite (COMP.IND) closed at record highs on Thursday, then slipped on Friday to end the week with a 1.4% gain.

All eyes were on chipmaker Nvidia (NASDAQ:NVDA), whose bumper earnings report Wednesday night triggered a 17% gain over the next two days that helped lift the S&P 500 and Nasdaq indexes.

Among industrial stocks, Union Pacific (UNP) gained after a report showed weekly U.S. rail traffic increased 3.7% from a year earlier. At an investor conference this week, Union Pacific (UNP) management touted a recovery this month in car loading that partially offset a 6% annual decline in January volumes, largely attributed to adverse weather conditions.

General Electrical (NYSE:GE) added 2.8%, bringing its year-to-date gain to 20%. The company has seen strong demand for jet engines and is expected to spin off its business that turns electric turbines into a separate publicly traded company this year.

Boeing (NYSE:BA) slipped 1.5%, bringing its year-to-date loss to 23%. The aviation giant shook up its factory management this week as it continues to deal with the aftermath of a mid-air emergency on an Alaska Airlines (NYSE:ALK) flight on January 5th.

Analysts at Northcoast Research downgraded Boeing (BA) stock today due to its uncertain outlook, while Bloomberg News reported that United Airlines (NASDAQ:UAL) is looking to replace some of its Boeing (BA) orders with planes from rival Airbus (OTCPK:EADSY) (OTCPK:EADSF).