Banks may have cut some of their branches, but maintaining a retail presence remains a priority even in the smartphone age.

This is the message from PNC Financial Services Group Inc. PNC,

JPMorgan Chase & Co.JPM,

and other banks continuing to open new branches in some areas, even as they scale back in others.

“Bank branches are more than just expensive billboards, they signal a bank’s commitment to the community,” said David Schiff, a senior partner at consulting firm West Monroe. “It’s showing that ‘we believe in community.’ It’s more than just sponsoring a Little League team.”

As routine transactions, such as check deposits or payments, are conducted more frequently via mobile banking apps, new bank branches dedicate less time to tellers and more to meeting with bankers for financial advice or questions about more complex products such as mortgages.

Coffee is often also available, or in the case of Capital One Financial Corp. COF,

branches often include bars or lounge areas. Capital One did not respond to an email.

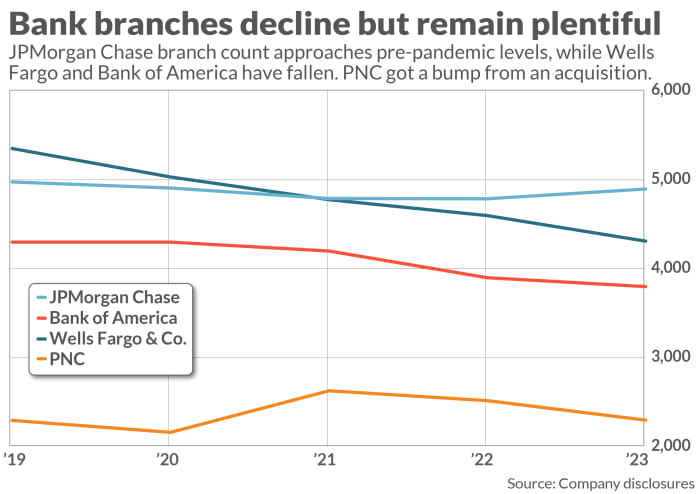

Overall, the U.S. bank branch footprint fell to 69,905 in 2022 from 70,644 in 2021 and 73,107 in 2020, according to Federal Deposit Insurance Co. data.

The four largest bank branch networks: JPMorgan Chase, Bank of America Corp. BAC,

Wells Fargo & Co WFC,

and PNC were all reduced from the level they were at at the end of 2019, before the COVID-19 pandemic. (See chart below)

Bank branch totals are mostly down, but still remain large.

MarketWatch/Terrence Horan

JPMorgan Chase’s total has increased over the past three years as it is the only bank with branches in all 48 states. The bank has built about 166 branches in the past year and plans to build a similar number in 2024. It continues to close some branches, but over time the closures will slow as it sees fewer profitable ways to consolidate.

The bank recorded $85 billion in deposits from branches opened between 2017 and Investor Day in May 2023.

“We continue to want to expand our branches in some markets where we have just entered or where the opportunities are high,” Marianne Lake said during her presence in December. Last month, Lake was promoted to sole managing director of consumer and community banking at JPMorgan Chase.

JPMorgan Chase said Feb. 6 that it plans to add 500 branches and 3,500 employees by the end of 2027 in Boston, Charlotte, North Carolina, Philadelphia, Minneapolis, Washington and other areas.

For its part, PNC said it plans to spend $1 billion on its branch network, including building more than 100 new branches and renovating 1,200 of 2,300 total by 2028.

““When you have a problem or if you’re getting a mortgage to buy your first home, having that human connection is really, really important and a relationship is built around that – you have to have it.” Branches are the soul of retail banks and that’s why we invest in them.’“

Alex Overstrom, head of PNC Retail Banking, told MarketWatch that the bank’s physical branches help build trust even as customers bank remotely more often.

“When people decide where they want to open a bank, whether it’s a college graduate or an entrepreneur, having the branch is really important even if they use it a couple of times a year,” Overstrom said. “The decision is often driven by that sense of convenience.”

The bank is planning to add hundreds of jobs for its new branches, Overstrom said.

The bank’s retail banking employees fell to 28,761 at the end of the fourth quarter from 29,692 employees as of Sept. 30. The number of part-time employees in retail banking grew to 1,540 in the fourth quarter from 1,480 in the third quarter.

The cuts are part of PNC’s effort to “optimize” its branch network. For example, it closed PNC branches in Washington supermarkets because “it’s a model that hasn’t particularly resonated with consumers,” Overstrom said.

Instead, PNC’s newer banks are designed to be more inviting.

“We are trying to create a welcoming environment where our customers can feel at home,” Overstrom said.

PNC’s mobile bank targets neighborhoods with fewer financial services options, as businesses try to maintain their physical presence despite the rise of mobile transactions.

PNC

For low- and moderate-income neighborhoods, PNC has created a fleet of 10 mobile branches in addition to having physical branches.

The effort for greater accessibility to branches is aimed at complementing the work bankers do once people enter.

“When you have a problem or if you’re getting a mortgage to buy your first home, having that human connection is really, really important and a relationship is built around that — you have to have it,” Overstrom said. “Branches are the soul of retail banks and that’s why we invest in them.”

West Monroe’s Schiff said that while banks have invested heavily in mobile service apps during the COVID-19 pandemic, the direct approach to banking has revealed “sales gaps” for products such as complex loans.

This has accentuated the need for human interaction despite the improved mobile experience. Foot traffic to banks increased after the pandemic, and banks began redesigning their branches.

“Some digital devices have been brought back into branches by installing ATMs and ITMs (interactive ATMs), but they don’t have as many ATMs,” Schiff said. “Instead, they have more desks where people can come in and discuss their financial health or for small business advice. No amount of digital services completely replaces the value of being on the ground.”

Many of the bank’s target customers still remember the global financial crisis and human contact gives them more trust in their bank, he said.

Rowan Berridge, manager of RBR Data Services, a division of Datos Insights, said the number of bank branches has declined over the past 15 years due to industry consolidation and the rise of online and mobile banking services. The trend is expected to continue.

“Banks are investing in branch transformation initiatives aimed at reducing costs and improving the role of branch staff, further automating routine daily transactions and reorienting the traditional role of the teller towards sales and advisory duties,” said Berridge .

Read also: That’s why Citi analysts believe banks will avoid losses in commercial real estate