The bitcoin halving is an event that occurs roughly every four years in which rewards for miners are halved, effectively limiting the supply of the token.

S3studio | Getty Images

Bitcointhe world’s largest cryptocurrency by market capitalization, extended a rally in Asian trading on Tuesday, hitting a two-year high of more than $56,000 and lifting the broader cryptocurrency market amid positive market developments and buying by bulls cryptocurrencies.

The price of bitcoin rose more than 10% in two days, according to CoinMarketCap data, after cryptocurrency investment and software firm MicroStrategy disclosed a purchase of about 3,000 bitcoins for $155 million on Monday.

MicroStrategy, based in Virginia, is currently the largest publicly traded owner of bitcoin. The company reported a holding of around 190,000 cryptocurrency tokens earlier this month, which would be worth over $10.5 billion today.

According to Greta Yuan, head of research at digital asset platform VDX, the market has been “encouraged by cryptocurrency bulls like MicroStrategy” and a “new record of Bitcoin ETF inflows.”

Most of the cryptocurrency market has rallied since the latest rally. Ethereumthe second-largest cryptocurrency by market capitalization, hit a multi-month high above $3,200.

Cryptocurrency-related stocks also rose in trading at U.S.-based crypto exchange firm MicroStrategy and San Francisco-based CoinBase both jumped more than 16% on Monday and continued gains in aftermarket trading.

The two cryptocurrency-related companies have seen their share prices rise 200% over the past year.

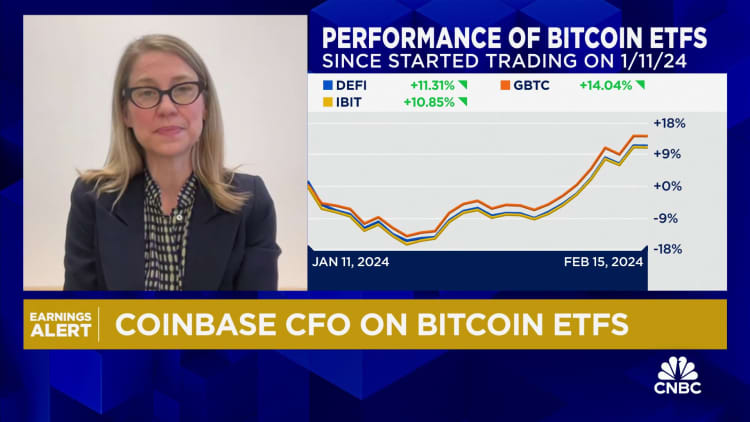

Speaking on CNBC last week, Coinbase CFO Alesia Haas attributed the company’s recent strong financial results to the regulatory approval of spot bitcoin ETFs in the United States last month, which had triggered renewed fervor around the cryptocurrency.

According to VDX’s Yuan, the bitcoin price increase also reflects “bullish investor sentiment, especially in the United States,” ahead of the upcoming “bitcoin halving” set for the second half of April.

A bitcoin halving event occurs every four years, with the reward for bitcoin mining – the process by which transactions are digitally verified on the blockchain – halved, thus reducing the rate at which new bitcoin tokens are created and lowering the amount of new supply available.

“As Bitcoin’s halving approaches, investors are scrambling to find the best positioning for the event. The new record inflow volume of Bitcoin ETFs is another test of confidence for bullish investors,” Yuan added .

Bitcoin’s strong performance also comes amid the dollar’s decline on Monday and Tuesday. Markets are anticipating U.S. economic data this week that could signal how soon the Federal Reserve might start cutting interest rates.

Bitcoin prices and US dollar index historically they have shown an inverse correlation.