Records continue to fall. The Nasdaq composite

entered the S&P 500 index

in securing a new high. Futures on Friday suggest a marginal decline from those levels at the opening bell.

The S&P 500 rose for four consecutive months, gaining 21.5%, its best four-month gain since July 2020, according to market data from Dow Jones.

But that’s the kind of momentum that makes some market watchers nervous. Bearish traders with a technical bias portentously tap their computer screens to highlight warnings issued by their favorite momentum indicator: the 14-day relative strength index, or RSI.

However, Mark Newton, head of technical strategy at Fundstrat, says that while many RSI readings are elevated, that doesn’t mean stocks are currently vulnerable.

Before explaining Newton’s thinking, let’s look a little deeper into the RSI. Having a rising RSI is a positive sign for a stock, as it shows that buying momentum is increasing, versus selling. A declining RSI is the opposite and is negative for those who are long a stock.

But the RSI becomes more useful as a short-term contrarian indicator in extreme conditions. If the RSI has risen very high, this suggests that the market is getting too excited and a reversal may be in order. According to most market technicians, the overbought threshold is set at an RSI of 70. An oversold RSI is below 30.

It should be noted that not all RSIs are created equal. One difference is that smaller-cap stocks (which are more vulnerable to herding by retail investors) that also have a high beta (typically move more than the underlying market) can more easily reach the extremes of the RSI.

And Newton notices another difference: the overbought territory is different between daily, weekly and monthly charts. Short-term traders may say that markets or individual stocks are overbought when daily indicators such as the traditional 14-day RSI move above 70. Long-term investors may focus on the weekly and/or monthly RSI.

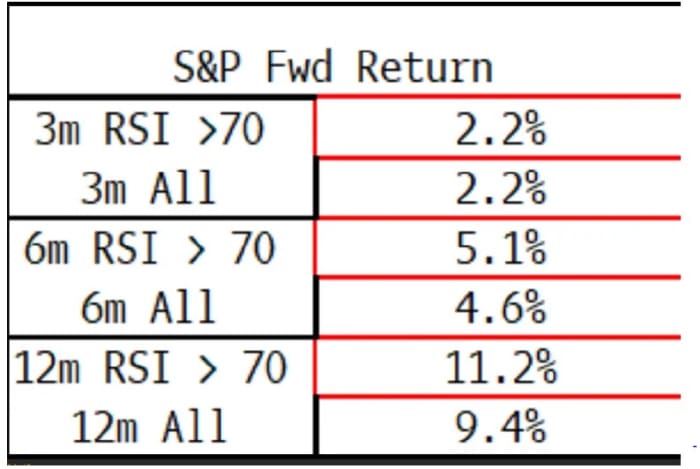

In essence, Newton shows in the table below that a pullback in, for example, members of the S&P 500 because the daily RSI has become overbought is likely to be short-term and the uptrend may therefore be resumed.

“On a three-, six- and 12-month basis, when SPX components have risen above 70%, gains have largely mirrored the percentages when the RSI is below 70. Therefore, being overbought in itself, not appears to be a barrier to further gains,” says Newton.

Source: Fundstrat

The good news for traders who follow the index is that neither the Nasdaq Composite at 62.6 nor the S&P 500 at 66.9 has an RSI in overbought territory. The German DAX

at 77.6 and Japan’s Nikkei at 225

at 81.2 appear vulnerable, at least, to a short-term pullback.

And to demonstrate how useful the RSI can be as a short-term contrarian indicator, let’s look at the SMCI Super Micro Computer.

Fired by the AI frenzy and options buying of the Wallstreetbets crowd, shares of the computer server provider soared well above $1,000 on Feb. 16, pushing its RSI above 98. Buy at such an extreme overbought level was a bad move. move that day with stocks ending the session down about 25% from the peak.

Markets

US stock index futures ES00

YM00

NQ00

are slightly lower as the benchmark Treasury bond yields

immersion. The dollar

has changed little, while the price of oil CL

increase and gold GC00

it trades around $2,050 an ounce.

|

Performance of key assets |

Last |

5 Q |

1 m |

Current year |

1 years |

|

S&P500 |

5,096.27 |

0.18% |

3.87% |

6.84% |

28.00% |

|

Nasdaq composite |

16,091.92 |

0.31% |

4.75% |

7.20% |

40.38% |

|

Ten-year treasure |

4,266 |

1.50 |

24.33 |

38.51 |

30.64 |

|

Gold |

2,059.30 |

0.66% |

0.11% |

-0.60% |

10.55% |

|

Oil |

79.15 |

3.37% |

9.32% |

10.96% |

-0.89% |

|

Data: MarketWatch. Change in Treasury bond yields expressed in basis points |

|||||

For more market updates and actionable trade ideas for stocks, options and cryptocurrencies, Subscribe to Investor’s Business Daily’s MarketDiem.

The buzz

U.S. economic data due Friday includes the final S&P manufacturing sector reading for February at 9:45 a.m. Eastern. Then, at 10 a.m., February ISM Manufacturing, January Construction Spending and February Consumer Confidence reports will be released .

Federal Reserve officials who commented include Dallas Fed President Lorie Logan at 10:15 a.m., Fed Governor Chris Waller, also at 10:15 a.m., Atlanta Fed President Raphael Bostic at 12:15 p.m., the San Francisco Fed President Mary Daly at 1:30 p.m. and Fed Governor Adriana Kugler at 3:30 p.m.

Elon Musk has filed a lawsuit against OpenAI and its CEO Sam Altman, alleging the ChatGPT maker’s alliance with Microsoft MSFT

it compromised the start-up’s original mission to build artificial intelligence systems to benefit humanity.

New York Community Bank NYCB Stock

are down 27% in premarket trading Friday after replacing its CEO and reporting weaknesses in its accounting protocols.

NetAppNTAP

shares are jumping 17% after the data storage group issued strong guidance for 2024, while well-received earnings are lifting Autodesk ADSK

shares 9%.

According to an official survey of factory managers, production in China contracted for the fifth consecutive month in February.

The best of the web

Why the stock market “doesn’t look very buzzy” to Ray Dalio right now.

What it’s like to live in the most polluted place on earth.

An AI startup making humanoid robots raises $675 million with Bezos and Nvidia in a funding round.

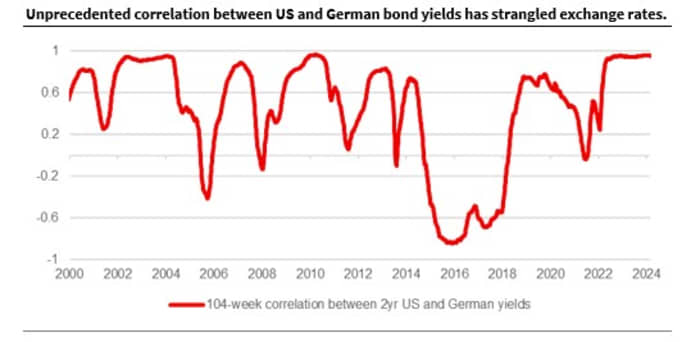

The graph

The dollar and the euro EURUSD

they have moved within a fairly narrow range between $1.07 and $1.10 for much of this year. Société Générale’s Kit Juckes explains why. “The foreign exchange market thrives on differences – in growth, in balance of payments, in politics, in inflation but above all in monetary policy,” he says. Policy is expressed through short-term bond yields and the chart shows 2-year German yields

they are tracking the 2-year Treasury bond

“at an unprecedented level”.

The best tickers

Here are the most active stock market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

AMD |

Advanced microdevices |

|

SOUND |

SoundHound AI |

|

CORK |

Connect the power |

|

NIO |

NIO |

|

AAPL |

Apple |

|

AMC |

AMC Entertainment |

|

MARA |

Digital marathon |

|

PLTR |

Palantir Technologies |

Random readings

Security guards on bicycles.

A very small frog.

The devil’s playground.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your email inbox. The emailed version will be sent around 7:30 am est.

Watch On Watch from MarketWatch, a weekly podcast about the financial news we all watch and how it impacts the economy and your wallet. MarketWatch’s Jeremy Owens focuses his attention on what drives the markets and offers insights that will help you make more informed financial decisions. Sign up on Spotify AND Apple.