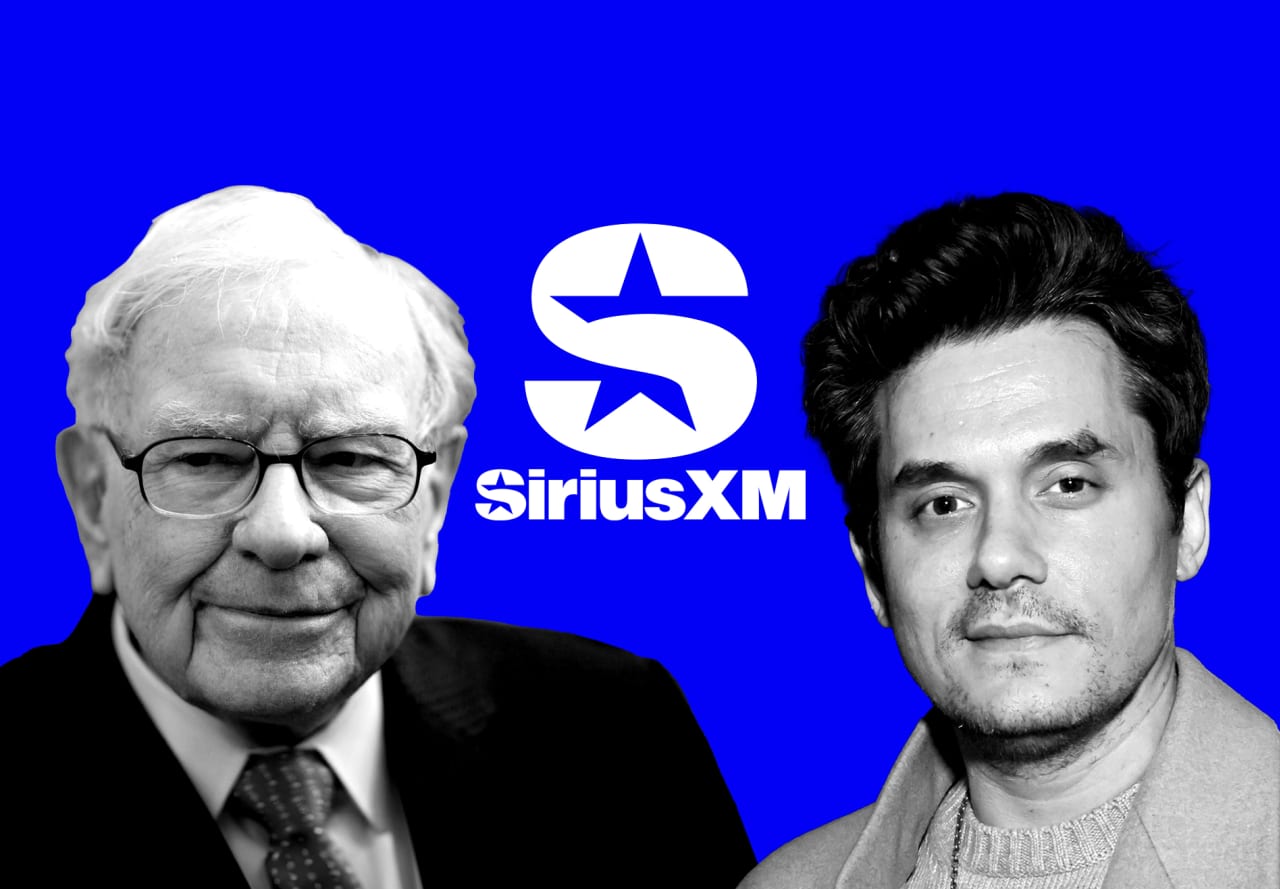

Warren Buffett, the famous investor, and John Mayer, the famous singer-songwriter and guitarist, would not seem to have much in common. But one thing they both share is a big bet on Sirius XM Holdings Inc. SIRI,

the satellite radio company.

Buffett’s interest comes via Berkshire Hathaway Inc.’s BRK.A,

BRK.B,

position in Liberty Media Corp.’s LSXMA Series A,

and C series LSXMK,

stock tracking for Sirius XM, representing the value of a portion of Sirius XM’s assets. Berkshire Hathaway has lost $267.2 million on Liberty trackers so far this year, at an average price of $30.28.

Mayer, meanwhile, is investing his time in Sirius XM. He can sell out big venues whenever he wants, but he also curates a new Sirius XM channel featuring his music and commentary, called “Life with John Mayer.”

‘FREE Money’

Buffett’s approach has an intriguing twist. Later this year, several Liberty Media tracking stocks will be consolidated into Sirius XM stock. The conversion rate will be 8.4 Sirius XM shares for each Liberty share.

Some simple math suggests there is some potential “free money” in the mix. The two classes of Liberty shares recently traded for around $29. Multiply the Sirius XM stock price of $4.43 by the stock conversion rate of 8.4 and you get $37.21. In short, as things stand right now, owning Liberty stock equates to a gift of $8 per share. The conversion should take place by the end of August.

One tactic might be to buy shares of Liberty Media, take the “free money” assuming the conversion gap holds, then exit the position. “The spread has to close at some point between now and the end of August,” says Chris Marangi, co-chief investment officer of value investing at Gabelli Funds. But Sirius XM stock might also be worth holding on to.

Of course, the risk is that the spread closes via the drop in Sirius XM stock. However, it would be difficult to lose all the “free money”. If you buy a Liberty tracking stock at $29, Sirius , notes FBN Securities analyst Robert Routh. . According to him, such a decline is unlikely. In fact, he’s more bullish on Sirius XM than the consensus, and makes a plausible case (more below).

Marangi sees owning Liberty shares as a way to get cheaper access to Sirius XM’s business. Sirius XM trades at an enterprise value to Ebitda of around 9.0. The value drops to 7.0 if you access Sirius XM stock through Liberty Tracking Stocks, owned by Gabelli Funds. Berkshire Hathaway could use the same logic.

Like Routh, Marangi is optimistic about Sirius XM’s prospects over a multi-year time frame. Beyond the free money aspect, Sirius

Surprise growth ahead?

Sirius XM has challenges. Revenue fell to $8.95 billion last year from $9 billion in 2022. The company’s 34 million subscriber base also declined slightly. The future doesn’t necessarily look much brighter. Sirius XM forecasts call for another year of declining sales in 2024, which is expected to come in at $8.75 billion. Morningstar analyst Ali Mogharabi expects 1% annual revenue growth for Sirius XM and its Pandora streaming platform over the next five years.

But Sirius XM could surprise investors. Routh sees the following avenues for growth, supporting his projection of 2.5%-3% annual sales growth over the next few years. “While some may think Sirius XM has no room to grow, we beg to differ,” he says. Here are four factors to consider:

1. Mayer could save the day: Sirius XM is trying to attract younger listeners. “They have to change their lineup to do it and not look like your dad’s radio station,” Routh says. This seems to make sense, given that nearly half of subscribers are over 45 and less than 20% are under 34, according to Sameweb.

Mayer has the marketing muscle to help achieve this goal. Her record proves that she has star power that can boost a company’s fortunes when she collaborates. A few years ago, Mayer co-designed an electric guitar with Maryland-based guitar maker PRS Guitars called the Silver Sky. It has become very popular and was ranked as the best-selling guitar of 2023 by musical instrument site Reverb.com, beating products from well-known guitar brands Fender and Gibson.

In addition to Mayer, Sirius XM has added channels with singer-songwriter Kelly Clarkson and the SmartLess Media podcast with Will Arnett, Jason Bateman and Sean Hayes. “This is really the first time we’re going to have meaningful content for a younger demographic,” Sirius XM Chief Content Officer Scott Greenstein noted in his February earnings call, citing those talents and artists Carrie Underwood, will. i.am. and Shaggy.

2. Sirius XM has potential beyond the car: In December, the company launched its new Sirius XM app, which improves access to content via smartphones and mobile devices. The app improves search and content discovery and “is providing promising signs of increased engagement,” CEO Jennifer Witz said on the February earnings call. “We see the recommendation engine working well and exposing listeners to a greater range of content.” Behind the scenes, the app supports marketing efforts and improves subscriber account management. “Sirius XM is expected to substantially increase its share of the ‘out-of-car’ market thanks to the company’s new app,” says Routh.

3. New car sales expected to rise this year: Routh also sees growth potential in rising new car sales this year. Most new cars come with Sirius XM radio and a free trial period. The subscriber conversion rate is 37%. To date, this has been the main source of new subscriptions.

4. Investors should continue to benefit from prodigious cash flow: Sirius XM produced $1.2 billion worth of cash flow last year. Of this sum, it returned $657 million to shareholders through dividends and share buybacks. Sirius will continue to use cash flow to increase shareholder value in this way. It expects $200 million in cost cuts in 2024, further boosting cash flow.

“They have such a large installed subscriber base, the cash flow is huge,” Routh says. The 34 million subscriber base has a monthly churn rate of 1.6%, meaning customers stay in service for an average of five years. Routh adds that Sirius

Michael Brush is a MarketWatch columnist. At the time of publication, he owned LSXMA, LSXMK and SIRI. Brush suggested BRK.B, LSXMA, LSXMK and SIRI in his stock newsletter, Brush Up on Stocks. Follow him on X @mbrushstocks.

Moreover: 9 stock tips hidden in Warren Buffett’s latest letter to Berkshire shareholders

Read also: Even Warren Buffett can’t compete with the S&P 500