According to Bespoke Investment Group, it’s not just the top seven companies in the S&P 500 that are benefiting from the AI-related stock market craze.

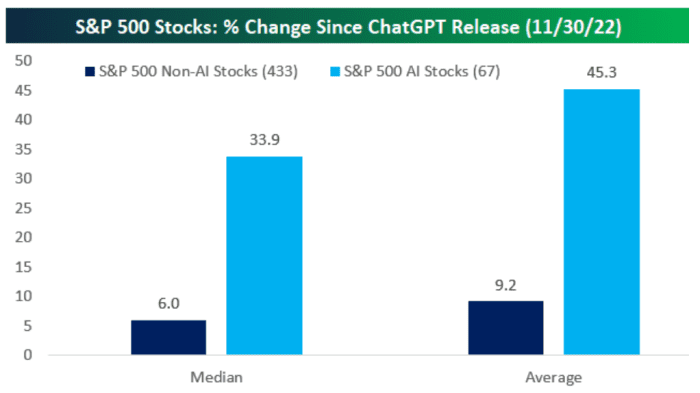

Sixty-seven S&P 500 AI-related stocks have risen an average of 45.3% since late November 2022, “when the first iteration of ChatGPT was released to the public,” Bespoke said in an emailed note Tuesday. “The remaining 433 non-AI stocks in the S&P 500 increased just 9.2% over the same time frame.”

CUSTOM INVESTMENT GROUP NOTE EMAILED IN FEBRUARY. 20, 2024

Nvidia Corp. NVDA,

The closely watched chipmaker that has benefited greatly from investor enthusiasm for artificial intelligence will report fourth-quarter earnings results after the U.S. stock market closes on Wednesday. The company’s gigantic market value of about $1.8 trillion puts it among the top weights in the S&P 500 index, whose gains last year were driven by a group of seven mega-cap technology stocks.

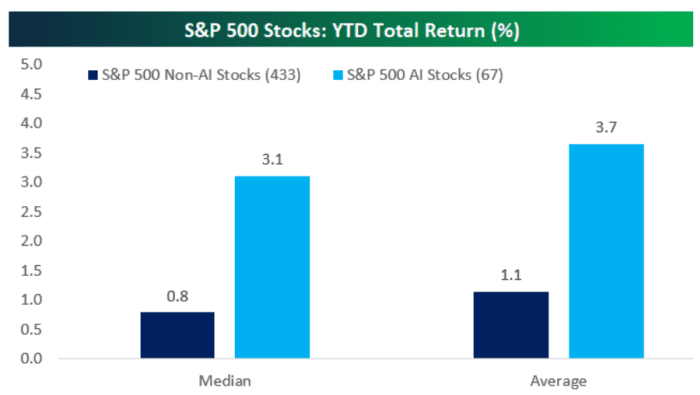

“AI stocks continue to attract the majority of the investment world’s attention,” Bespoke said. The firm found that “year to date, the average S&P 500 AI stock is up 3.7% versus a 1.1% gain for non-AI stocks.”

CUSTOM INVESTMENT GROUP NOTE EMAILED IN FEBRUARY. 20, 2024

Nvidia shares were down about 6% as of Tuesday afternoon, but even with that drop, the stock is up more than 37% this year, according to FactSet data, at last check.

The technology sector of the S&P 500 Index XX:SP500.45,

which includes Nvidia, is up more than 5% so far in 2024, according to trading Tuesday afternoon.

Meanwhile, shares of the Roundhill Magnificent Seven ETF MAGS, whose megacap holdings include Microsoft Corp. MSFT,

Apple Inc. AAPL,

Nvidia, Amazon.com Inc. AMZN,

Meta Platforms Inc., parent company of Facebook, META,

Google’s parent company, Alphabet Inc., GOOGL,

GOOG,

and Tesla Inc. TSLA,

– have risen nearly 8% this year, according to FactSet data, at last check.

The S&P 500 Index has lagged over the same period and is up about 4% in 2024.

Five of the “Magnificent Seven” stocks have risen this year, with gains led by Nvidia. Only Apple and Tesla are in the red so far in 2024.

“Some of the most followed large-cap AI stocks” beyond the Magnificent Seven include companies like Advanced Micro Devices Inc. AMD,

ServiceNow Inc. NOW,

Broadcom Inc.AVGO,

Intuitive Surgical Inc. ISRG,

CRM by Salesforce Inc.,

and Intel Corp. INTC,

according to the customized note. While Intel is down this year, the rest of these six have outperformed the S&P 500 in 2024.

But on Friday, the 67 AI-related stocks in the S&P 500 tracked by Bespoke “took a breather” and fell an average of 1.3%, while “non-AI stocks” fell just 0.3 %, as the company note shows.

U.S. stocks fell Tuesday, following a three-day weekend in honor of Presidents Day on Monday. The S&P 500 SPX fell 0.8% in afternoon trading Tuesday, while the Dow Jones Industrial Average DJIA lost 0.2% and the tech-heavy Nasdaq Composite COMP fell 1.3%, according to FactSet data, at last check.

Light: Higher interest rates needed to pop AI ‘baby bubble’ in stocks, says BofA