Key points

- Thanks to NVDA’s earnings boost, AMD is now up nearly 20% year-to-date and more than 100% year-over-year.

- With AMD trading near bullish consolidation resistance and boasting excellent valuations, it represents an interesting potential growth opportunity.

- Sentiment remains broadly bullish on AMD, with bullish forecasts and recent increases in price targets.

- 5 stocks we like best from Advanced Micro Devices

While the shares of Advanced Micro Devices NASDAQ:AMD may not grab headlines as much as its competitor, Nvidia NASDAQ:NVDAShareholders of the global semiconductor company are undoubtedly happy.

Thanks to a significantly higher gap in this morning’s premarket, AMD shares are now up nearly 20% year to date and well over 100% year over year. However, the gap was higher this morning due to its competitor, Nvidia, after the company reported extraordinary earnings in the extended hours on Thursday to help lift the sector and the entire market.

The gap in AMD this morning presents an intriguing opportunity. Shares of the well-established semiconductor company are now trading near bullish consolidation resistance. The title is also the most rated, one of the most updated titles and one of the most sought after.

So, could the recent momentum mean a significant upside for AMD?

AMD is an established semiconductor company founded in 1969 and headquartered in Santa Clara, California. It plays a crucial role in various sectors of the global economy.

The company operates in two segments: computing and graphics, enterprise, embedded and semi-custom. Their product portfolio includes microprocessors, chipsets, GPUs, data center solutions, and gaming console technology, making them one of the most versatile semiconductor companies on the market today.

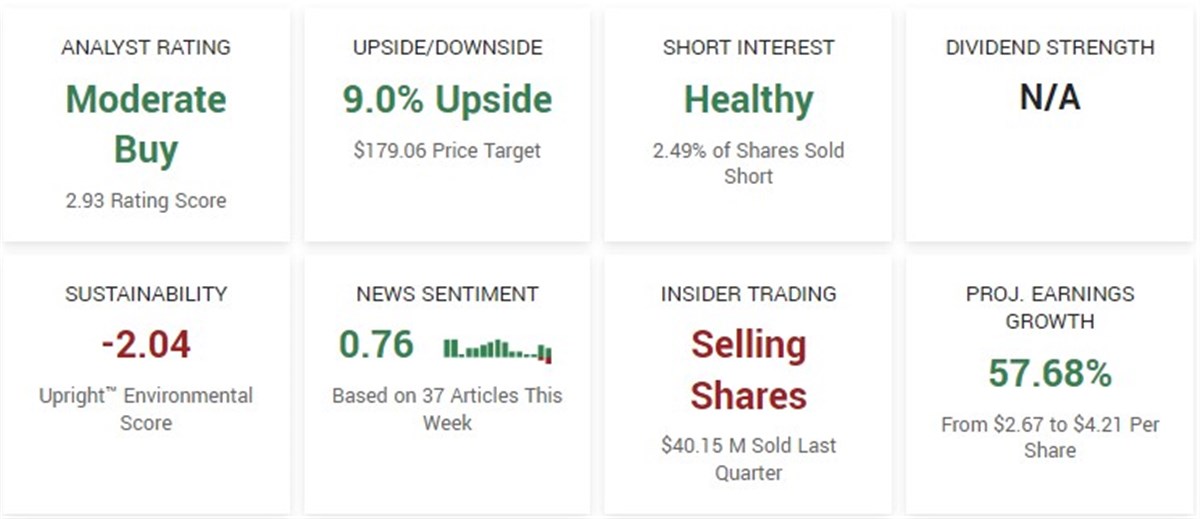

In its latest earnings report on January 30, the company slightly beat analysts’ expectations with EPS of $0.77. AMD reported quarterly revenue of $6.17 billion, slightly higher than analysts’ forecasts of $6.13 billion and marking a 10.2% increase from a year earlier. Over the past year, AMD has generated diluted earnings per share of $0.52 and maintains a high price-to-earnings (P/E) ratio of 315. Forecasts suggest significant 57.68% earnings growth for AMD for next year, from 2.67 to $4.21 per share.

Sentiment is bullish on AMD

While AMD shares are already up double digits year to date, analysts expect significant further upside, with a consensus price target calling for an upside of nearly 9%.

AMD has a Moderate Buy rating based on twenty-seven ratings. Of the twenty-seven ratings, twenty-five analysts have AMD as a Buy and two have AMD as a Hold. Over the course of three months, the consensus price target has moved from $134.77 to the current target of $179.06.

Most recently, on February 13, analysts at Mizuho increased their target for AMD from $175 to $200, predicting an upside of 17.05% at the time of the report. Two days ago, on February 20, analysts at Cantor Fitzgerald reiterated its rating as Overweight, with a price target of $190.

The general sentiment is bullish, especially regarding its shares, as AMD is one of the most followed and searched for stocks. AMD is also on the list of best-rated stocks along with the list of most up-to-date stocks.

AMD nears major breakout level

After the stock retreated towards its simple moving averages (SMA), such as its 200-day SMA late last year, the stock found support and broke higher. Since crossing the $110 mark in November last year, the momentum has been steady and AMD hit a new all-time high of $184.92 in January.

Since reaching that high, the stock has essentially consolidated in a tight range above its rising moving averages. Note that the $165 acted as support and resistance from the $180. With earnings beats for industry leader, Nvidia, and AMD approaching the breakout level, upward momentum could soon follow. If the stock manages to hold above $180 with authority, it could begin a new upward phase and reach new all-time highs for the second time this year.

Before you consider Advanced Micro Devices, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Advanced Micro Devices wasn’t on the list.

While Advanced Micro Devices currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

With average gains of 150% since the start of 2023, now is the time to take a look at these stocks and boost your 2024 portfolio.

Get this free report