This article is an on-site version of our Inside Politics newsletter. Sign up here to receive the newsletter directly to your inbox every weekday

Good morning. Theresa May has become the latest Conservative MP to announce plans to stand down at the next election. Although her tenure as prime minister was overwhelmed by the pressures of the Brexit negotiations, I think it’s fair to say that she, in general, was an example of how to behave after leaving that office.

As Home Secretary she was a contradictory figure: she significantly broadened the scope and scope of Labour’s hostile environment policy, but when it came to the police she was the most reformist Home Secretary of modern times.

I continue to think that negotiating the backstop was an extraordinary diplomatic achievement and we will increasingly look back at the decision by several MPs to dismiss it as a mistake.

But in this day and age, his exit adds a note of gravity to the sense that this era of conservative politics is coming to an end. She was a key player in the party’s comeback having first been elected in 1997 and she leaves the party on track for a similar defeat unless something changes.

One thing that could change that is the dispute over taxes and spending. Some thoughts on this below.

Inside Politics is edited by Georgina Quach. Read the previous edition of the newsletter here. Please send gossip, thoughts and feedback to insidepolitics@ft.com

Repair a hole

Most polls will say that, given the choice, people think the government should prioritize fixing public services over cutting taxes. Ask most pollsters what they think these numbers actually tell us and they’ll tell you it’s a little more complicated than that.

Both the Conservative leadership and their Labor opposites think alike. Everything Keir Starmer and Rachel Reeves say and do about taxes and spending is based on the assumption that, sure, people like the idea of giving higher priority to public services in theory, but in practice, at an election, this will only allow Labor to the party has come so far. And everything Rishi Sunak and Jeremy Hunt say about taxes and spending is also based on this assumption.

There’s another important difference between what polls suggest and what parties conclude: What voters say they think about policies in the abstract is different from what they think when tied to specific politicians or political parties.

Both the Conservatives and the Labor Party carry with them a century of historical baggage: in different ways, what you might call their “brand identity” shapes how what they say and do is perceived and interpreted. This also determines how the two parties act.

This is the important subtext of the latest argument the two parties are having over alleged “black holes” in each other’s plans.

At the start of the week, the Labor Party had four main sources of additional tax revenue. They would have stripped private schools of VAT exemption, extended and increased capital gains tax on energy companies, abolished the non-dom tax regime and taxed carried interest at the same level as income tax . rather than as a capital gain.

These fiscal policies meant that Keir Starmer and Rachel Reeves could claim that Labour’s various spending promises were a) fully funded and b) would not involve politically controversial taxes, such as income tax, national insurance , fuel tax or VAT.

Jeremy Hunt pocketed two of these revenue increases in his Budget this week (the windfall tax and the abolition of the non-dom regime) and is now trying to attack a third: Treasury officials, based on the assumptions provided by Conservative special advisers, Labor estimates changes to carried interest would actually decrease overall revenue, thanks to capital flight and behavioral changes. The department says the tax rise could cost the Treasury up to £3.3 billion in lost revenue if the policy is introduced in 2025 and lasts until the end of 2029.

The Labor Party will use two things as a shield here: the earlier comments by Nick Macpherson, former permanent secretary to the Treasury, that these estimates have “little or no credibility” because the underlying assumptions are set by special advisers. The party will also point out that until last week Rishi Sunak was saying the same thing about the extension of windfall taxes, while Hunt was saying the same thing about the non-dom regime, just over a year ago. Furthermore, Labor claims that its sums are based on forecasts from the Resolution Foundation, an independent think tank, while the Treasury’s estimates are inevitably political.

In practice, I think it is likely that Labour’s proposals here will go the same way as George Osborne’s flirtation against doing something similar with capital gains tax: in office, he chose not to do so partly because of concerns that would have lost rather than increased revenue. The former chancellor increased CGT from 18 to 28% in his first Budget for higher rate taxpayers (although he cut it to 20% in 2016, still higher than when the Conservatives took office).

Opposition tax plans are by their nature quite impressionistic: Labour’s aim will be to give as favorable an impression to all of us as possible, while the Conservatives will want to paint as bleak a picture of Labor’s proposals as possible.

The Labor Party also has its own line of attack: claiming that Sunak and Hunt’s proposal to abolish employee pension contributions will create a £46 billion black hole.

This line of attack is literally true in the sense that this is what it would cost to abolish NI, but not really, I think that’s a fair description of what Sunak and Hunt would actually do, which is that unite NI and income tax. But again, the game is that the Labor Party wants to find every excuse possible to use the words “Liz Truss” as close as possible to the words “Rishi Sunak” and “Jeremy Hunt”, and talking about big holes in the Tories. plans is a good way to do this.

Yesterday I asked you whether British voters had already decided on their preferred party for the next election. About 62% of respondents said yes, 23% said no, and 15% were undecided.

Now try this

I saw Frank Dupree play with the Philharmonia last night: I particularly liked Borodin’s Second Symphony and Dupree’s interpretation of Kapustin’s Fifth Piano Concerto, both of which I’ve added to the Inside Politics playlist. As we were leaving, I noticed the BBC Radio 3 team were in the nearest box, so I can’t wait to listen to it all again on March 19th.

However you spend it, I hope you have a wonderful weekend.

Top stories today

-

‘Of course they’ll take it away from us’ | Jeremy Hunt has wound up a scheme providing an extra £200 million a year for social housing in England, in a controversial move that will further squeeze the finances of cash-strapped local councils.

-

Cut fears at the Ministry of Defense | The UK government has no “credible plan” to deliver the military capabilities it seeks and the country’s armed forces will have to cut some of their programs unless overall defense spending is increased, according to a cross-party group of MPs .

-

Flight of fantasy | Liz Truss spent more than £15,000 on onboard catering on a single trip to Australia while she ran the Foreign Office in 2022, Politico’s Emilio Casalicchio reports.

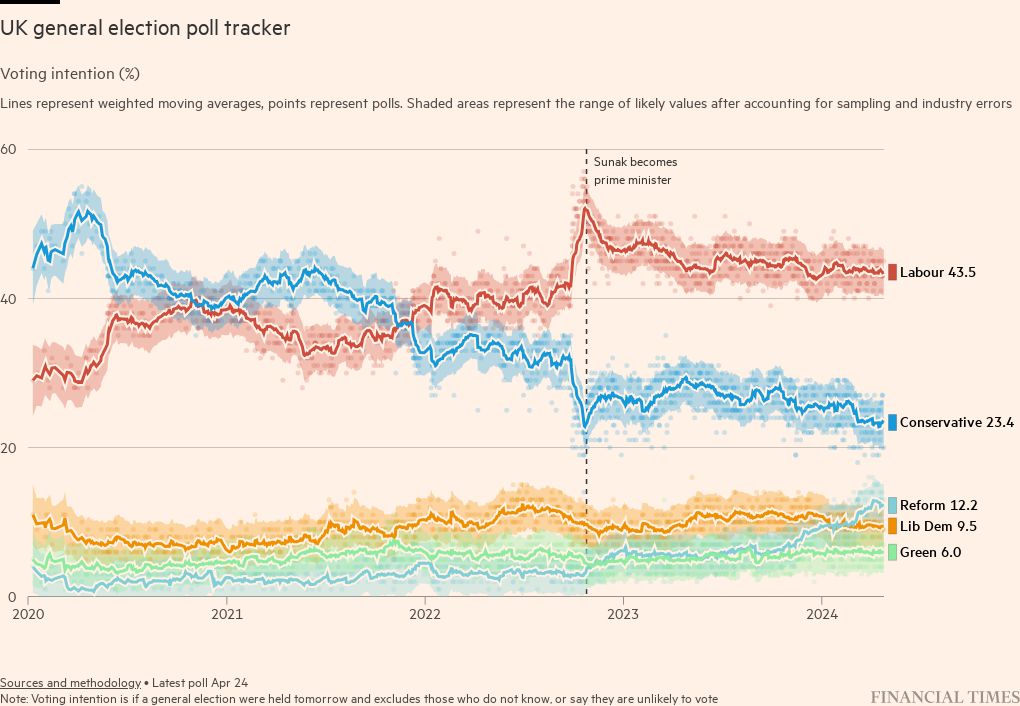

Below is the UK poll of polls updated in real time by the Financial Times, combining polls on voting intentions published by major UK pollsters. Visit the FT’s poll tracker page to discover our methodology and explore poll data by demographics, including age, gender, region and more.

Newsletters recommended for you

One to read — Extraordinary journalism not to be missed. Sign up here

FT opinion — Insights and opinions from the best commentators. Sign up here