Berezko/iStock via Getty Images

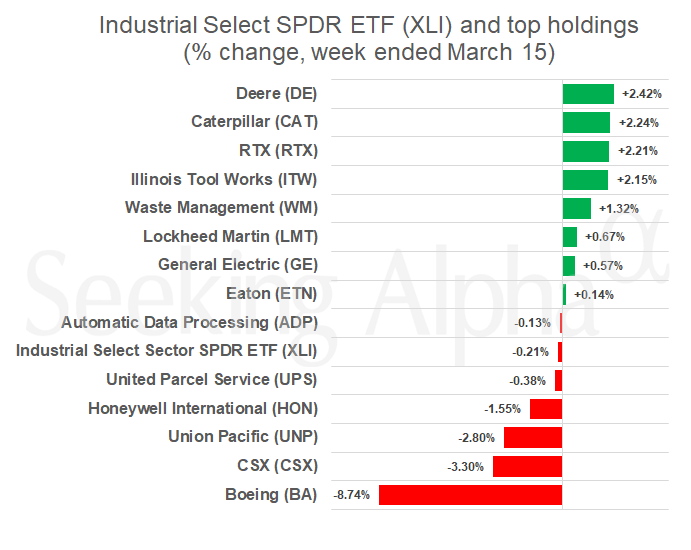

Boeing (NYSE: BA) led to weekly declines in stocks of major U.S. industrial companies, as stocks fell for a second straight week on investor worries about inflation data.

The SPDR Industrial Select Sector ETF (NYSEARCA:XLI), whose holdings include some of that of the largest US companies in the sector, fell less than 1% for the week.

The performance mirrored that of other benchmarks, with the Standard & Poor’s 500 stock index (SP500) falling less than 1%. The Dow Industrial Average (DJI) and 2.2% and the Nasdaq Composite (COMP.IND) also fell less than 1% for the week.

Consumer and producer price data indicated that inflation was higher than economists expected. The reports have rattled investors who are looking for signs that the Federal Reserve will soon begin cutting interest rates. Fed Chair Jerome Powell has said in previous statements that policymakers want to see inflation fall to the target of 2% per year.

Boeing: Further safety concerns

Boeing (BA) ended the week down 8.7%, although it managed to eke out a gain on Friday. The plane maker faced further concerns about the safety of its planes after 50 people were injured when a Boeing (BA) 787 Dreamliner briefly nose-dived on Monday during a Latam Airlines flight from Sydney to Auckland.

Concerns about possible technical problems were limited to the possibility of a flight attendant accidentally pressing a switch on the pilot’s seat, pushing him against the cockpit controls. Boeing (BA) sent a memo to 787 operators on Thursday, informing them to inspect the pilot’s chairs for any loose covers on the switches and giving instructions on how to turn off power to the pilot’s seat motor if necessary.

Another news item indicated that United Airlines (NASDAQ:UAL) was looking to replace some of its Boeing (BA) aircraft orders with jets made by European rival Airbus (OTCPK:EADSY) (OTCPK:EADSF). Boeing (BA) is not allowed to increase production of its popular 737 Max planes until the US Federal Aviation Administration is satisfied that the company has improved factory operations and safety controls. The agency has stepped up scrutiny of Boeing (BA) and its supply chain following the mid-air blowout of a door plug on a 737 flown by Alaska Airlines (NYSE:ALK) I fly in January.

Deere’s job cuts

Amid the broader market decline, Deere (NYSE:DE) gained 2.4% weekly for the best performance among the top holdings of the Industrial Select Sector SPDR ETF (XLI).

The farm equipment maker is laying off about 150 people at a factory in Ankeny, Iowa, the Des Moines Register reported Tuesday. The plant is said to employ around 1,700 people, including 1,136 production workers.

| The best holdings of the industrial SPDR fund selected for the sector | ||

| First name | Ticker | ETF Weighting (as of March 14) |

| General Electrical | (NYSE:GE) | 4.8% |

| caterpillar | (NYSE:CAT) | 4.6% |

| Uber Technologies | (NYSE:UBER) | 4.2% |

| Union Pacific Corp | (NYSE:UNP) | 4.0% |

| RTX | (NYSE:RTX) | 3.5% |

| Honeywell International | (NASDAQ: ON) | 3.4% |

| Eaton | (NYSE:ETN) | 3.2% |

| United Parcel Service | (NYSE:UPS) | 2.9% |

| Boeing | (BA) | 2.7% |

| Deere | (FROM) | 2.7% |

| Automatic data processing | (NASDAQ:ADP) | 2.6% |

| Lockheed Martin | (NYSE: LMT) | 2.5% |

| Waste management | (NYSE:WM) | 2.0% |

| CSX | (NASDAQ:CSX) | 1.9% |

| The Illinois tool works | (NYSE:ITW) | 1.9% |