Maxiphoto

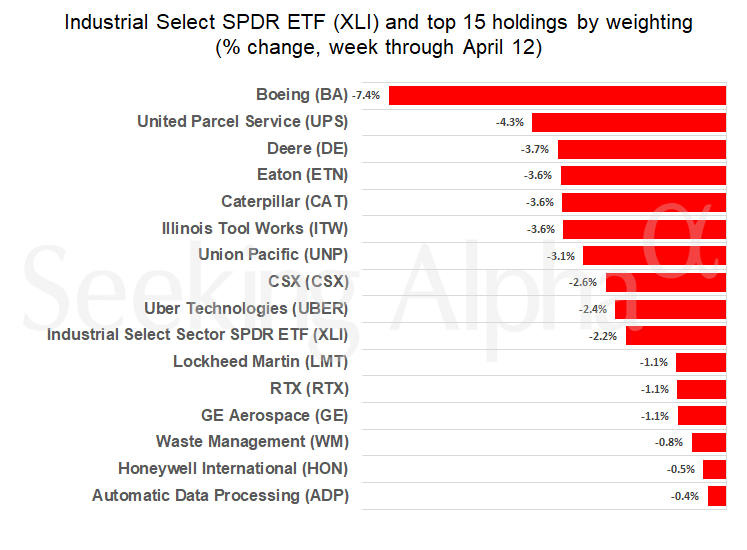

Boeing (NYSE: BA) fell the most among major US industrial companies in a turbulent week for stocks.

The SPDR Industrial Select Sector ETF (NYSEARCA:XLI), whose holdings include some of the largest U.S. companies in the sector, fell 2.2% for the week.

The performance mirrored movements in other benchmarks, with the Standard & Poor’s 500 stock index (SP500) losing 1.5%, the Dow Industrials Average (DJI) 2.4% and the Nasdaq Composite (COMP :IND) 1.6%.

Consumer prices rose much faster than expected in March, according to a report released Wednesday. The data has investors considering how persistently high inflation will prevent the Federal Reserve from cutting borrowing costs soon.

Geopolitical tensions in the Middle East have pushed oil prices higher. Iran has threatened to retaliate against Israel for last week’s attack in Syria. (Iran followed up on the threat by launching hundreds of drones and missiles toward Israel on Saturday, whose air defenses shot down most of them.)

The yield on the 10-year Treasury note rose to 4.499% on Friday from 4.377% a week earlier.

Gold futures rose 1.3% on the week, reaching a new record on Friday.

Boeing (BA) fell 7.4% on the week to extend its year-to-date loss to 35%, also hitting a 52-week low on Friday.

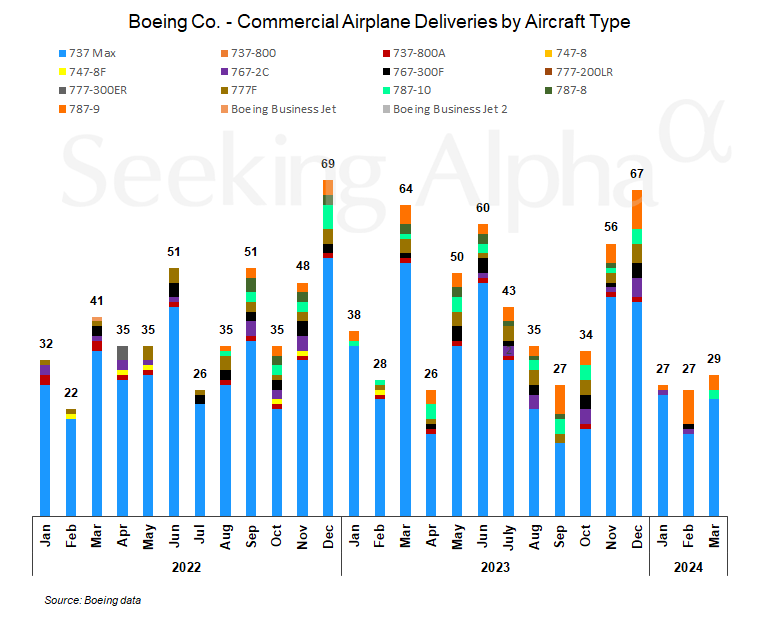

The aerospace and defense company on Tuesday reported the lowest quarterly commercial aircraft deliveries since mid-2021. The quarterly total of 83 planes included 66 of its best-selling 737 narrowbody jets.

In January, the US Federal Aviation Administration imposed a limit on Boeing’s (BA) production of the 737 Max after a door plug blew on a plane operated by Alaska Airlines (ALK). The agency limited production to 38 planes per month. Boeing (BA) delivered 24 737 Max jets in March.