Unlock the Publisher’s Digest for free

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

Prime Minister Rishi Sunak’s plan to introduce a highly complex tax regime for UK wine importers will drive up prices, reduce consumer choice and tie small businesses into red tape, the industry has warned.

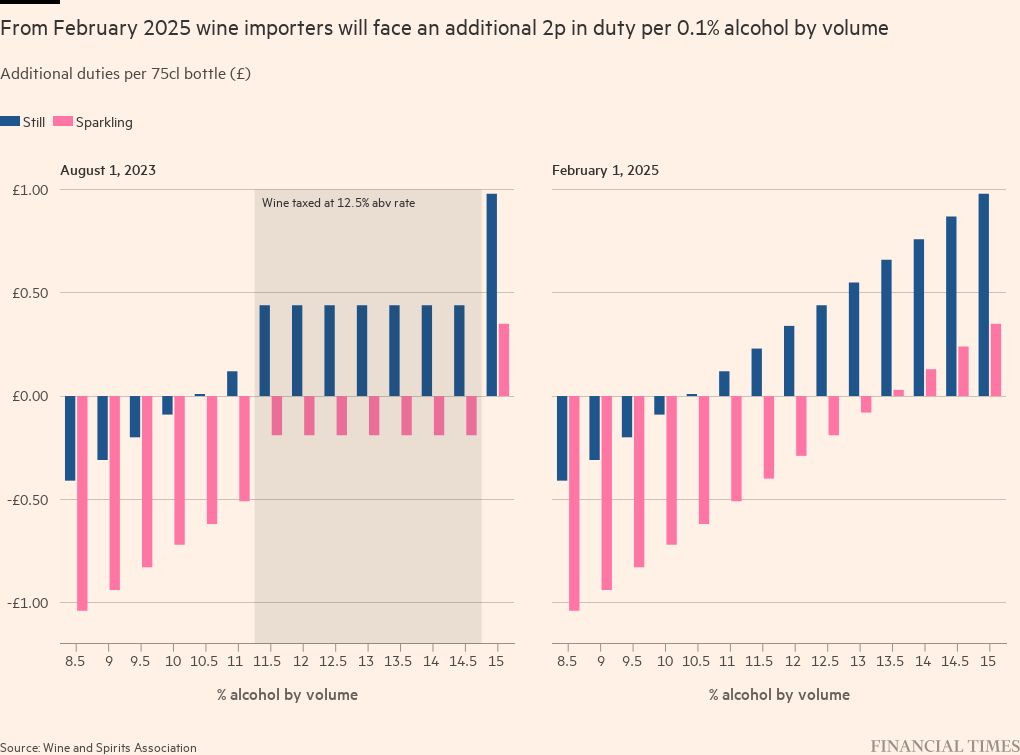

From February 2025 wine duty will rise in 2p increments for every 0.1% increase in alcohol content, a system which industry leaders have declared “unworkable”, particularly for small importers.

Sunak announced the changes in the 2021 spending review when he was chancellor of the exchequer, calling them a benefit of Brexit and promising they would lead to a “simpler, fairer and healthier” system.

However, the plans have sparked a furious reaction from the British wine industry which, according to the Wine and Spirit Trade Association, supports more than 400,000 jobs and contributes £72 billion to economic activity.

Matthew Hennings, whose small family business Hennings Wine in Sussex imports around 500,000 bottles a year and employs 22 people, said the new regime would be “incredibly burdensome” on his business.

“We’re going from two or three service bands to more than 30,” he said. “I will have to hire another full-time staff member to keep up with the paperwork, and even then it will be tough.”

Hennings added that the rules would also make the pricing of the wines a matter of guesswork, as the amount of alcohol in each bottle differed from year to year, depending on the weather and sometimes within a year.

“For table wines that are stored in tanks to keep them fresh and then bottled to order, the alcohol content could vary, for example, from 11.2% to 11.8% in a single year, which will make the incredibly difficult and unstable prices for the restaurant industry. ,” he said.

The changes were first introduced in August 2023, but with an ‘easement’, meaning all wines between 11.5% and 14.5% alcohol by volume attracted a flat tax of £2.67 a bottle. This covered 85% of the 1.2 billion bottles sold in the UK last year. The easement will end on February 1 next year.

The government has resisted intense pressure from the WSTA and industry players, including Majestic Wine and The Wine Society, to maintain the easement and avoid piling red tape on the sector.

The new regime has attracted cross-party criticism, including from leading conservatives. Priti Patel, a former home secretary, said in a Westminster Hall debate in March that the changes were “increasing bureaucracy at a time when the government should be doing much more to reduce it”.

Miles Beale, chief executive of the WSTA, called the rules “ridiculous” and warned they would lead to “substantial” price increases, with stronger wines at 14.5% alcohol seeing duty increases of more than 40%. pence a bottle.

John Colley, chief executive of Majestic Wine, said ministers’ claims that the new system would be “simpler” were wrong. “That’s simply not the case: in fact, the system in place before Brexit was much simpler to administer,” he said after the Westminster Hall debate on 7 March.

Steve Finlan, chief executive of The Wine Society, which estimates it would need to spend more than £400,000 to upgrade its systems to accommodate the changes, said the decision to push ahead with the reforms was “completely out of touch with business reality” .

Kim Wilson, the founder of North South Wines in Bicester, Oxfordshire, which imports around 15 million bottles a year and services most of the big supermarket brands, said the move to the 0.1% tariff bands it is “one hundred percent unmanageable”.

He added that from one vintage wine to another, the alcohol content can vary by up to 0.5%, depending on the time and fermentation process, requiring a new label and barcode for each, which will increase bureaucracy.

“It will need one full-time person to manage ABV and two part-time employees for logistics – that’s 8% of my workforce dealing with ABV, not to mention the daily distraction where we would have to focus on growing the business — is frankly stupid,” he said.

The Treasury said alcohol duty was frozen for a further six months until February 1 during the last budget, meaning it was 10p lower than it would have been if the planned rise had been carried forward.

A spokesperson added: “We have engaged closely with the wine industry throughout the consultation on the historic alcohol tax reforms.”