Unlock the Publisher’s Digest for free

Roula Khalaf, editor of the FT, selects her favorite stories in this weekly newsletter.

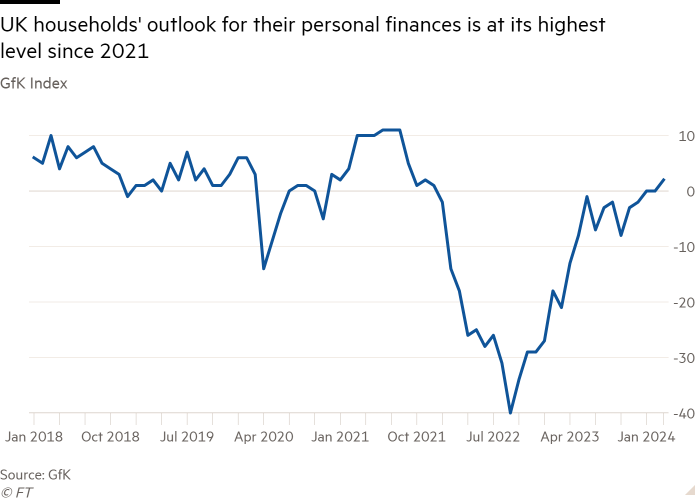

British consumer confidence about their personal finances has reached its highest level in two years, according to a closely watched survey.

Research firm GfK said on Friday that people’s outlook on their financial situation for the year ahead – a sub-index of its overall consumer confidence index – rose by two points month on month, reaching 2 in March.

The increase marked the first time since December 2021 that the measure has been above zero, and puts it well above its long-term average of minus 1.7.

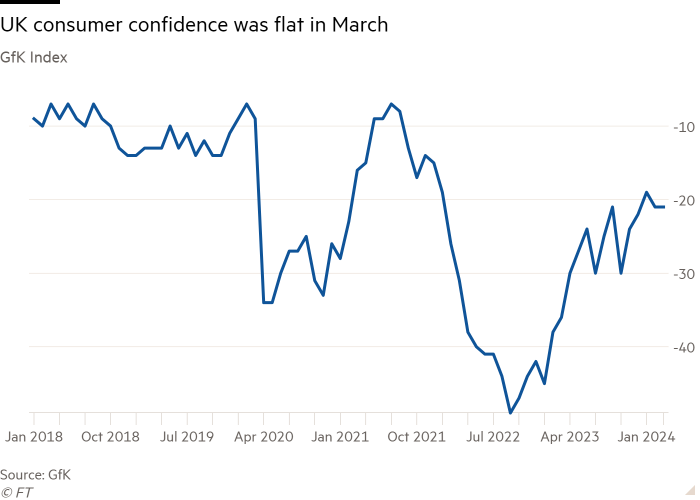

However, GfK said the overall index – a measure of how people view their personal finances and the broader economic outlook – was unchanged since February at minus 21 after a year of near-persistent increases, suggesting consumers remain cautious about inflation.

“The improvement in the personal finance measure to +2 is encouraging,” said Joe Staton, director of client strategy at GfK. “[Yet] the improvements found in consumer confidence are evident [in] most months since January 2023 have vanished.”

Although the overall index remained flat, confidence in the outlook for the general economy improved by 1 point from February to minus 23, after falling between January and February.

But respondents lowered their view of the economy over the past 12 months by 2 points to minus 45, in a sign that persistent inflation is causing consumers to reevaluate the U.K.’s recent economic progress.

Separate official data on Wednesday showed rents rose at a record pace of 9% last month, while overall inflation fell sharply to 3.4%, the lowest level since 2021.

Prime Minister Rishi Sunak pointed to easing price growth as evidence that his economic plan was working, and the decline encouraged Number 10 to believe inflation could fall below the 2% target of the Bank of England ahead of the general election due in the autumn.

A fall in inflation – and the boost to consumer confidence it could provide – is a key part of Sunak’s strategy as he seeks to narrow Labour’s 20-point lead in opinion polls and convince voters that the Conservatives are the best managers of the economy.

Households remain uncertain about the overall direction of travel, even as some retailers announced bigger-than-expected profits, boosted by the outlook for British consumer confidence.

Tomasz Wieladek, an economist at investment firm T Rowe Price, said it was “plausible”. [economic] volatility. . . generated a context of significant financial uncertainty and that this in turn continues to have a negative impact on general consumer confidence”.

The BoE on Thursday cited a “broadly stable” consumer confidence index, saying interest rates will remain at a 16-year high of 5.25% after “further encouraging signs of declining inflation.”

“The stability is ultimately a good sign,” Staton added.