By Divya Rajagopal

TORONTO (Reuters) – An unusually warm winter this year in Canada has delayed the opening of a 400-kilometer (250-mile) ice road that is rebuilt every year as a main conduit for Rio Tinto (NYSE:), Burgundy Mines and De Beers to access its diamond mines in the remote Arctic region.

The Winter Road, which serves the region accessible only by air for 10 months of the year, opened with a two-week delay in mid-February, disrupting the movement of goods along the ice road built across 64 frozen lakes.

Earlier this week, the Tlicho government in the Northwest Territories (NWT) restricted commercial truck travel on one of its winter roads for a few days due to expected warmer weather in the northern slave country.

While diamond production remains unaffected, the delay highlights the challenges companies face as the mines that make Canada the world’s third-largest diamond producer reach the end of their productive lives.

It also highlights the infrastructure hurdle for NWT and Nunavut as they position themselves as the next frontier in the exploration of critical metals, such as rare earths, cobalt and lithium, in the transition to a greener future.

Delays in construction on Winter Road, which first became operational in 1982, have occurred in the past, but this year’s delay is the longest in recent years, according to Tom Hoefer, senior counsel for the NWT and the Chamber of the mines of Nunavut.

“As a result, we started the journey a little later,” he said.

Climate change, driven by the use of fossil fuels, coupled with the emergence of the natural El Nino climate pattern, has pushed the world into record heat territory in 2023.

The impact of El Nino this year led Yellowknife, the NWT capital, to record a maximum temperature of zero degrees Celsius (32 degrees Fahrenheit) in December and minus 8.7 degrees Celsius (17.6 F) in February, making the winter days warmer. in a decade, according to data from Environment Canada.

The Winter Road opens in late January to early April and requires a minimum of 29 inches (74 cm) of ice for vehicles that can carry 26,000 kilograms (57,320 pounds) of gross vehicle weight, to carry diesel and dynamite necessary for the operation of the mines.

On warmer days, engineers have found ways to trick nature by creating artificial ice by using giant sprinklers to spray water high into the air so that they cool and form a thick layer of ice when they fall.

Paul Gruner, CEO of the indigenous company Tlicho Investment Corp & Group of Companies, said that the warm winter is at the beginning of this year and that if there is a late warmer season or an early spring, a closure could be risked anticipated.

“So when you nibble away at both aspects, you start to create a very short season,” Gruner said.

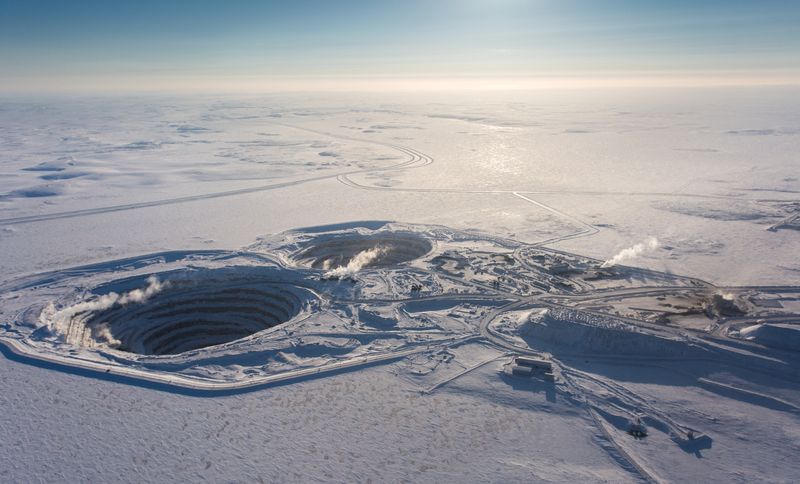

Winter Road is jointly operated by the Burgundy Diamond Mines Group, Rio Tinto and De Beers of Anglo American (JO:) who operate the Ekati, Diavik and Gahcho Kue diamond mines respectively.

De Beers and Burgundy Diamonds said operations at their mines were unaffected by the mild winter. Rio Tinto declined to comment.

The Winter Road costs C$25 million ($18.54 million) to operate for two months, an amount that is split by the three companies based on goods transported on the road and distance travelled.

However, mines have an operational life of around 20 years and when they reach the end of their useful life they must be closed.

Rio Tinto has said it will close the Diavik mine in 2026 and De Beers plans to close Snap Lake at the end of this year, while seeking to extend the life of Gahcho Kue.

CHICKEN AND EGG

Canada’s remote Arctic region, home to around 86,000 people, is facing a complete closure of all diamond mines by 2030 and is looking for ways to keep mining alive.

Lack of infrastructure presents a challenge, and reduced seasonal use of the ice road could compromise investments needed to extract critical minerals.

“If you’re in the exploration phase … and you’re considering winter road use as part of your core business model, risks start to come … into your decision-making process as to whether or not to pursue a project,” he said Tlicho Investment. Gruner said.

Hoefer of the NWT and Nunavut Chamber of Mines said the two Northern territories, the size of Europe, have the largest infrastructure deficit in Canada – one reason for the very high costs of living and doing business in the North.

“It’s a chicken and egg situation, mining companies probably won’t come unless there’s infrastructure, it’s just too expensive,” said Heather Exner-Pirot, director of the Energy, Natural Resources and Environment program at Macdonald- Laurier. Institute.

Building dirt roads costs C$3 million per kilometre, Pirot said.

Mining groups are pushing for a mega infrastructure project linking the NWT to Nunavut that runs through diamond mines and could help unlock the region’s mineral riches. At least 23 of the 31 critical minerals listed by the Canadian government are found in the NWT.

“When the project comes to fruition, it will replace roads that have served mining for 40 years, but until that happens, ice roads will be necessary,” Hoefer said.

($1 = 1.3483 Canadian dollars)