Having overtaken the Hong Kong stock market in December, India is now the world’s fourth largest stock market and is worth more than $4 trillion.

Javier Ghersi | Moment | Getty Images

According to analysts, India’s market capitalization can easily reach $40 trillion in the next 20 years, thanks to increased investor confidence and robust economic growth.

“We can easily reach $40 trillion by then,” said Sujan Hajra, chief economist at Anand Rathi Share and Stock Brokers, citing the country’s strong economic growth and a “much more stable” currency.

Manish Chokhani, director of investment services firm Enam Holdings, is even more optimistic, predicting that Indian markets could reach $60 trillion over the next two decades.

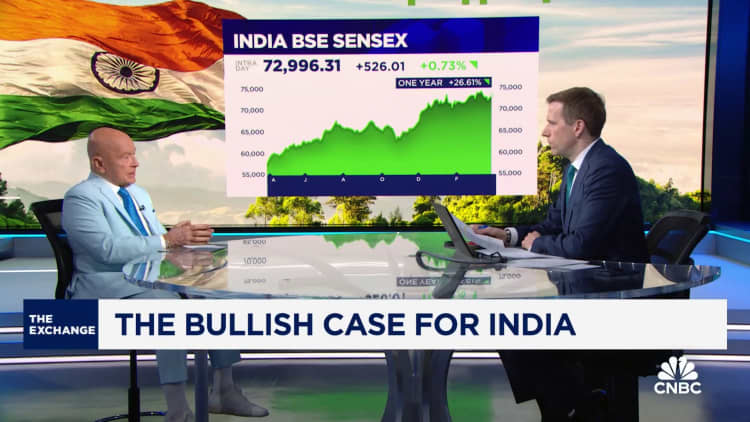

India’s benchmark Nifty 50 index is up 20% in 2023. After overtaking Hong Kong in December, the country’s market is now ranked as the fourth largest in the world, worth more than $4.6 trillion . On Monday, the Nifty 50 and BSE Sensex rose to fresh closing highs of 22,666 and 74,742 respectively, Refinitiv data showed.

“India’s GDP growth has led companies to increase their earnings and this translates into stock market performance,” said Atul Singh, CEO and managing director of wealth management firm LGT Wealth India.

India’s Ministry of Statistics said the country’s economy grew by 7.2% for financial year 2023 and is estimated to grow by 7.6% in financial year 2024. The country’s financial year begins on April 1st and ends March 31st.

In contrast, Singh noted that China’s economic growth has not led to stock market appreciation in recent years. China’s economy grew 5.2% last year, meeting the official target of about 5%. However, the benchmark CSI 300 has declined for three consecutive years, losing 11.4% last year.

“So India’s stock market growth is driven by real earnings growth… That process of converting nominal GDP growth into earnings growth and stock market returns will remain intact over the next 20 years as well,” Singh told CNBC in an interview.

India also has a “pipeline of new capital” that can continue to boost market valuations, Hajra said. India saw 220 initial public offerings in 2023, the highest of any country according to EY.

“India has the largest number of listed companies in the world, over 6,000, and prefers to pick up shares in the early stages of their life cycle,” Hajra explained.

“Opportunities are everywhere”

Indian markets have become more expensive after recent rallies. The benchmark BSE Sensex has a P/E ratio of 25.44, compared to the Shanghai Stock Exchange and Shenzhen Stock Exchange’s average P/E ratio of 12.25 and 21.12, respectively.

Despite these high valuation multiples, analysts believe India should still be part of an investor’s core allocation.

Sunil Koul, Asia-Pacific portfolio strategist at Goldman Sachs, advised investors to pay more attention to large-cap stocks as he expects there will be a shift away from small- and mid-cap stocks.

“One of the key views we have for the current year is that we should see a rotation in the markets. It has been the year of mid and small caps and it seems that things are changing already in the last month,” he said. Koul told CNBC’s “Street Signs Asia” last week.

LGT Wealth India’s Singh, however, said “opportunities are everywhere”.

He recommended paying attention to the financial services sector since “there are large companies that have strong secular growth,” he noted.