Key points

- Extreme Networks provides networking solutions by offering hardware and software to data centers, government agencies and schools.

- Extreme Networks shares were upgraded to Buy from Hold at B. Riley Securities.

- Riley analyst Dan King believes the post-COVID inventory normalization is over and demand is improving.

- 5 titles we like most from Extreme Networks

Extreme Networks Inc. NASDAQ: EXTR is a cloud-based networking solutions provider serving three seemingly “recession-proof” industries: government, education and healthcare. With nearly 40% of its revenue coming from government and education, this IT and technology company should do relatively well even in uncertain macroeconomic conditions. However, shares are down nearly 38% for the year.

This can be attributed to excess inventory, which has been a common theme among fellow networkers Ciena Co. NYSE: CIENtech companies like them Mobileye Global Inc. NASDAQ: MBLY and retailers like Under Armor Inc. NYSE: United Arab Emirates.

What do extreme networks do?

Extreme networks

(At 5:27 p.m. ET)

- 52 week interval

- $10.57

▼

$32.73

- P/E ratio

- 6.48pm

- Price target

- $22.36

Extreme Networks is a networking company that offers hardware and software-as-a-service (SaaS) solutions to businesses, data centers and organizations. It sells the hardware and then uses a SaaS model to sell maintenance, services, and software. It integrated artificial intelligence (AI), security and analytics on a single platform. This is what sets Extreme apart from the competition, helping it drive subscription ARR growth by 37% in fiscal Q2 2024.

Improved inventory and demand

B. Riley Securities upgraded shares of Extreme Networks to a buy from hold rating. Analyst David King believes channel inventory and demand have improved, particularly as channel inventory normalized.

King cites optimistic comments from one of Extreme Network’s largest IT solutions provider clients TDSYNNEX Co. New York Stock Exchange: SNX, from which Extreme derives nearly 18% of its revenues. TD SENNEX noted that the demand environment has stabilized and the company expects further improvement in the second half of 2024. King also believes that Extreme may have lowered its estimates, leaving more room for the upside. His price target is $14.

Broker downgrade

Following its fiscal second-quarter 2024 earnings report, Rosenblatt and UBS downgraded shares of Extreme Networks to Neutral on February 1, 2024. Rosenblatt cut his price target from $19 to $15, while UBS cut its target from $22 to $14.

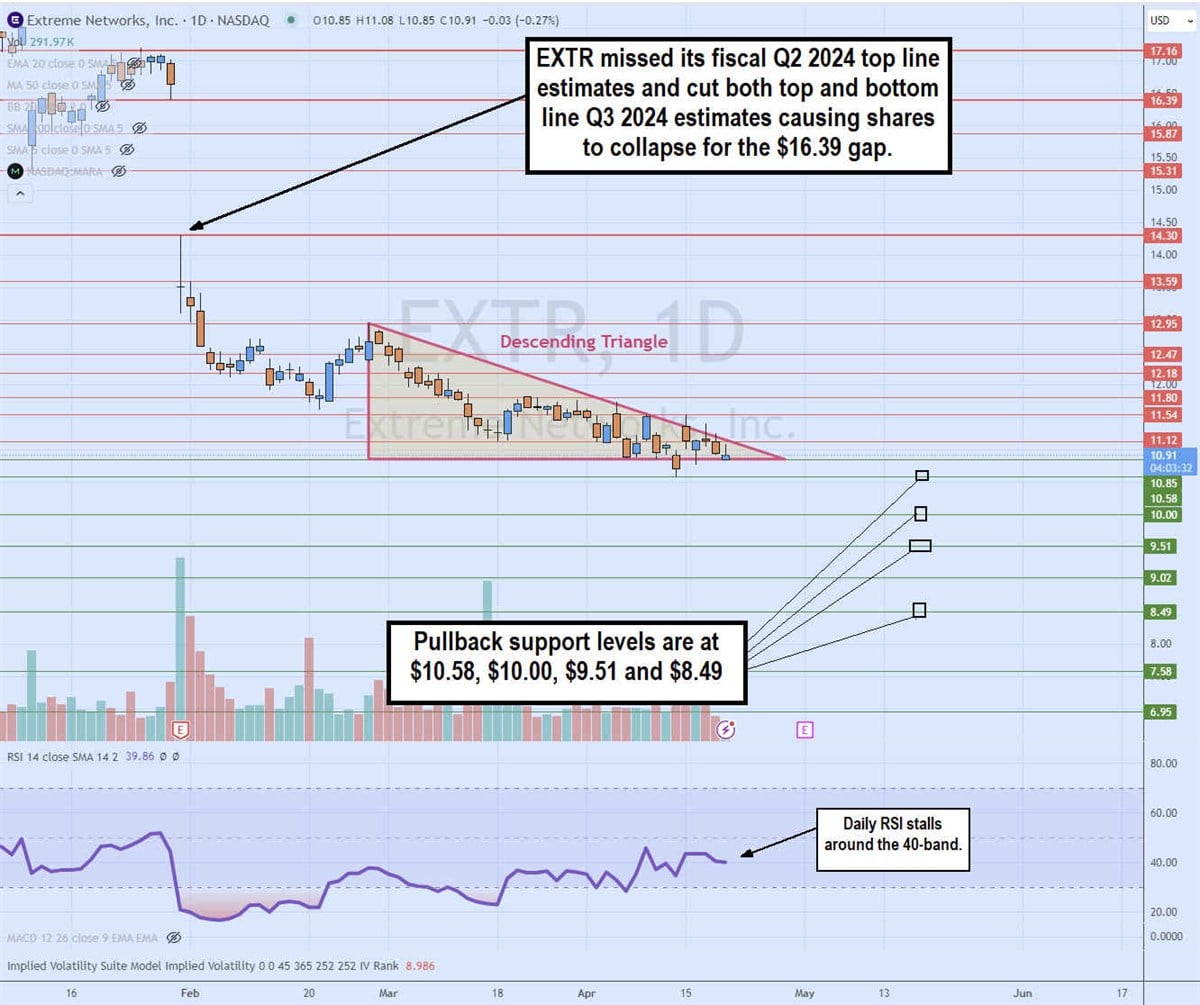

Daily pattern of the descending triangle

The daily candlestick chart on EXTR illustrates a descending triangle pattern. The descending trendline formed at $12.95 on February 28, 2024, dropping to the flat-bottomed lower trendline at $10.85. The daily relative strength index (RSI) remained flat around the 40 band. EXTR is preparing for a breakout through the flat lower trendline or a breakout through the upper descending trendline. The pullback support levels are at $10.58, $10.00, $9.51, and $8.49.

Lost the catwalk

On January 31, 2024, Extreme Networks reported EPS of 24 cents, beating consensus analysts’ estimates by a cent. Revenue fell 6.9% year-over-year to $296.4 million, missing consensus estimates of $303.2 million. The company noted that the product portfolio has been normalized. Double-digit year-over-year booking growth was prevalent in the EMEA and APAC regions. Cloud SaaS subscription deferred revenue increased 32% year-over-year to $246 million. ARR increased 37% year over year to $158 million. Non-GAAP gross margins increased 400 basis points year over year to 62.5%.

Metrics to keep an eye on

Extreme says 17% of total product bookings came from new logos in the quarter. Logos refer to customers and refer to company logos. The company acquired new customers representing 17% of total quarterly bookings. The company took its customers from over a million dollars to 44.

Weaker Extreme Lowball Fiscal Guidance for Q3 2024?

Extreme provided soft guidance for the fiscal third quarter of 2024, with an EPS loss of 22 cents to 17 cents versus consensus analyst estimates for a profit of 28 cents. Revenue expectations were lowered from $200 million to $210 million from consensus estimates of $321.36 million. Fiscal fourth-quarter 2024 revenues are expected to be between $265 million and $275 million, up from $355.27 million.

CEO Insights

Extreme Networks CEO Ed Meyercord made optimistic comments regarding the final stage of COVID-era supply chain constraints. Meyercord commented: “The networking industry, like much of IT, is emerging from the final phase of the COVID-induced era of supply chain constraints, which is still impacting our business. As a result, our distributors and partners have reduced inventory purchases, which we expect to accelerate in the third quarter. We expect to emerge in the fourth quarter at a more normalized level of revenues and earnings. Our booking trends and funnel of new opportunities better reflect customer demand and growth in APAC”.

Extreme Networks analyst ratings and price targets I’m on MarketBeat.

Before you consider Extreme Networks, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and Extreme Networks wasn’t on the list.

While Extreme Networks currently has a “Hold” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Are you trying to avoid the hassle of confusion, volatility and uncertainty? You would have to be out of business, which is not feasible. So where should investors put their money? Find out with this report.

Get this free report