Key points

- CarMax shares fell 9.2% from its fiscal 2024 fourth-quarter earnings report, marking its first EPS decline since its fiscal 2023 second quarter.

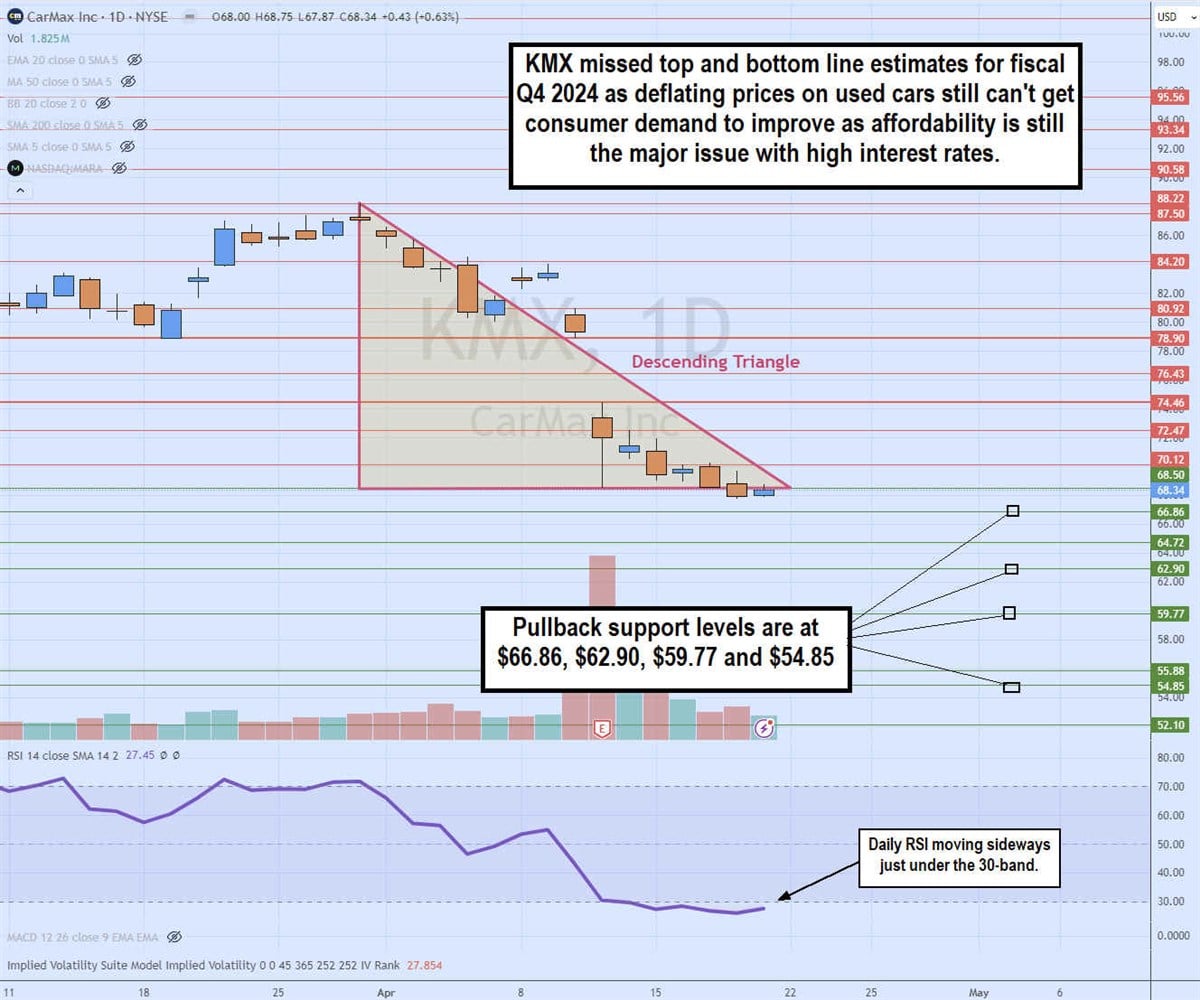

- CarMax is suffering from declining used car prices that are not stimulating consumer demand as affordability remains a major challenge driven by high interest rates and low consumer confidence.

- CarMax unit sales have increased on the retail front, and the CEO is confident they will accelerate market share growth as used car affordability improves with deflation and as vehicle values stabilize.

- 5 stocks we like better than CarMax

CarMax Inc. New York Stock Exchange: KMX is a nationwide used car dealership focused on providing a hassle-free, streamlined and convenient vehicle buying and selling experience for customers. CarMax has built its reputation on its no-haggle list pricing policy. Customers pay the sticker price shown on the car as the negotiation process is eliminated, providing a time-saving and stress-free process. The auto/tire/truck company provides repairs, maintenance service plans, financing and money back guarantees for its vehicles.

CarMax owns its stores and is not franchised

CarMax has 248 company-owned locations and more than 60,000 searchable vehicles online. The average CarMax location is approximately 59,000 square feet and has 300 to 400 used and refurbished cars in inventory. The company competes with AutoNation Inc. NYSE:AN, Carvana Inc. NYSE:CVNA AND Vroom Inc. NASDAQ: VRM.

The hangover of the pandemic reopening

During the pandemic and reopening, auto dealers failed to keep enough inventory in stock as supply chain disruption and chip shortages boosted used car business. This took CarMax stock to a high of $155.98 in November 2021. However, the hangover effect continues today as excess inventory, weak macroeconomic conditions, contraction in consumer spending and high rates of interest make customer demand tremble. Although used car prices have fallen due to deflation, demand has not increased.

Gains from car accidents

(As of 04/22/2024 ET)

- 52 week interval

- $59.66

▼

$88.22

- P/E ratio

- 10.40pm

- Price target

- $77.42

Investors panicked after the company reported declining sales and its first earnings shortfall since the fiscal third quarter of 2023. CarMax reported fiscal 2024 fourth-quarter earnings per share of 32 cents, missing estimates of consensus of 13 cents. Revenue fell 1.7% year over year to $5.63 billion, missing consensus estimates of $5.76 billion. Retail used unit sales increased 1.3% and comparable used units in storage increased 0.1% compared to the same period last year.

Wholesale units fell 4% year over year. The company earned a gross profit of $2,251 per unit used at retail and a gross profit of $1,120 per unit at wholesale, both down from the same period a year earlier. CarMax repurchased 685,600 shares for $49.3 million in the quarter at $71.97 per share.

Vehicle statistics

CarMax sold 287,603 vehicles combined retail and whole units, down 0.9% year over year. Total retail used car sales increased 1.3% year over year to 172,057. Used unit sales at comparable stores increased 0.1% year over year.

Widespread inflationary pressures have exacerbated current vehicle affordability challenges, which have impacted unit sales performance. The main drivers were high interest rates, low consumer confidence and tightening lending standards. The average cost of a car fell by $600 per unit, which increased sales volume but still resulted in a 0.7 percent decline, eroding margins while gross profit fell by 4, 1% to $586.2 million.

CarMax purchased 234,000 vehicles from dealers and customers, down 10.8% from the same period last year. Dealer purchases increased 44.8% year-over-year to 21,000, while customer purchases fell 14.1% year-over-year to 213,000 vehicles. On the bright side, the cost of purchasing vehicles also fell, causing used vehicle gross profit to rise 0.1% to $2,251 on the retail front. An overall gross profit decline of 9.4% meant an average decline of $67 per unit to $1,120.

Automotive finance income

CarMax Auto Finance revenue increased 18.9% year over year, generating $147.3 million, thanks to lower loan loss provisions, tighter lending standards and an increase in average accounts receivable under management. Net interest margin compressed to 5.9%, in line with the third quarter.

Online sales and PPE down

The company reported a 3.7% decline in other revenue resulting from a $6.2 million decline in Extended Protection Plan (EPP) revenue. Online retail sales accounted for 14% of retail unit sales, generating $1.7 billion or 30% of net revenues in the fourth quarter of 2024.

Store openings

CarMax opened 4 new locations in the fourth quarter, including 2 in New York and 1 each in Los Angeles and Chicago. This brings the total number of stores to 245 as of February 29, 2024. It opened its first stand-alone refurbishment center for the Atlantic market in the quarter. For fiscal 2025, CarMax plans to open 5 new locations, a second stand-alone reconditioning center and a single stand-alone auction facility. Capital spending is expected to be between $500 million and $550 million.

Long-term goals rejected

Its long-term plan calls for sales of 2 million combined retail and wholesale units per year between fiscal 2026 and fiscal 2030 and $33 billion in annual revenue. The deadline was extended due to uncertainty over the timing of the market recovery. This is what led CarMax shares to drop 9%. CarMax hopes to achieve a market share of more than 5% for used vehicles between 0 and 10 years of age sooner than expected. Interest rate cuts may be a key driver of consumer demand.

Daily descending triangle

The KMX daily candlestick chart illustrates a descending triangle pattern. The upper descending trendline formed at the high $88.22 on March 28, 2024, ending each bounce at a lower high. KMX attempted to break out of the descending trendline heading into fiscal Q4 2024 earnings, but fell behind the results to re-enter the triangle. The flat-bottomed lower trendline is at $68.34, which is being tested by KMX stock. The daily relative strength index (RSI) moved sideways, just below the oversold 30 band. The pullback support levels are at $66.86, $62.90, $59.77 and $54.85.

The CEO highlights the positive side

CarMax CEO Bill Nash noted that the company reported its fifth consecutive quarter of sequential used unit growth at retail and reported growth in total used unit sales and comps. Nash said: “We have provided great GPUs to retail and wholesale. We increased used salable inventory units by more than 10% while maintaining total used inventory units year over year.”

Nash remains confident in its ability to accelerate market share growth as used car affordability improves and vehicle values stabilize. Nash added: “We continue to actively manage our SG&A and have significantly increased CAF revenue as we have substantially reduced the loan loss provision year-over-year while sequentially maintaining stable net interest margins.”

CarMax analyst ratings and price targets I’m on MarketBeat.

Before you consider CarMax, you’ll want to hear this.

MarketBeat tracks Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and CarMax wasn’t on the list.

While CarMax currently has a “Hold” rating among analysts, top analysts believe these five stocks are better buys.

View the five stocks here

Is it enough to enter the stock market? These 10 simple stocks can help novice investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get this free report