Former US President Donald Trump speaks after attending the wake for New York City Police Department (NYPD) officer Jonathan Diller, who was shot and killed while conducting a traffic stop routine on March 25 in the Far Rockaway section of Queens, in Massapequa Park, New York. York, United States, March 28, 2024.

Shannon Stapleton | Reuters

Decades of trade deficits and a strong dollar have created too many “losers” in the US economy who have turned to Donald Trump’s protectionist policies, according to Richard Koo, chief economist at the Nomura Research Institute – and those conditions remain.

Trump’s “America First” economic policies have led his administration to institute a series of trade tariffs on China, Mexico, the European Union and others, including the imposition of 25% tariffs on imported steel and aluminum.

As the Republican candidate for the 2024 presidential election, Trump proposed a basic 10% tariff on all US imports and a 60% minimum levy on imported Chinese products.

These policies have drawn widespread criticism from economists, who argue that the tariffs are counterproductive, making imported goods more expensive for the average American.

Speaking to CNBC’s Steve Sedgwick on the sidelines of the Ambrosetti Forum on Friday, Koo said that protectionism is a “horrible thing,” but that Trump’s approach “has a certain economic logic.”

“When we studied economics and free trade, in particular, we were taught… that free trade always creates both winners and losers in the same economy, but the gain that the winners get is always greater than the loss of the losers , so society as a whole always gains. That’s why free trade is good,” he noted.

Koo argued, however, that this is based on the assumption that trade flows are balanced or in surplus, while the United States has run huge deficits over the past forty years, which has expanded the number of “losers.”

“In 2016, the number of people who saw themselves as losers from free trade was large enough to elect Trump president, and so we really need to go back and ask ourselves: what did we do wrong to allow so many people in the United States to see themselves as losers of free trade?” He said.

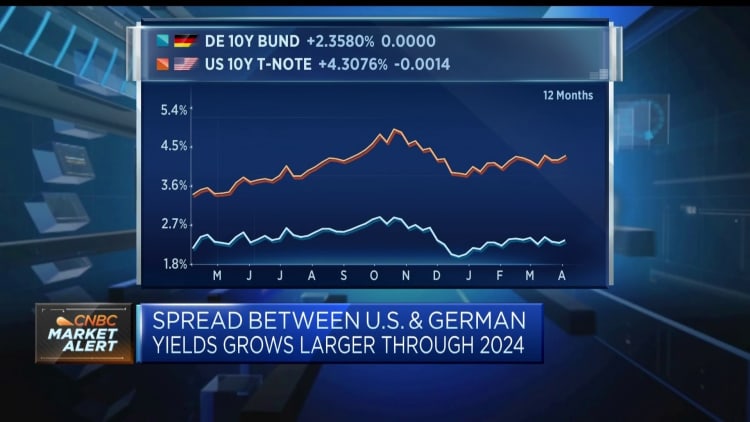

For Koo, the key issue was the exchange rate, as the strength of the U.S. dollar incentivized foreign imports and hurt U.S. companies exporting around the world.

“In a sense we let the exchange rate be decided by the so-called market forces, by the speculators, by my clients, by those on Wall Street, but the exchange rate must be set in such a way that the number of losers does not grow to the point where free trade itself is lost,” Koo said.

He pointed to a similar pivotal moment in 1985, when President Ronald Reagan faced the same issue of a strong dollar and growing protectionism. At the time, Reagan responded by facilitating the Plaza Agreement with France, West Germany, Japan, and the United Kingdom to devalue the U.S. dollar relative to these countries’ respective currencies through foreign exchange market intervention.

“This is the kind of thing we should have done more consciously, instead of allowing it [the] dollar to go wherever the market leads [it]and then these people who are not as lucky as us in the financial markets end up suffering and voting for Trump,” Koo added.

He argued that economists need to move beyond the idea that the trade deficit is simply due to “too much investment” and “too little saving” in the United States, since this means that the deficit can only be reduced by remaining in recession until the domestic demand will not weaken to that extent. so much so that US companies can export more goods, which would not be possible in a democracy.

Koo again pointed to previous dealings with Japan, suggesting that if the argument was that foreign companies are simply filling in where U.S. companies can’t meet domestic demand, then American companies that fought Japanese ones in the 1970s and ’70s 70 were expected to post huge profits due to excess demand.

“But that didn’t really happen. The opposite happened. Many of them went bankrupt, so many free trade losers were left on the street, because it wasn’t a question of savings and investment, it was a question of the exchange rate ,” he said.

“The dollar should have been much weaker, and Reagan understood that that was why he took this action.”