If the past is any lesson, the S&P 500 could continue to rise in 2024 after posting strong returns in January, according to an analysis by Bespoke Investment Group.

A team of stock market analysts at Bespoke found that, typically, when the S&P 500 SPX is trading in positive territory for the previous month, the index continues to rise during the last four trading days of January.

And when the index ends January in the green, the chances of it continuing to advance for the rest of the year increase dramatically.

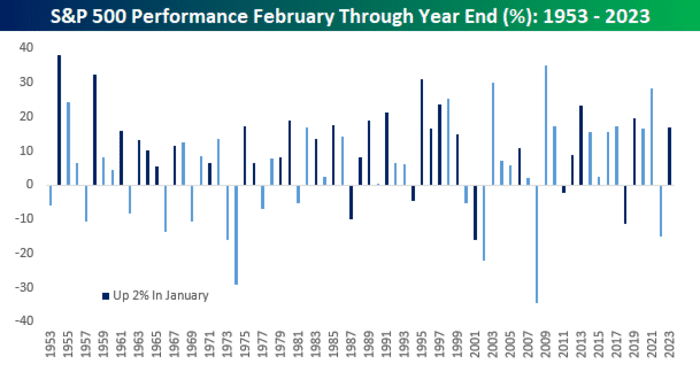

Since 1953, the year the current five-day trading week first hit the U.S. stock market, when the S&P 500 rose 2% or more in January, its average performance for the rest of the year was a gain of 13.5%. This is according to a bespoke analysis in a report shared with MarketWatch on Friday.

Furthermore, the index recorded positive returns for the balance of the year in 84% of cases. Overall, the index closed January up 2% or more 31 times between 1953 and 2023, the Bespoke team showed.

TAILORED INVESTMENT GROUP

The new year marks a fresh start for markets, which have made the first few weeks of each year subject to scrutiny from investors trying to read the tea leaves over the next 11 months.

Light: The stock lost money in the first 5 trading days of January. What does this mean for 2024?

To be sure, the index’s outlook for the rest of the year is typically much less rosy when it ends January with weaker gains, or in the red. When the S&P 500 Index closes January with a gain of less than 2%, its median performance for the rest of the year drops to 6.4%, with positive returns materializing only 68% of the time.

According to FactSet data, the S&P 500 has gained 2.5% since the beginning of January. The index is on track to close lower on Friday, and fell 0.1% to 4,887 in the final 90 minutes of trading of the week.