krblokhin

A new report from the International Monetary Fund explains just how big a hole the United States has dug for itself in terms of the federal deficit and how action needs to be taken now to mitigate it.

“Support measures in the era of the crisis should be stopped immediately, and the political budget cycle and the push for further spending increases should be resisted,” IMF economists say in the report, “Fiscal Policy in the Great Election Year.” “Reforms are needed to contain the growing spending pressures, for example, through entitlement reforms in advanced economies with aging populations and by improving the targeting and efficiency of social safety nets to support the most vulnerable populations.”

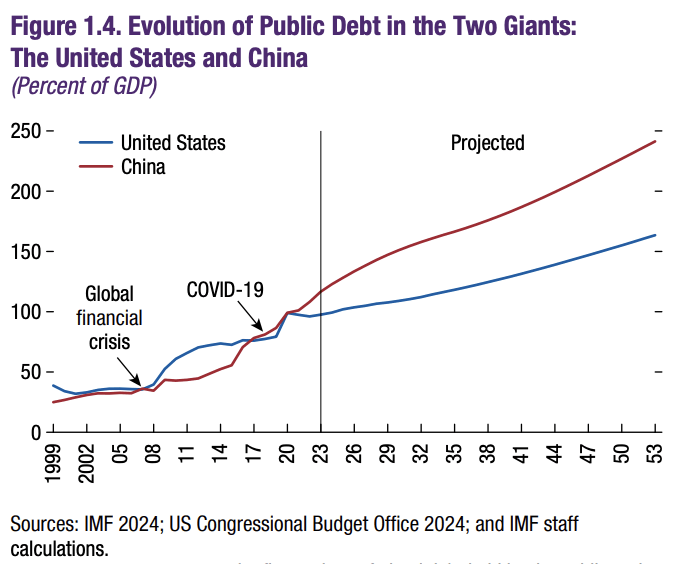

According to the International Monetary Fund, global public debt is expected to approach 99% of GDP by 2029, thanks above all to the policies of the United States and China.

Courtesy of the IMF

“Loose fiscal policy and rising debt levels, as well as tightening monetary policy, have contributed to rising long-term government yields and their greater volatility in the United States, raising risks elsewhere through spillovers to interest rates,” according to the report.

Based on data from the U.S. Treasury Department, the federal government is running a $1.1 trillion deficit so far in fiscal 2024, which began Oct. 1, 2023.

![]()

Courtesy of the Bipartisan Policy Center

In fiscal 2023, the deficit was $1.7 trillion, which was $320 billion more than in fiscal 2022.

On April 19, the 10-year bond yield closed at around 4.6%. On January 2, the first trading day of 2024, it closed around 3.9%. This makes debt payments more expensive for the federal government.

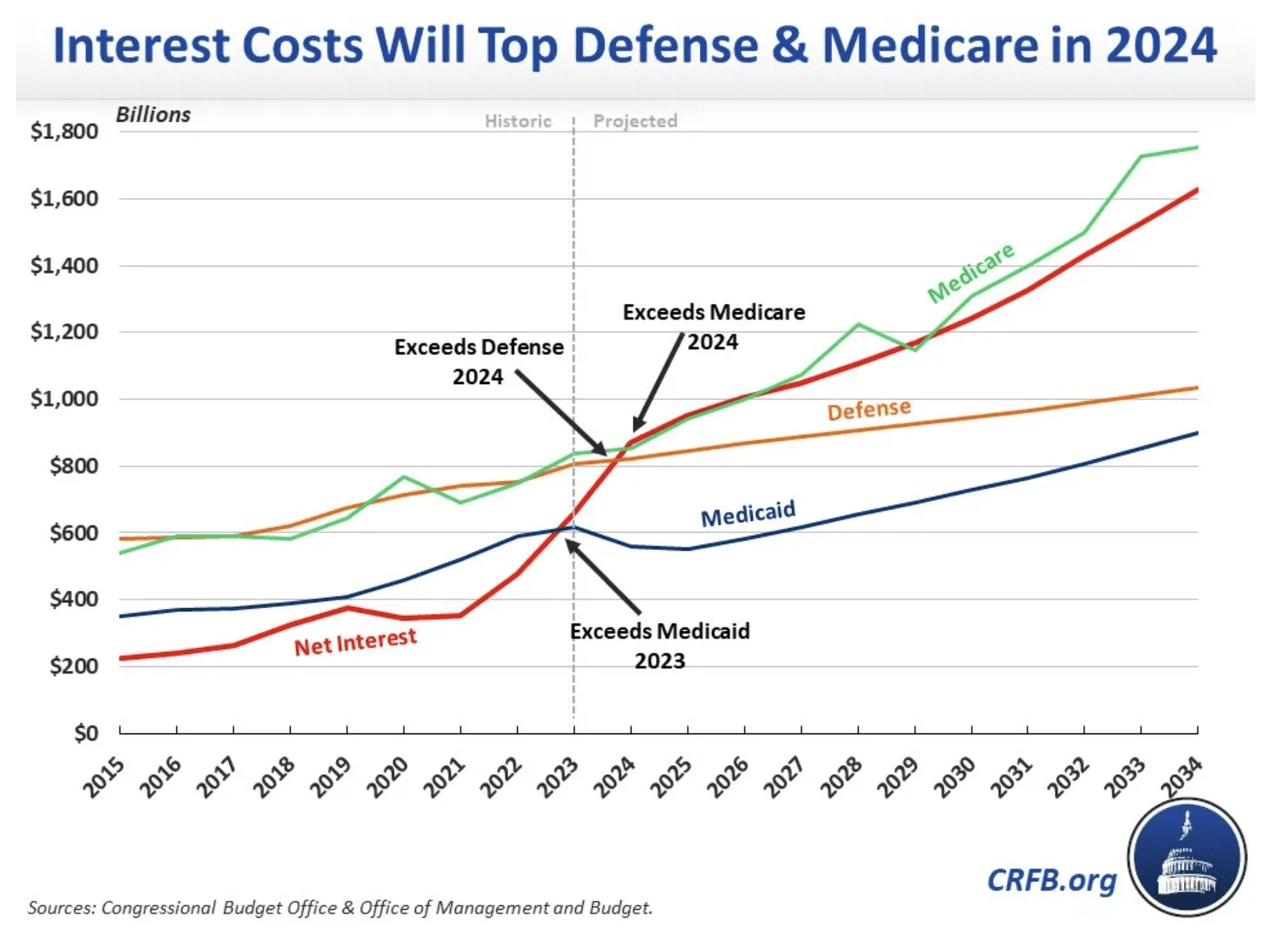

A recent blog post from the Committee for a Responsible Federal Budget found that debt service spending in the first half of fiscal 2024 is already $429 billion, an amount equal to 39% of the income tax individual paid so far this year. And that figure is expected to reach $870 billion by the end of the year.

“At this level, interest payments will exceed spending on both defense and Medicare this year and rise to become the the second most important item of the budget,“reads the blog post.

Courtesy of the Committee for a Responsible Federal Budget

In March, President Biden announced a budget plan that calls for cutting $3 trillion in the deficit over 10 years, mostly by raising taxes on the wealthy and corporations.

However, Biden also did not rein in spending. Early in his presidency, he won approval of a $1.7 trillion stimulus package that led to a $2.7 trillion deficit in fiscal 2021, according to a report Axios relationship. In fiscal 2022 and fiscal 2023, deficits were $1.4 trillion and $1.7 trillion, respectively.

During his presidency, President Trump has seen deficits grow dramatically, following Covid-19 spending and significant tax cuts, especially for corporations and the wealthy. The deficit was $3.1 trillion in fiscal 2020, up from $984 billion in fiscal 2019, according to Congressional Budget Office data.

In Trump’s first full fiscal year in office – fiscal 2018 – the federal deficit was $779 billion. However, this is $113.3 billion more than in fiscal 2017, according to the Treasury Department’s Bureau of the Fiscal Service.

Dear readers: We recognize that politics often intersect with the financial news of the day, so we invite you to click here to join the separate political discussion.