Key points

- Artificial intelligence (AI) tailwinds are boosting NetApp’s all-flash array (AFA) business, with margins expanding amid low NAND prices.

- Low flash memory prices are driving the all-flash array business, replacing HDDs in AI applications.

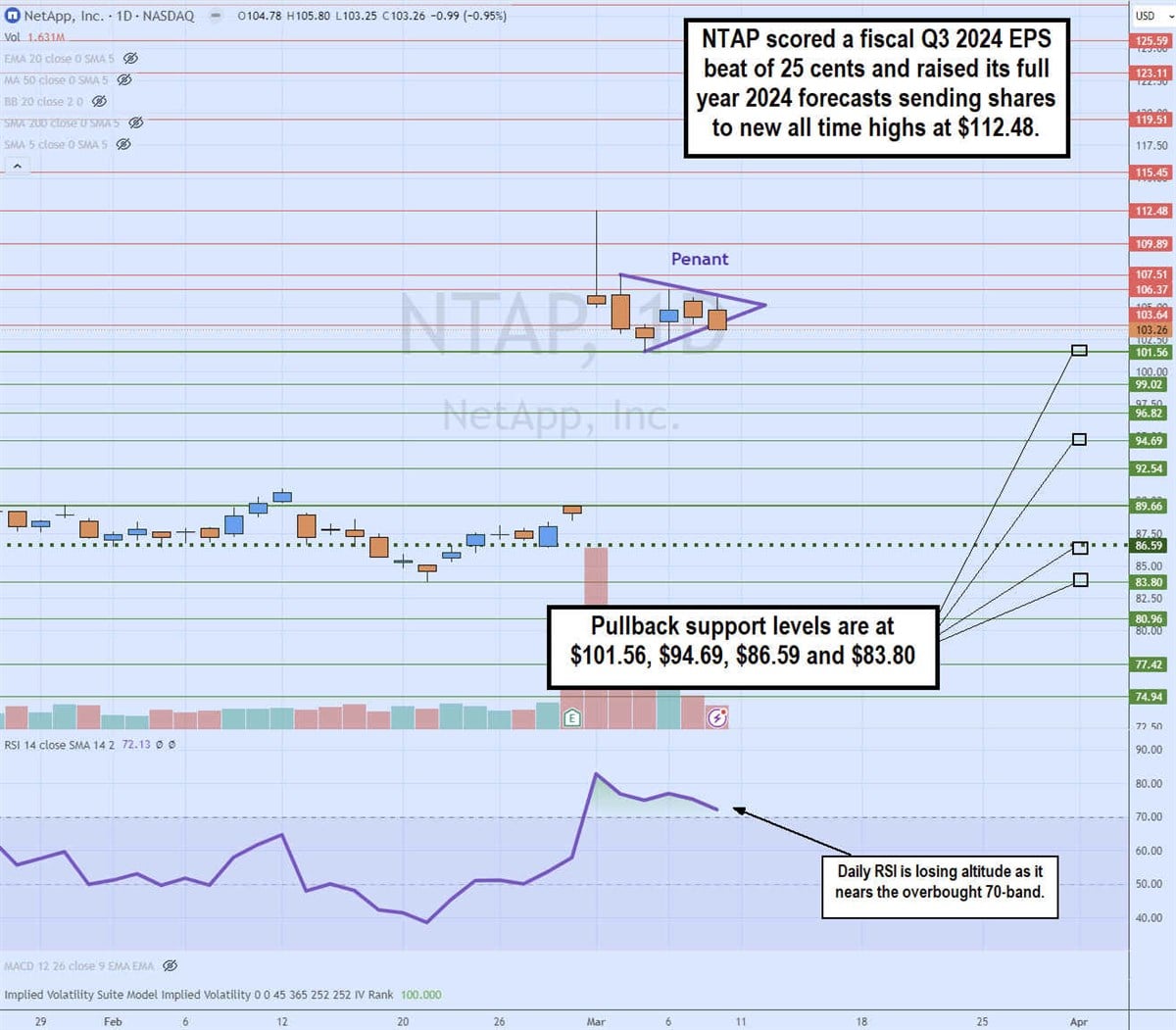

- NetApp reported a banner fiscal year in the third quarter of 2024, beating consensus estimates by 25 cents and raising full-year forecasts.

- 5 stocks we prefer to NetApp

NetApp Inc. NASDAQ:NTAP is a data management company that enables businesses to store, share and manage data on-premises and in the cloud. The IT and technology company specializes in hybrid cloud data storage, operating in 2 segments, including public cloud and hybrid cloud. Its all-flash array and data-centric solutions are used by hyperscaler giants like Amazon.com Inc. NASDAQ: AMZN, Microsoft Co. NASDAQ:MSFT AND Alphabet Inc. NASDAQ:GOOGL.

The artificial intelligence (AI) benefits of NetApp credit enable you to achieve the best operating margins in a favorable NAND pricing environment. It has gotten dozens of acquired customers, including many great Nvidia Co. NASDAQ:NVDA SuperPOD and BasePOD distributions. NetApp stock trades at 20x forward earnings and 13x forward non-GAAP EPS versus its largest competitor Pure Storage Inc. New York Stock Exchange: PSTG at 128.72X.

Data Fabric architecture drives competitive advantage

Data fabric refers to a machine-enabled intelligent system that brings together different types of data from various places, using metadata to organize, merge and control data from different sources. The data fabric keeps data secure and accessible, enabling seamless connections between different data pipelines on-premises, cloud or devices.

Standardize data management practices and processes, improving data security so customers can build end-to-end data pipelines. This enables smooth and efficient data flow between data sources and data consumers. Check the heat map of the sector on MarketBeat.

NetApp throws the ball out of bounds

On February 29, 2024, NetApp reported fiscal third-quarter 2024 EPS of $1.94, beating consensus analyst estimates of $1.69 by 25 cents. Revenue grew 5.2% year over year to $1.61 billion, beating consensus estimates of $1.59 billion. Bills increased 7% year over year to $1.69 billion, compared to $1.57 billion in the same period a year ago. The annualized rate of return (ARR) of all-flash arrays grew 21% year-over-year to $3.4 billion. Third-quarter GAAP gross margins of the consolidation were 72%. Third quarter GAAP operating margins were 23% and non-GAAP operating margins hit a record 30%. The company ended the quarter with $2.92 billion in cash and cash equivalents.

Both cloud segments show revenue growth

Its Hybrid Cloud segment posted revenue of $1.46 billion, up from $1.38 billion in the same period last year. Its Public Cloud segment generated $151 million, up from $151 million in the fiscal third quarter of 2023. Public cloud ARR was $608 million versus $605 million in the fiscal third quarter of 2023.

NetApp provides online help

NetApp delivered positive fiscal fourth-quarter 2024 earnings per share of $1.73 to $1.83 versus consensus analyst estimates of $1.73. Revenues are expected to be in the range of $1.585 billion to $1.735 billion versus consensus estimates of $1.65 billion. Full-year fiscal 2024 EPS is expected to be in the range of $6.40 to $6.50 versus consensus estimates of $6.14. Full-year 2024 revenues are expected to be in the range of $6.185 billion to $6.335 billion versus consensus estimates of $6.23 billion. The next cash dividend of 50 cents per share will be paid on April 24, 2024 to shareholders of record at the close of business on April 5, 2024.

CEO Insights

NetApp CEO George Kurian highlighted that its all-flash business has grown to 60% of Hybrid Cloud segment revenues and that it expects sustainable growth in core product gross margin going forward. Kurian pointed out that only NetApp offers a complete architecture anchored on a single, silo-free operating system capable of supporting any type of data and applications on-premises and multiple cloud environments. It is also available in traditional as-a-service or CapEx procurement models.

Its unified data solutions help address some of the top priorities facing IT organizations today, including building scalable AI data pipelines for AI workloads, improving resilience against ransomware attacks, and modernizing legacy infrastructure.

CEO Kurian concluded: “We are well positioned with an expanded TAM, including block storage, and new market opportunities such as artificial intelligence to drive continued growth and revenue sharing. We are moving towards a margin profile of higher product, supported by growth in all-flash products. And we will continue to maintain the operational discipline that has delivered record profitability.”

NetApp analyst ratings and price targets I’m on MarketBeat. NetApp peers and competitor stocks can be found with MarketBeat Stock Screener.

Daily banner template

The daily candlestick chart on PSTG illustrates a pennant pattern. On March 1, 2024, NTAP stock posted an 18% gap to its fiscal third quarter 2024 results. The stock formed a descending upper trendline composed of lower highs against an ascending lower trendline composed of higher lows close to the peak. The large price gap serves as a flagpole. The pennant will eventually crack or break when it reaches the apical point. The daily relative strength index (RSI) peaked at the 83 band while falling towards the overbought 70 band.

Before you consider NetApp, you’ll want to hear this.

MarketBeat tracks daily Wall Street’s highest-rated and best-performing research analysts and the stocks they recommend to their clients. MarketBeat identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market takes hold… and NetApp wasn’t on the list.

While NetApp currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.

View the five stocks here

Click the link below and we’ll send you MarketBeat’s guide to investing in electric vehicle (EV) technologies and which EV stocks are most promising.

Get this free report